Bitcoin price today: drops below $105k after $1.3 bln crypto liquidation wave

Weekly CFTC Net Speculator Crude Oil Report

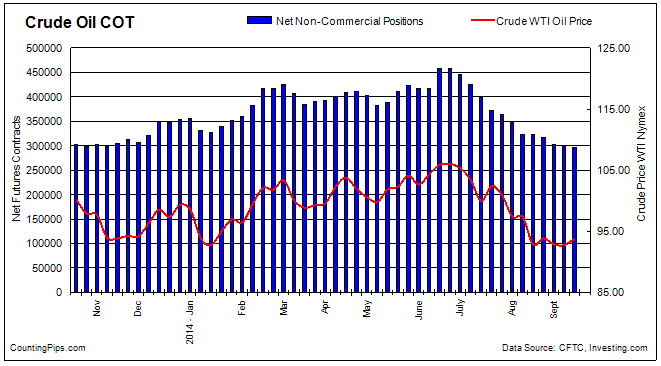

Oil Speculators overall long positions drop to lowest since July 2013

Crude Oil futures market traders and large speculators edged down their overall bullish bets in crude oil futures last week for a twelfth straight week and to the lowest level since July 2013, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

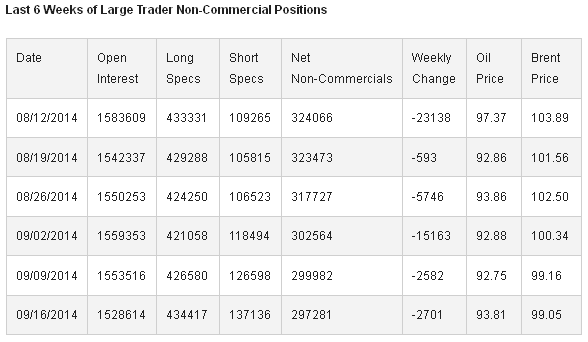

The non-commercial contracts of crude oil futures, traded by large speculators, traders and hedge funds, decreased to a total net position of +297,281 contracts in the data reported for September 16th. This was a change of -2,701 contracts from the previous week’s total of +299,982 net contracts for the data reported through September 9th.

For the week, standing non-commercial long positions in oil futures increased by a total of 7,837 contracts but were more than offset by the short positions which rose by 10,538 contracts to total the overall weekly net change of -2,701 contracts.

The non-commercial trader’s net positions dropped to the lowest level since July 2nd 2013 when overall net positions equaled +289,595 contracts.

Over the same weekly reporting time-frame, from Tuesday September 9th to Tuesday September 16th, the crude oil price rose slightly from $92.75 to $93.81 per barrel, according to Nymex futures price data from investing.com. Brent crude prices, meanwhile, edged slightly lower from $99.16 to $99.05 per barrel from Tuesday September 9th to Tuesday September 16th, according to price data from investing.com.

Disclaimer: The weekly commitment of traders report summarizes the total trader positions for open contracts in the futures trading markets. The CFTC categorizes trader positions according to commercial hedgers (traders who use futures contracts for hedging as part of the business), non-commercials (large traders who speculate to realize trading profits) and nonreportable traders (usually small traders/speculators).

Which stocks should you consider in your very next trade?

The best opportunities often hide in plain sight—buried among thousands of stocks you'd never have time to research individually.

That's why smart investors use our Stock Screener with 50+ predefined screens and 160+ customizable filters to surface hidden gems instantly.

For example, the Piotroski's Picks method averages 23% annual returns by focusing on financial strength, and you can get it as a standalone screen. Momentum Masters catches stocks gaining serious traction, while Blue-Chip Bargains finds undervalued giants.

With screens for dividends, growth, value, and more, you'll discover opportunities others miss. Our current favorite screen is Under $10/share, which is great for discovering stocks trading under $10 with recent price momentum showing some very impressive returns!