If you are getting a little bored of dealing with equities and would like a bit more of a challenge from the markets – and larger profits – then keep reading on. We want to look at the immense power of a futures trading system. If you work in the stock market, you will still have the high risk-high reward lifestyle that many stock traders have, but the advantage of futures trading and futures trading systems is that risk can be managed 24/7.

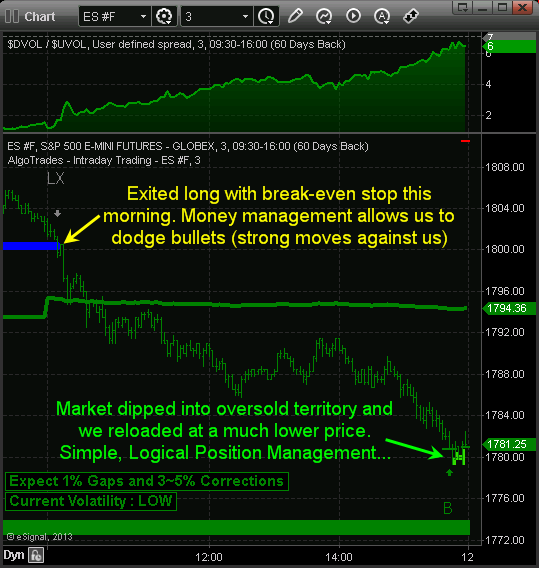

However, while the profits can be massive, so can the losses. So you need to be ready for virtually any outcome that could happen, and the best way to do this is with a futures trading system that has position and money management built into it. The best futures trading systems allows you stay away from poor decision making because they are automated in which removes emotional based trading. It also saves you from making any silly mistakes and miscalculations, as the entire futures system is automated and will execute futures strategies for you.

Futures trading is quite difficult and don’t think because you have bossed other markets, you can do the same here. A deep knowledge, power and real life experience is required to successfully trade these markets. However, once you find yourself in a position where you can take on and even absorb the larger risks that come with futures trading, you will be ready to make the most of this market.

Must Know Formula for Futures Trading System Development

The first thing that you need to concentrate on with a futures trading system is the specific market you want it to trade. Find something you are comfortable with – if you prefer to trade futures on indexes, you could start with the S&P 500, NASDAQ, DOW and Russell 2K. Or you could walk into the world of commodities like gold, oil and grains.

Once you have selected a market to trade, creating, building and testing your new automated futures trading system is important. Keep in mind there are many down falls to back testing and the further back you can go, the better. Most futures trading system developers only back test 6-12 months which to me is not enough data. You really should back test the strategy as far back as possible. If the data points you use in your futures trading system goes back 6 years, then build a system that works well during all of that time. If the data goes back 10 years, then even better. The farther back you go the more solid the futures trading system will be going forward.

Once you have successfully backtested the futures trading strategies its time to manually review each and every trade to confirm your system and testing was accurate. If not, adjust the system, backtesting criteria and repeat until you are happy with the results.

Some of the best futures trading systems are dynamic. This means they automatically adjust to market volatility, trend direction and manage positions on the fly without the futures trading system developer having to manually adjust strategies each week or month in which the market conditions change.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI