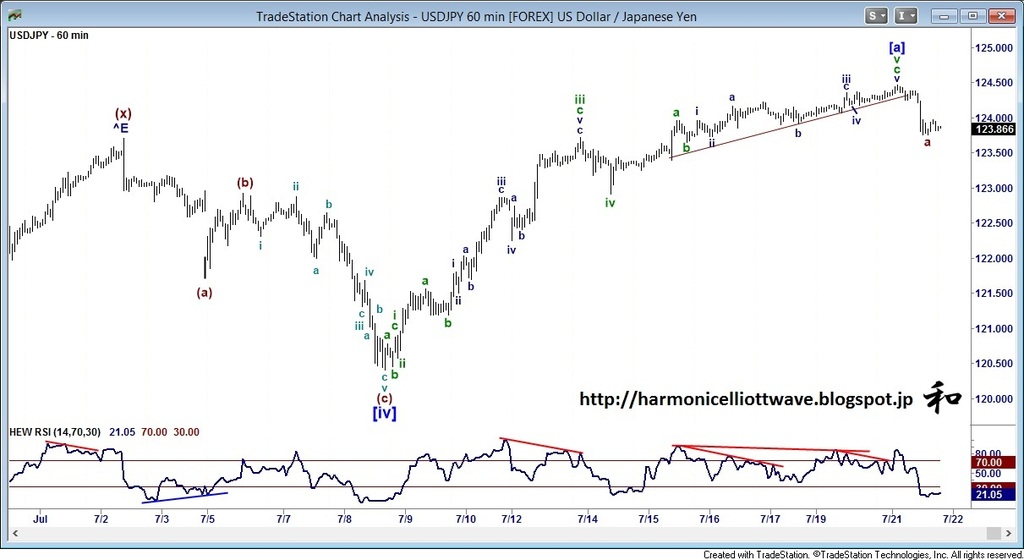

USD/JPY INTRADAY CHART

BIAS: We should see 124.00-25 caps for further losses

MAIN ANALYSIS: The 124.40-57 area capped perfectly and saw another perfect first reversal back to the 123.65-75 area. I suspect we'll see the 124.00-25 area cap for losses below 123.65-75 and for losses to extend to the next support around 122.91-123.20. Expect a correction from here also.

Below, note the 122.50-70 congestion area and also 121.76-00.

COUNTER ANALYSIS: Only a break above 124.47 would extend gains to 124.80-85 and potentially towards 125.12-36, with the 125.85 high the next barrier.

MEDIUM TERM ANALYSIS:

22nd July: We have seen the rally stall in the expected mid 124's, and should now see losses back to 122.50-70, at least - possibly 121.76-00. There are deeper retracements, but this will need observation as the correction develops. Overall, we should be looking for a corrective low.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.