SPX topped within 100 basis points of its 78.6% retracement of Wednesday’s drop at 1266.65. Today’s exuberant rally still has all the earmarks of a countertrend. A decline below mid-cycle support at 1246.71 puts the SPX back in the bearish half of the cycle range, while a decline below 1231.00 changes the absolute trend to “down.”

The next cycle turn either happens today or at the open on Monday. The hourly pattern suggested that the retracement may have already been over at 11:00. There is no reason to stay long over the weekend.

The NDX rallied slightly above its 61.8% retracement at 2360.00. Its mid-cycle support is much closer at 2346.59. Notice the Broadening Wedge and Head& shoulders neckline just below it. Broadening formations often have similarities to Head & Shoulders patterns. Finding both patterns either conjoined or nearby may be an extra confirmation of what outcome to expect for the markets.

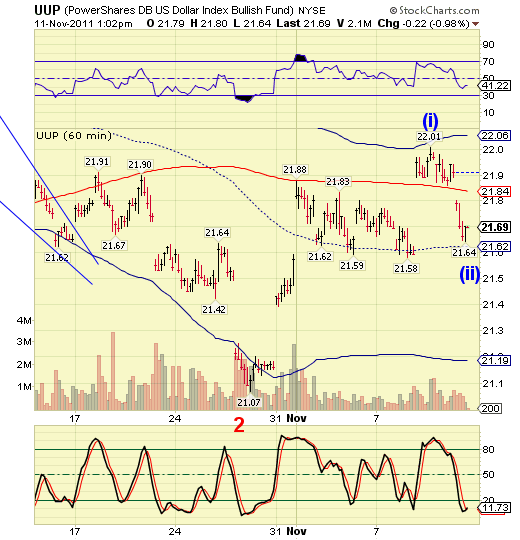

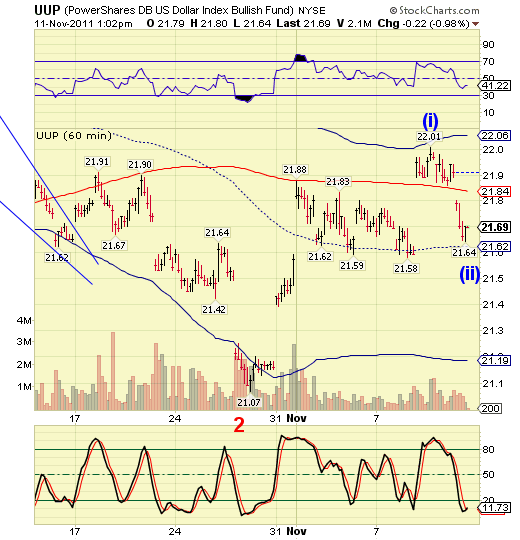

The US Dollar (UUP) completed an impulsive rally and retracement above mid-cycle support today, maintaining its bullish bias. It appears to be poised for the next lift-off, which will be confirmed by rallying above intermediate-term support/resistance at 21.84.

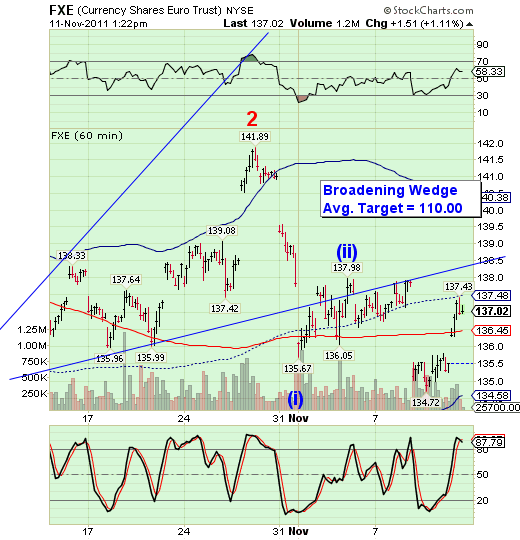

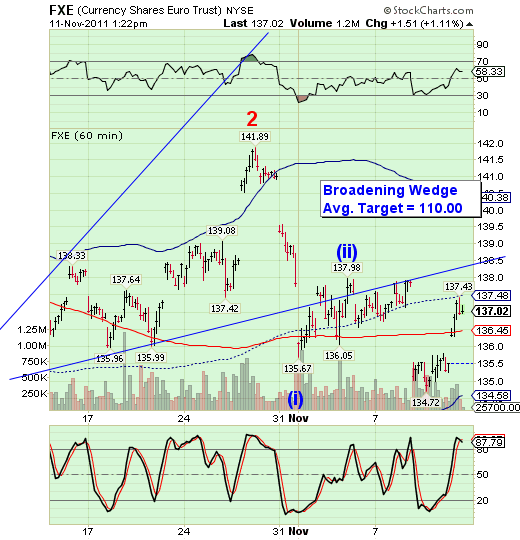

The Euro (FXE) made an 83% retracement of its decline, only to be stopped by its mid-cycle resistance at 137.48. Trading is being done on extremely light volume, which allows the HFT computers to push the envelope to the extreme. The damage to the Euro has already been done, however. Last week’s retracement could not even make the 38.2% level. This has led some technicians to speculate that the rally in the Euro may not be over. However, the lower low at 134.72 and the resistance at mid-cycle (137.02) suggests otherwise.

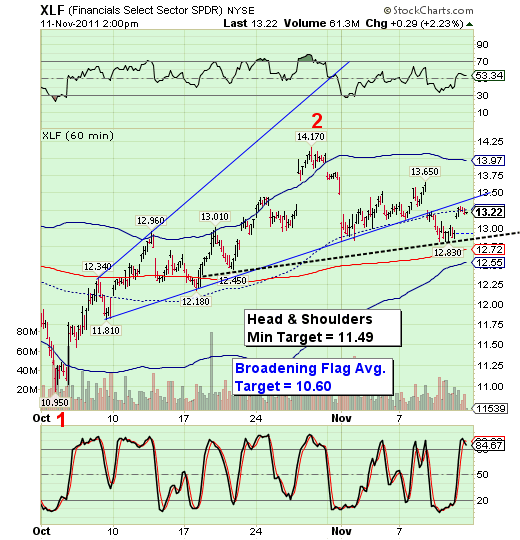

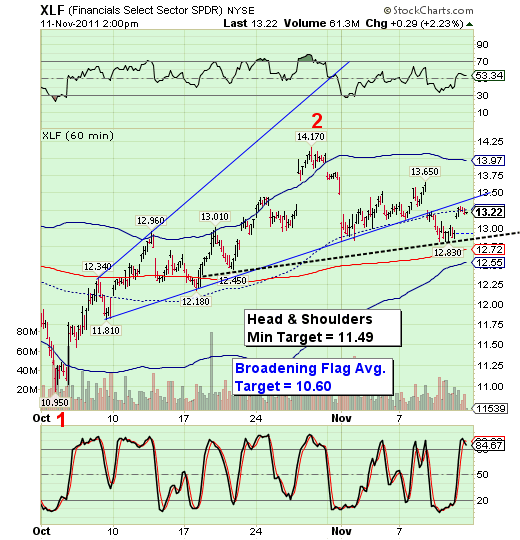

The Banking Index (XLF) was also stopped at mid-cycle resistance at 13.26. A cross of the Head & Shoulders neckline at 12.85 sets off a potential third-of-a-third wave decline that could be devastating for the index.

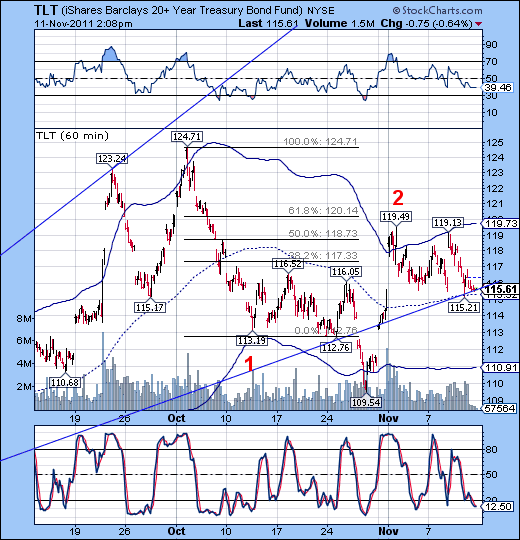

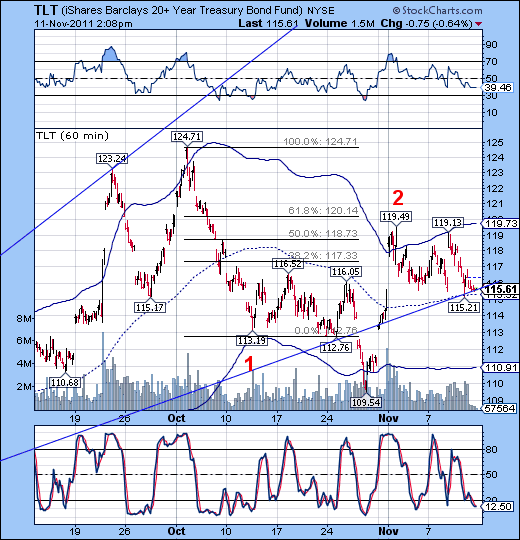

TLT keeps teasing us with its “edgy” behavior. It is possible that a Monday morning decline in stocks may provoke the usual knee-jerk rush into bonds, so the immediate path for bonds is still murky. However, the larger Broadening Wedge pattern is quite bearish and any further decline below this level may cause bonds to join stocks in a deflationary sell-off.

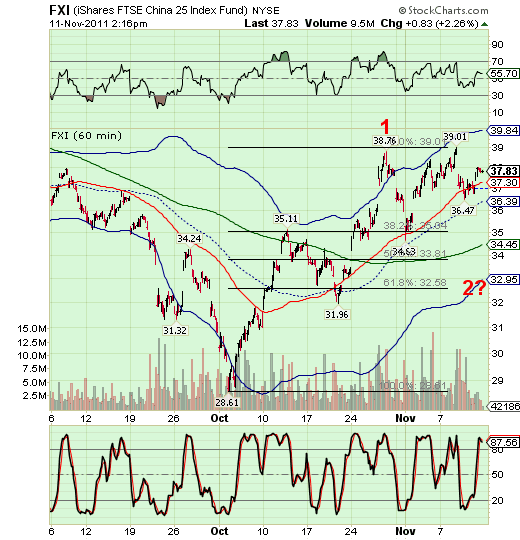

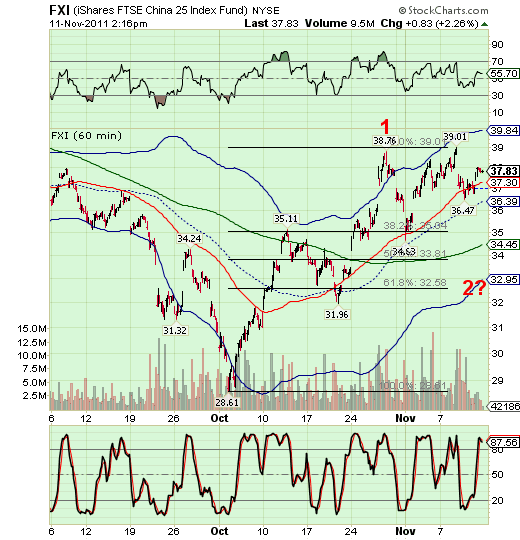

The Shanghai Index (FXI) has remained more positive than even I had expected. However, its decline into an early-December low has finally begun. My trading model suggests a potential 61.8% retracement before FXI resumes its upward journey.

The next cycle turn either happens today or at the open on Monday. The hourly pattern suggested that the retracement may have already been over at 11:00. There is no reason to stay long over the weekend.

The NDX rallied slightly above its 61.8% retracement at 2360.00. Its mid-cycle support is much closer at 2346.59. Notice the Broadening Wedge and Head& shoulders neckline just below it. Broadening formations often have similarities to Head & Shoulders patterns. Finding both patterns either conjoined or nearby may be an extra confirmation of what outcome to expect for the markets.

The US Dollar (UUP) completed an impulsive rally and retracement above mid-cycle support today, maintaining its bullish bias. It appears to be poised for the next lift-off, which will be confirmed by rallying above intermediate-term support/resistance at 21.84.

The Euro (FXE) made an 83% retracement of its decline, only to be stopped by its mid-cycle resistance at 137.48. Trading is being done on extremely light volume, which allows the HFT computers to push the envelope to the extreme. The damage to the Euro has already been done, however. Last week’s retracement could not even make the 38.2% level. This has led some technicians to speculate that the rally in the Euro may not be over. However, the lower low at 134.72 and the resistance at mid-cycle (137.02) suggests otherwise.

The Banking Index (XLF) was also stopped at mid-cycle resistance at 13.26. A cross of the Head & Shoulders neckline at 12.85 sets off a potential third-of-a-third wave decline that could be devastating for the index.

TLT keeps teasing us with its “edgy” behavior. It is possible that a Monday morning decline in stocks may provoke the usual knee-jerk rush into bonds, so the immediate path for bonds is still murky. However, the larger Broadening Wedge pattern is quite bearish and any further decline below this level may cause bonds to join stocks in a deflationary sell-off.

The Shanghai Index (FXI) has remained more positive than even I had expected. However, its decline into an early-December low has finally begun. My trading model suggests a potential 61.8% retracement before FXI resumes its upward journey.