Bitcoin price today: reaches new record high over $122k ahead of ’crypto week’

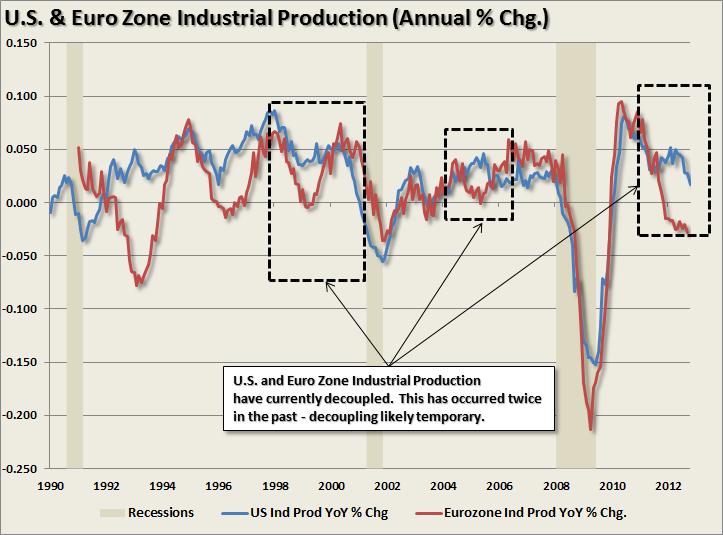

Over the past year there have been many articles published about the decoupling of the U.S. economy from the the Euro zone. The belief was based on the simple fact that the Euro zone was facing a debt crisis, combined with austerity measures, which the U.S. would avoid. While the U.S. is unlikely to have a similar debt crisis, since the U.S. can print its own currency, the drag on economic growth is a different issue. This is an assertion I have made all year -- betting on a decoupling of the U.S. from the rest of the world is a mistake.

In January I wrote: Today the world is more globally interconnected than at any time in past history. The internet, Fed Ex, cellular and satellite technology, faster mobility and coordinated planning have brought the world economies into close proximity with each other. You don't have to look any further than the recent earthquake in Japan that impacted the U.S. economy within the span of just three months. With the economy of one country dependent on that of another for the goods and services from which revenue is derived, taxes are paid and money is spent - there is little margin for error.” I have reiterated this point many times since. (See here, here and here).

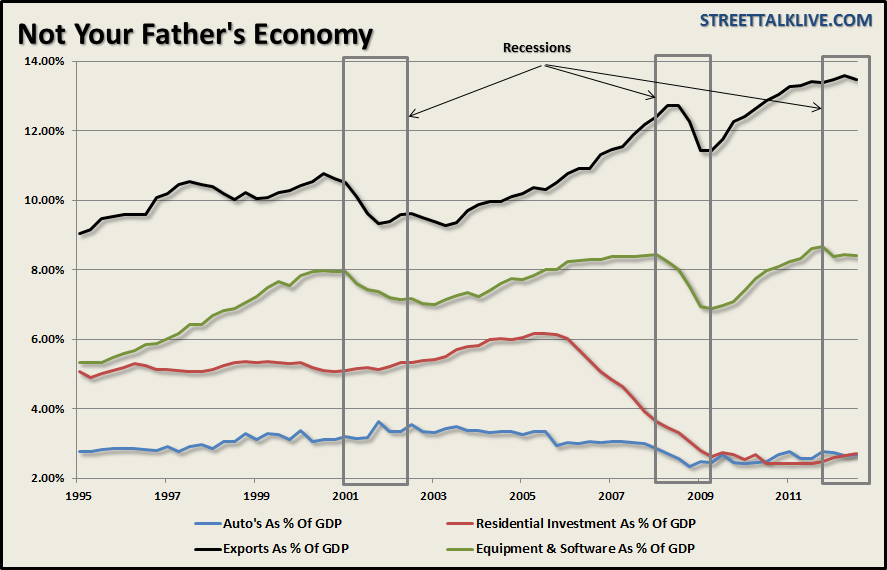

The economic reality is that with exports now making up roughly 40% of corporate profits, and more than 13% of GDP (almost triple housing and automobile manufacturing combined), the inevitable drag to the U.S. economy was only a function of time. The chart below shows the importance of exports as a percentage of GDP.

While the majority of the mainstream media, and the head of the Federal Reserve, continue to support the notion that housing is the key to economic recovery, today it is really equipment, software and exports that are driving the U.S. economy. Furthermore, expectations of future capital investment, which is a core component of the GDP calculation, has plummeted in recent months as well. A recent article in the WSJ confirmed our analysis...better late than never.

WSJ: U.S. companies are scaling back investment plans at the fastest pace since the recession, signaling more trouble for the economic recovery. Half of the nation's 40 biggest publicly traded corporate spenders have announced plans to curtail capital expenditures this year or next, according to a review by The Wall Street Journal of securities filings and conference calls.

Nationwide, business investment in equipment and software -- a measure of economic vitality in the corporate sector -- stalled in the third quarter for the first time since early 2009. Corporate investment in new buildings has declined.

At the same time, exports are slowing or falling to such critical markets as China and the euro zone as the global economy downshifts, creating another drag on firms' expansion plans.

This background brings us to our 'CHART OF THE DAY', which shows the annual change in Industrial Production for the U.S. and the Euro zone.

While there have been brief moments where the U.S. looked like it could stand on its own in the past -- the drag from a global slowdown proved too strong to withstand. This time, as expected, appears to be no different.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.