Genetic Technologies Ltd (NASDAQ:GENE) is the micro cap stock that keeps on giving…profits, that is, to traders, both going long and short. Genetic Technologies Ltd is a life science company based in Australia. What traders care about is its beta of 1.38. The market (NYSE:SPY) as a whole has a beta of 1.

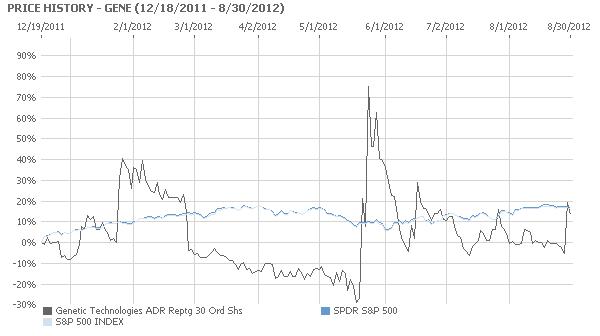

Genetic Technologies Ltd has demonstrated that it will rise on good news, and then fall again. The chart below certainly reveals that trend.

That results in Darth Vader profits for traders. This has been detailed in previous articles: both how to capture Darth Vader profits and how to gain from trading Genetic Technologies Ltd. A Dart Vader profit is when traders gain from going both long and short on the same stock. “The circle is complete” as profits are booked taking a round trip. That was the line Darth Vader used to goad Obi Wan Kenobi into laser sword combat.

Today, Genetic Technologies Ltd fell more than 5%. It was a leading gainer yesterday, soaring. For the week, as a result, it is up more than 14%. The good news that sent the share price surging for the micro cap ($57 million) was the filing of a patent law suit. For a micro cap, Genetic Technologies Ltd has sizable volume: more than 250,000 are traded shares daily.

Genetic Technologies Ltd has a negative profit margin of 86.15% and a negative return-on-equity of 55.87%. Now trading around $3.73 a share, the mean analyst target price for Genetic Technologies Ltd over the next year of market action is $7.50. The 52-week range for Genetic Technologies Ltd is $2.29 to $7.45.

The short float is tiny at just 1.84%. There is no debt and plenty of cash on the balance sheet. On a quarterly basis, both sales growth and earnings-per-share growth are plunging. For the year, however, earnings-per-share growth is higher by 108.56%. Next year, earnings-per-share growth is projected to rise by another 36.80%

As Genetic Technologies Ltd, once again, demonstrates: go short on good news and go long on good earnings to profit.

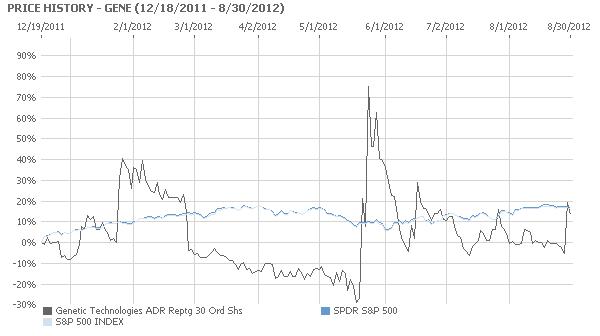

Genetic Technologies Ltd has demonstrated that it will rise on good news, and then fall again. The chart below certainly reveals that trend.

That results in Darth Vader profits for traders. This has been detailed in previous articles: both how to capture Darth Vader profits and how to gain from trading Genetic Technologies Ltd. A Dart Vader profit is when traders gain from going both long and short on the same stock. “The circle is complete” as profits are booked taking a round trip. That was the line Darth Vader used to goad Obi Wan Kenobi into laser sword combat.

Today, Genetic Technologies Ltd fell more than 5%. It was a leading gainer yesterday, soaring. For the week, as a result, it is up more than 14%. The good news that sent the share price surging for the micro cap ($57 million) was the filing of a patent law suit. For a micro cap, Genetic Technologies Ltd has sizable volume: more than 250,000 are traded shares daily.

Genetic Technologies Ltd has a negative profit margin of 86.15% and a negative return-on-equity of 55.87%. Now trading around $3.73 a share, the mean analyst target price for Genetic Technologies Ltd over the next year of market action is $7.50. The 52-week range for Genetic Technologies Ltd is $2.29 to $7.45.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

The short float is tiny at just 1.84%. There is no debt and plenty of cash on the balance sheet. On a quarterly basis, both sales growth and earnings-per-share growth are plunging. For the year, however, earnings-per-share growth is higher by 108.56%. Next year, earnings-per-share growth is projected to rise by another 36.80%

As Genetic Technologies Ltd, once again, demonstrates: go short on good news and go long on good earnings to profit.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI