A new PEW study on Household Incomes and Expenditures goes a long ways towards explaining why economists who expected a big jump in consumer spending based on falling gasoline prices were dead wrong.

The study shows that although expenditures recovered from the downturn, income did not.

Also, low-income families spent a far greater share of their income on core needs, such as housing, transportation, and food, than did upper-income families. Households in the lower third spent 40 percent of their income on housing, while renters in that third spent nearly half of their income on housing, as of 2014.

None of this is surprising to Mish readers, but the charts are quite interesting.

PEW based its analysis on the Bureau of Labor Statistics’ Consumer Expenditure Survey.

Previously, I have linked to Fed studies that show consumers have done just what they say they would: spend less.

However, the Fed places more faith in consumer sentiment numbers than its own surveys and real data.

Households in the lower third spent 40 percent of their income on housing, while renters in that third spent nearly half of their income on housing, as of 2014.

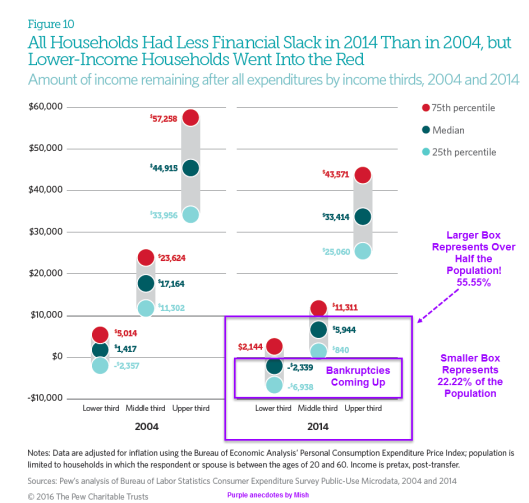

In 2004, typical households at the bottom had $1,500 of income left over after expenses. By 2014, this figure had decreased by $3,800, putting them $2,300 in the red.

The lack of financial flexibility threatens low-income households’ financial security in the short-term and their economic mobility in the long-term.

Mish Comments

The bottom 2/9ths of the population, 22.22%, spends every penny and then some. This group is rapidly careening towards bankruptcy.

5/9ths of the population can save at most $5,944 dollars a year. Most of that will get eaten up somewhere down the line in unexpected expenses.

Moreover, things are worse now than in 2014.

Rent vs. Income Trends

It’s safe to suggest the trend in rent is far more ominous than the CPI shows, especially in places like San Francisco.

We cannot afford the inflation the Fed seeks. 2/9ths of the population cannot afford any inflation at all.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI