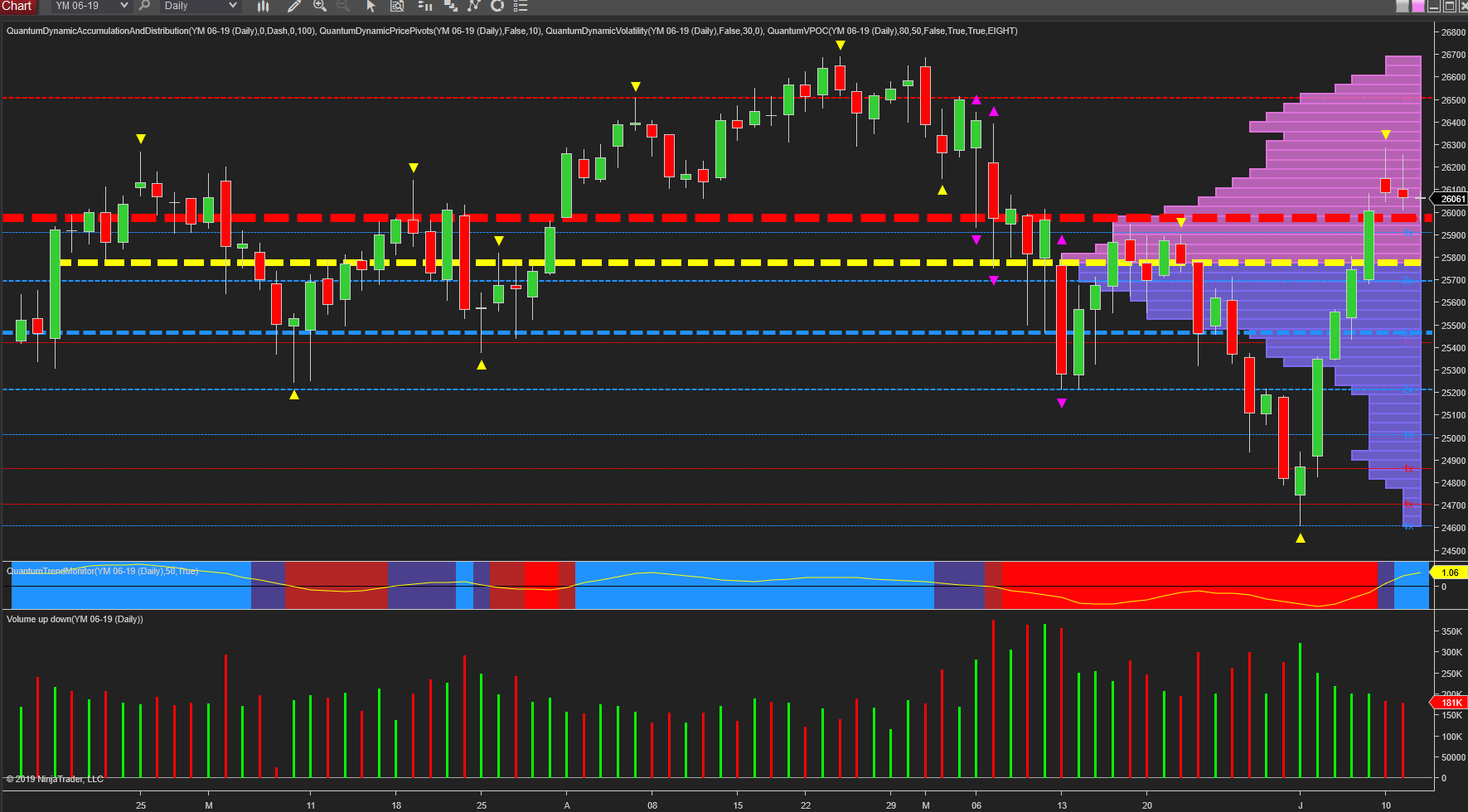

Whether you are a longer-term investor in US stocks or an intraday speculative index trader, the daily chart for the indices is always worth considering in detail, and none more so than now following the recent move higher driven by the prospect of falling interest rates. And perhaps the most interesting example of the three sisters is the YM Emini which is now perched at a delicate point on the chart.

If we begin with the recent rally of July, this was characterized with solid widespread up candles, blasting through level after level of price resistance and finally through the volume point of control itself, denoted with the yellow dashed line. However, note the volume associated with this move, it is falling with strongly rising prices, and so signals weakness ahead, which has duly arrived over the last few days with consecutive days of weakness as the index rallied only to close near the open and creating deep wicks to the upper body as a result. Volume on both was good, but the price action alone is enough to suggest weakness. However, what is perhaps more significant for the longer term is the extremely strong region of price support denoted with the red dashed line of the accumulation and distribution indicator just below 26,000. This is a level which until last week had been acting as very strong resistance, but which was finally breached, and consequently now acts as a strong platform of support and one which has already been tested in trading today.

Note the trend monitor has transitioned to blue, confirming the bullish trend, but if this is to continue, the platform of support at 26,000 needs to remain unbroken, in which case the index should continue higher in the longer term, and on towards weak price and volume based resistance in the 26,500 area.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI