It’s common belief that Bernanke and the Fed are printing $85 billion per month ($40 billion to buy Mortgage Backed Securities and $45 billion to buy Treasuries). After all, these are the policies that the Fed announced in September and December 2012, respectively.

The only issue with this is that the Fed lied.

Today, the Fed’s balance sheet is $1.3 billion smaller than it was at this time last year. Last week it was $19 billion smaller. The largest year over year growth the Fed balance sheet has shown since QE 3 was announced occurred on November 23, 2012 when the Fed balance sheet was a mere $48 billion larger than it was at the same point in 2011.

Since that time the Fed balance sheet has shrunken year over year.

The implications of this are severe. If the Fed is indeed not employing the policies it announces but is simply engaging in verbal intervention (stating it will do something just so the markets react), then it has lost total credibility as a monetary authority and is nothing more than a market manipulator.

Consider the above chart… the S&P 500 today is 14% higher than it was this time last year. Over the same time period, the Fed’s balance sheet has shrunken. This is proof positive that stocks have not only disconnected from economic fundamentals… but are now disconnected from the Fed’s actual actions.

Put another way, stock investors are now bullish based on their belief that the Fed is pumping $85 billion in the system every month and nothing more.

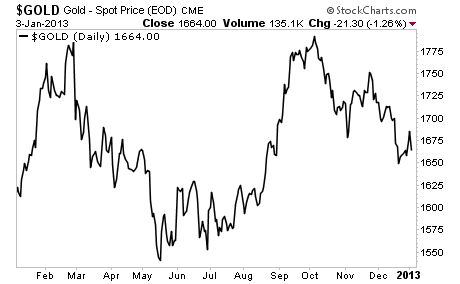

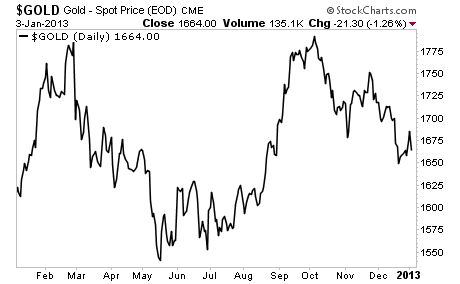

Not every asset class is this mindless. Consider Gold’s recent action:

Considering that the Fed announced QE 3 in September and QE 4 in December, Gold should be soaring. Instead it peaked right around the time QE 3 was announced and has since fallen. Year over year it’s barely higher.

All of this adds yet more evidence that the Fed is in fact running out of ammo. We already knew that the Fed believed in verbal intervention as a tool for dealing with the markets. But now it’s clear that this is the primary tool for the Fed. This hardly bodes well for the financial system.

The only issue with this is that the Fed lied.

Today, the Fed’s balance sheet is $1.3 billion smaller than it was at this time last year. Last week it was $19 billion smaller. The largest year over year growth the Fed balance sheet has shown since QE 3 was announced occurred on November 23, 2012 when the Fed balance sheet was a mere $48 billion larger than it was at the same point in 2011.

Since that time the Fed balance sheet has shrunken year over year.

The implications of this are severe. If the Fed is indeed not employing the policies it announces but is simply engaging in verbal intervention (stating it will do something just so the markets react), then it has lost total credibility as a monetary authority and is nothing more than a market manipulator.

Consider the above chart… the S&P 500 today is 14% higher than it was this time last year. Over the same time period, the Fed’s balance sheet has shrunken. This is proof positive that stocks have not only disconnected from economic fundamentals… but are now disconnected from the Fed’s actual actions.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

Put another way, stock investors are now bullish based on their belief that the Fed is pumping $85 billion in the system every month and nothing more.

Not every asset class is this mindless. Consider Gold’s recent action:

Considering that the Fed announced QE 3 in September and QE 4 in December, Gold should be soaring. Instead it peaked right around the time QE 3 was announced and has since fallen. Year over year it’s barely higher.

All of this adds yet more evidence that the Fed is in fact running out of ammo. We already knew that the Fed believed in verbal intervention as a tool for dealing with the markets. But now it’s clear that this is the primary tool for the Fed. This hardly bodes well for the financial system.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI