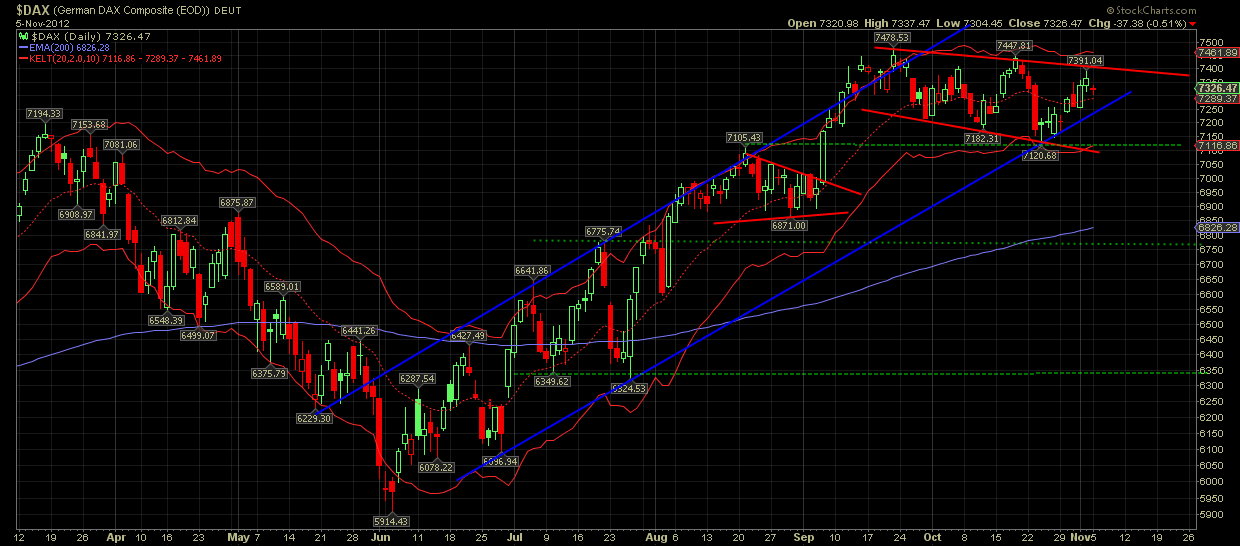

DAX has recently made a sideways movement with successive lower highs and lower lows. Although an overlapping pattern, traders should be very cautious with any long position. Short term support at 7300 and resistance at 7400 provide us with a trading range where we should be neutral. Very important support is at the 7100-140 level. Very important resistance is 7500. Trades should be made when resistance or support levels are broken. US elections could provide a bit of extra volatility in the next few sessions.

Prices still trade inside the upward blue channel and the bullish resumption of trend remains a good possibility. Breaking that channel downwards could push prices into a deeper correction. Another bearish sign that makes us be even more cautious is that the downward portions of this move feel impulsive, whereas the upward movements are corrective. Whether forming a longer term top or just an intermediate one, traders should be very cautious and ready to change strategy from long to short.

Disclosure: None of the information or opinions expressed in this blog constitutes a solicitation for the purchase or sale of any security or other instrument. Nothing in this article constitutes investment advice and any recommendations that may be contained herein have not been based upon a consideration of the investment objectives, financial situation or particular needs of any specific recipient. Any purchase or sale activity in any securities or other instrument should be based upon your own analysis and conclusions.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI