Weekly CFTC Net Speculator Crude Oil Report

CFTC COT data Monday Release due to US Thanksgiving Holiday

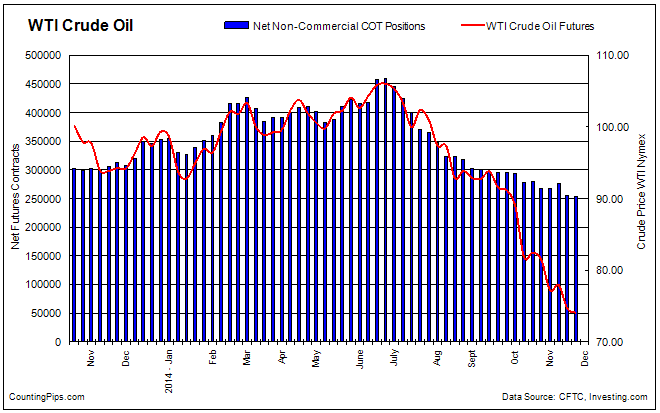

CRUDE OIL: Futures market traders and large speculators slightly trimmed their overall bullish bets in crude oil futures on Tuesday of last week a few days before OPEC decided not to cut oil production in response to lower oil prices, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Monday due to Thanksgiving US holiday.

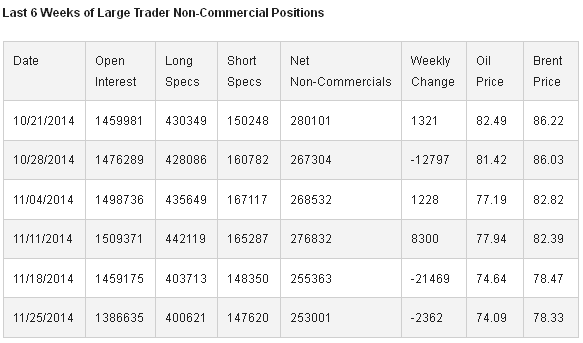

The non-commercial contracts of crude oil futures, traded by large speculators, traders and hedge funds, declined to a total net position of +253,001 contracts in the data reported for November 25th. This was a change of -2,362 contracts from the previous week’s total of +255,363 net contracts for the data reported through November 18th.

For the week, standing non-commercial long positions in oil futures decreased by a total of -3,092 contracts which overcame the short positions that fell by just -730 contracts to total the overall weekly net change of -2,362 contracts.

OPEC decided not to reduce production of oil at last week’s meeting to offset the dramatic oil price slide since June. The next batch of COT data that will be released on Friday will possibly show a reflection of the new reality for the oil market.

Over the same weekly reporting time-frame, from Tuesday November 18th to Tuesday November 25th, the WTI Crude Oil price slid from $74.64 to $74.09 per barrel, according to Nymex futures price data from investing.com. Brent crude prices, meanwhile, also showed a small decrease from $78.47 to $78.33 per barrel from Tuesday November 18th to Tuesday November 25th, according to price data from investing.com.

*COT Report: The weekly commitment of traders report summarizes the total trader positions for open contracts in the futures trading markets. The CFTC categorizes trader positions according to commercial hedgers (traders who use futures contracts for hedging as part of the business), non-commercials (large traders who speculate to realize trading profits) and nonreportable traders (usually small traders/speculators).

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.