USD/CHF Daily Outlook

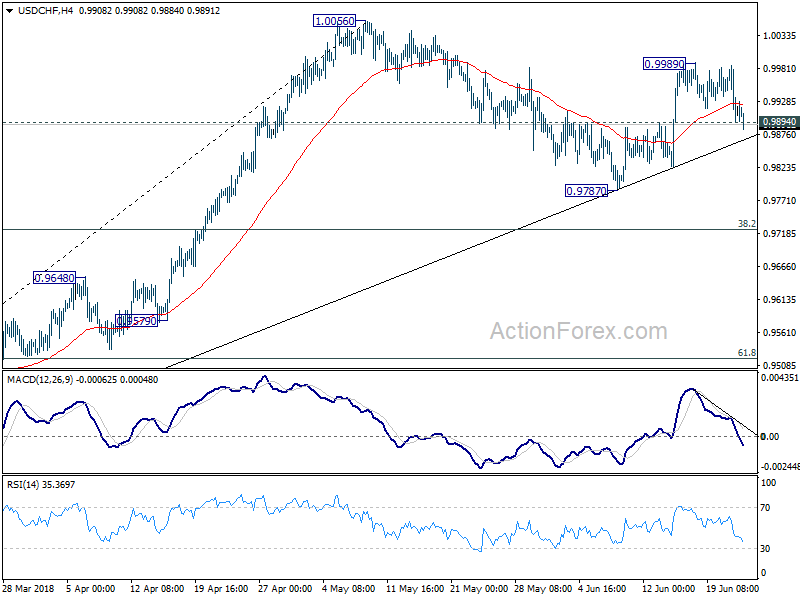

Daily Pivots: (S1) 0.9882; (P) 0.9934; (R1) 0.9971;

USD/CHF’s break of 0.9894 minor support suggests that rebound from 0.9787 is completed at 0.9989. And, correction from 1.0056 is extending. Intraday bias is turned back to the downside for 0.9787 support and possibly below. But we’d expect strong support from 38.2% retracement of 0.9186 to 1.0056 at 0.9724 to contain downside to bring rebound. On the upside, break of 0.9989 will target a test on 1.0056 first. Break will resume whole rise from 0.9186.

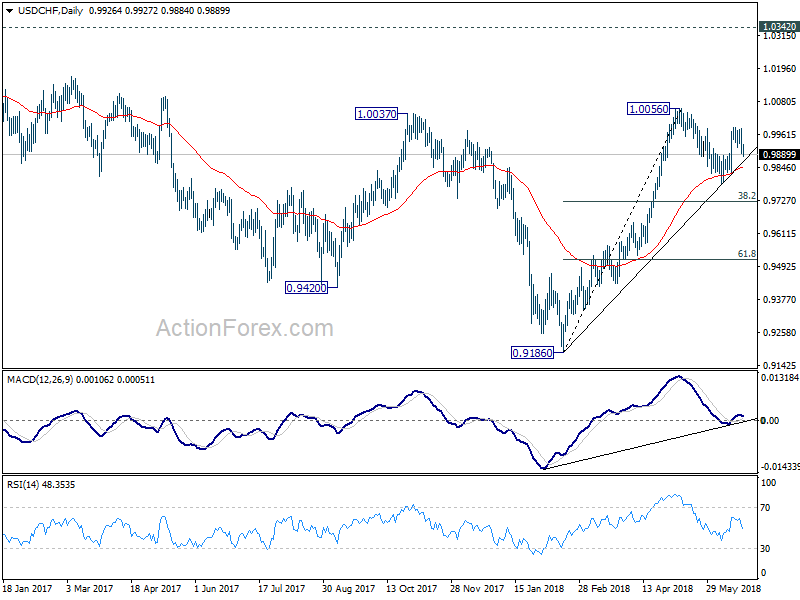

In the bigger picture, medium term decline from 1.0342 has completed with three waves down to 0.9186. Rise from there is currently viewed as a leg inside the long term range pattern. Hence, while further rally would be seen, we’d be cautious on strong resistance from 1.0342 to limit upside. For now, further rise is expected as long as 38.2% retracement of 0.9186 to 1.0056 at 0.9724 holds. However, sustained break of 0.9724 will dampen this bullish view and would at least bring deeper fall to 61.8% retracement at 0.9518.

GBP/USD Daily Outlook

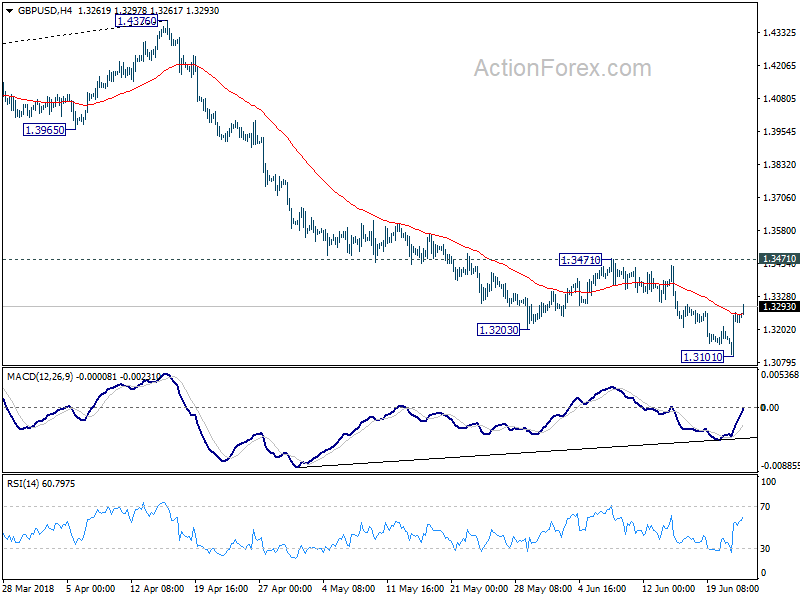

Daily Pivots: (S1) 1.3139; (P) 1.3205; (R1) 1.3308;

GBP/USD’s rebound from 1.3101 temporary low is in progress and could extend higher. Still, near term outlook will remain bearish as long as 1.3471 resistance holds. And larger decline is expected to continue. On the downside, break of 1.3101 will resume the fall from 1.4376 for 61.8% retracement of 1.1946 to 1.4376 at 1.2875 next.

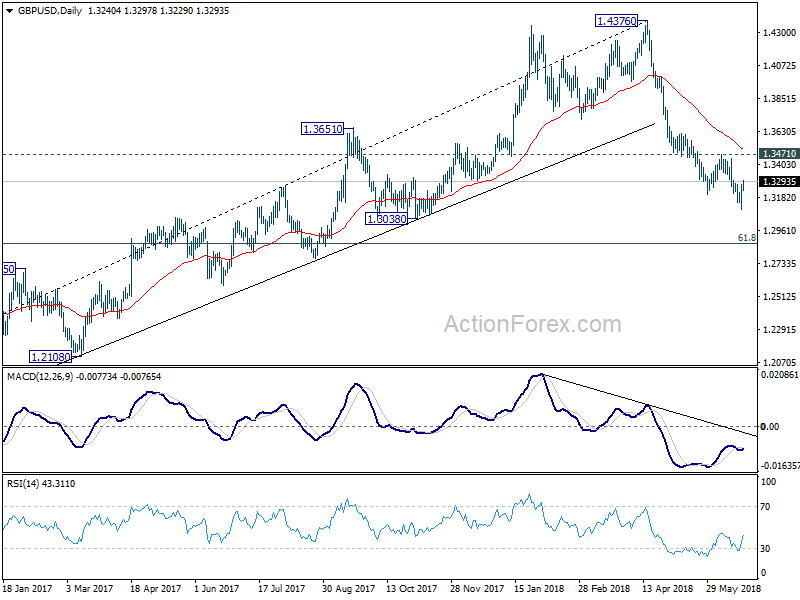

In the bigger picture, current development suggests that whole medium term rebound from 1.1936 (2016 low) has completed at 1.4376 already, with trend line broken firmly, on bearish divergence condition in daily MACD, after rejection from 55 month EMA (now at 1.4177). 61.8% retracement of 1.1936 (2016 low) to 1.4376 at 1.2874 is the next target. We’ll pay attention to the reaction from there to asses the chance of long term down trend resumption. For now, outlook will stay bearish as long as 55 day EMA (now at 1.3527) holds, even in case of strong rebound.