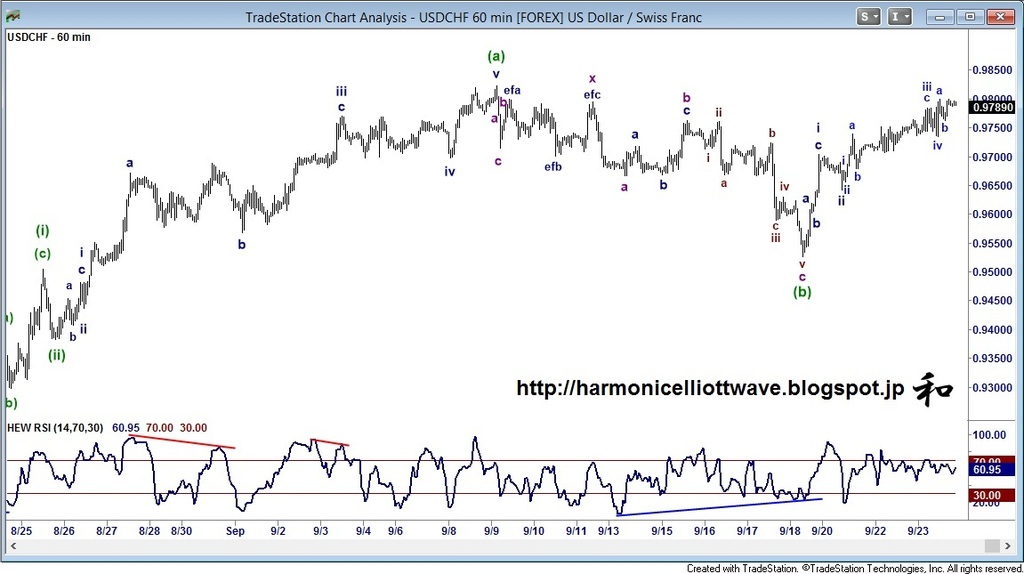

INTRADAY CHART

BIAS: We should see a move above 0.9800 but followed by a correction - expected to be shallow- before gains resume

MAIN ANALYSIS: Price towards the 0.9762-70 target and then precisely to the higher 0.9784 projection target for a correction of around 50 points. This should then see the rally extend towards the 0.9800-23 area. Maybe allow a little higher. However, this care should cap for a correction lower but I suspect the 0.9734-63 area will provide support. Thus, watch for bullish reversal patterns/ indications for the rally to extend above 0.9830 and towards 0.9902 and above.

COUNTER ANALYSIS: Only a break below 0.9706-15 would concern and suggest a test of the 0.9675-80 support. Only below would extend losses further.

MEDIUM TERM ANALYSIS: 18th September: We have made some constructive progress and the collective development across the Europeans now appears to suggest stronger gains in the dollar. This should see relatively quick gains above 0.9823 and 0.9902 and above.

Only back below 0.9585 would concern - but note 0.9530 and 0.9487 - much below would risk an alternative daily corrective structure - but one I'll only deal with should it develop...

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI