Bitcoin price today: rises to $111.5k, altcoins lag ahead of payrolls test

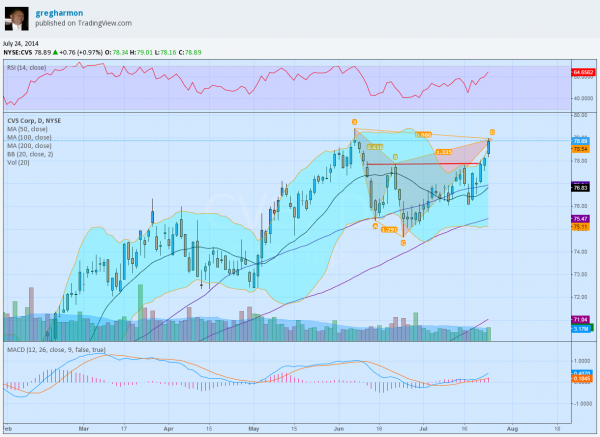

CVS Corporation (NYSE:CVS) broke above short term resistance earlier this week and is testing the all-time high price level. Stocks making new all-time highs are often described by pundits as one that you should ‘take off some risk’ in. Does that really make any sense? If you sell every stock that makes an all-time high then as the market keeps making all-time highs you will be on the sidelines watching, uninvested. I guess the bright side is that you will have more time to play golf or what ever else you enjoy.

I am not trying to discourage proper risk management, but come on! You got to be in it to win it! So what do you do? With a stock like CVS there are plenty of options. Literally.

The chart does have some things in it that raise caution. The bearish Shark Harmonic has a Potential Reversal Zone (PRZ) at 79 nearby. Of course that could always morph into a longer Shark with PRZ at 80.05. Or the prior top could halt its progress. But the momentum indicators, RSI and MACD, suggest there is more upside.

If you are long this stock already then you can add protection by buying a collar. This is selling a covered call and buying a put or put spread. With earnings coming up on August 5th, maybe a August 9 Expiry 78/75 Put Spread (offered at 62 cents as I write). That is less than 1% cost to protect the downside to the 200 day moving average, below the last consolidation. And if you sold the August 29 Expiry 81 Calls, making them Covered Calls, the options combination comes at no cost, and still allows for 2.5% upside over the next month.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

Which stocks should you consider in your very next trade?

The best opportunities often hide in plain sight—buried among thousands of stocks you'd never have time to research individually.

That's why smart investors use our Stock Screener with 50+ predefined screens and 160+ customizable filters to surface hidden gems instantly.

For example, the Piotroski's Picks method averages 23% annual returns by focusing on financial strength, and you can get it as a standalone screen. Momentum Masters catches stocks gaining serious traction, while Blue-Chip Bargains finds undervalued giants.

With screens for dividends, growth, value, and more, you'll discover opportunities others miss. Our current favorite screen is Under $10/share, which is great for discovering stocks trading under $10 with recent price momentum showing some very impressive returns!