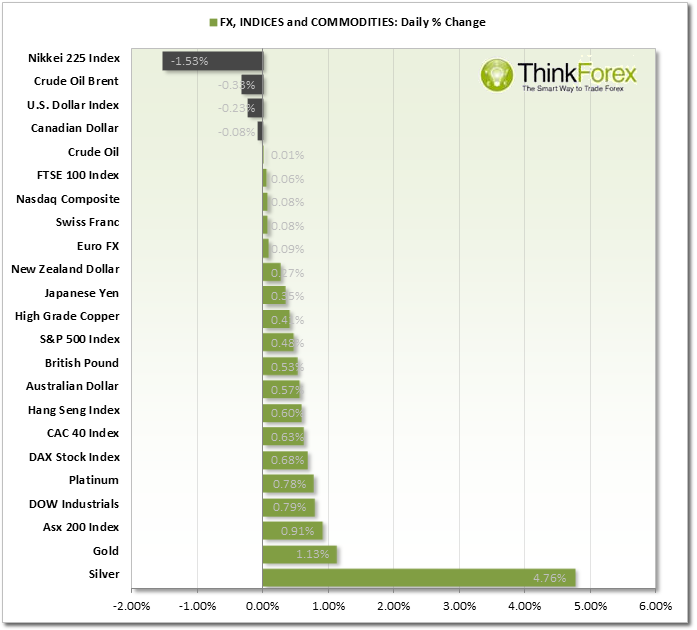

MARKET SNAPSHOT:

AUD: Today New car sales were down -3.5% versus 1.4% expected, the lowest in 6 months, to denote a lack in consumer confidence.

CAD: Manufacturing sales were down 0.9% versus 0.2% expected, is lowest level since June 2013. It is a relatively quiet week for the Canadian Dollar until Friday's Core CPI and Retail Sales.

EUR: German ZEW Economic Sentiment is due out today with a consensus of 61.3. A reading above 0 suggests increased confidence, which has been rising since Dec 2012.

JPY: GDP came in at 0.3%, much lower than the 0.7% expected.

NZD: Both Retail and Core Retail sales came in less than expected today but the market quickly shrugged these off as the Kiwi continues to appreciate against the major currencies.

USD: Bank holiday in US to celebrate Presidents' Day which may result in lower trading volume for the NYLON session and late US session.

Charts Of The Day:

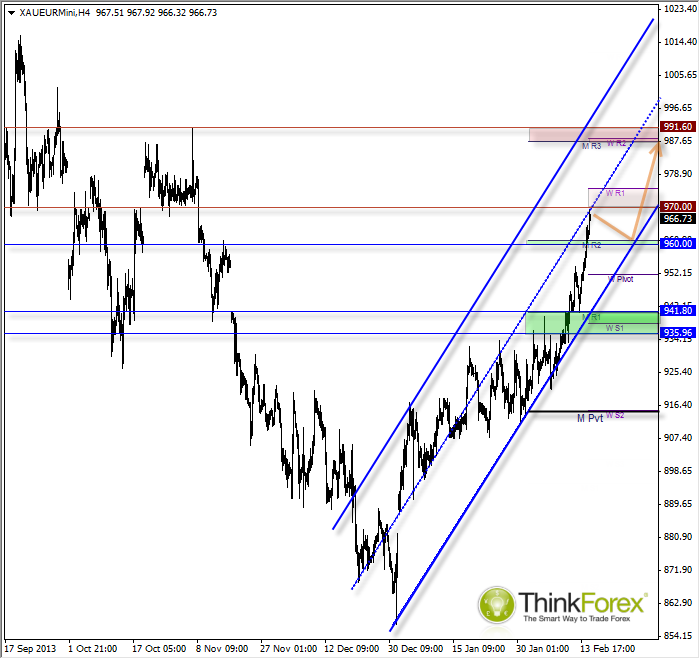

XAU/EUR: Above 1260, targets 988 XAU/EUR Hourly Chart" title="XAU/EUR Hourly Chart" width="474" height="242" />

XAU/EUR Hourly Chart" title="XAU/EUR Hourly Chart" width="474" height="242" />

In light of recent Gold strength and to make you aware of our new Mini-Metal contracts I thought it would be appropriate to cover the XAU/EURchart today.

After breaking up through 942 resistance a bullish channel can be seen, which we are currently trading just beneath the midway point near 1970 resistance. Due to this my bias is for a modest pullback prior to a resumption of to the clearly bullish uptrend.

960 is a likely support area as this comprises of Monthly R2 resistance and a pivotal S/R level.

Due to the increasingly bullish momentum and weaker USD across the board my next target beyond 1270 is 988.00

Only a break back below the 1235-42 support zone puts us back into bearish territory on the daily timeframe.

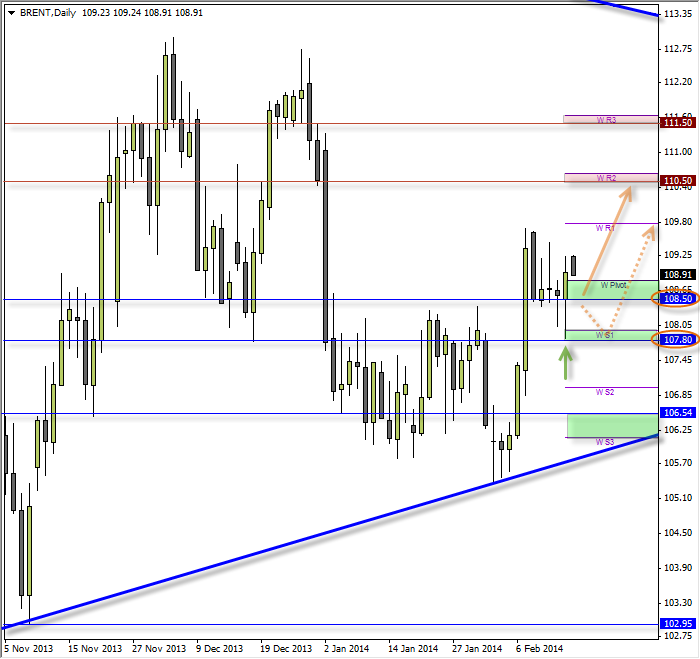

Brent: Bullish Pinbar suggests bullish flag breakout

Friday tested but failed to break 107.80 support and closed the day with a bullish pinbar. Seeing as the original bias was for a bullish flag to be forming this provides further clues towards a pending bullish breakout and for a run up to 110.50 / 111.50.

In the event we break beneath Friday's low of 107.80 then next likely support is around 106.50. However keep in mind this is the lower trendline of a larger triangle which may provide good support. However should this break to the downside then we can expect a more significant move to 103 and 100. However due to the USD weakness across the board this is a less likely scenario, so favour the run up to 110.50.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.