Bitcoin price today: muted at $118k but altcoins soar as House passes new bills

Weekly CFTC Net Speculator Crude Oil Report

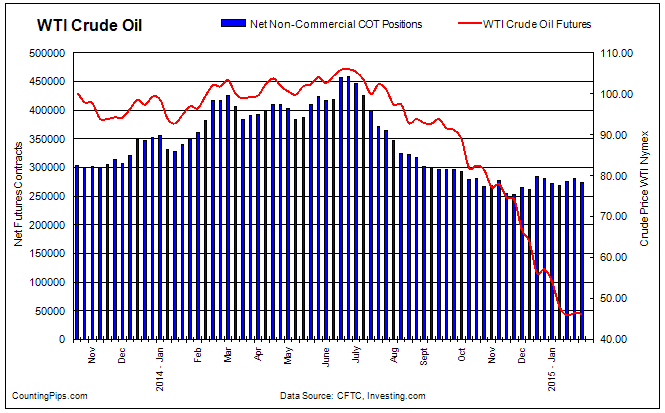

CFTC COT data shows speculators decreased oil bets last week

CRUDE OIL: Futures market traders and large speculators decreased their overall bullish bets in WTI crude oil futures last week for the first time in three weeks, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

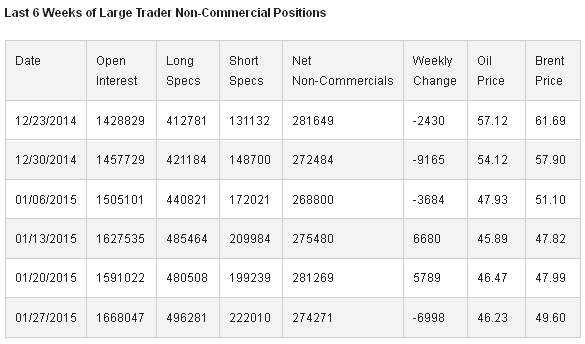

The non-commercial contracts of crude oil futures, traded by large speculators, traders and hedge funds, totaled a net position of +274,271 contracts in the data reported for January 27th. This was a change of -6,998 contracts from the previous week’s total of +281,269 net contracts for the data reported through January 20th.

For the week, standing non-commercial long positions in oil futures rose by a total of 15,773 contracts but were more than offset by a rise in the short positions by 22,771 contracts to total the overall weekly net change of -6,998 contracts.

Over the same weekly reporting time-frame, from Tuesday January 20th to Tuesday January 27th, the WTI crude oil price edged lower from $46.47 to $46.43 per barrel, according to Nymex futures price data from investing.com. Brent crude prices, meanwhile, also saw a slight decrease from $47.99 to $47.60 per barrel from Tuesday January 20th to Tuesday January 27th, according to price data from investing.com.

*COT Report: The weekly commitment of traders report summarizes the total trader positions for open contracts in the futures trading markets. The CFTC categorizes trader positions according to commercial hedgers (traders who use futures contracts for hedging as part of the business), non-commercials (large traders who speculate to realize trading profits) and nonreportable traders (usually small traders/speculators).

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI