There was no shortage of strong movements in the markets on Wednesday. However, a short-lived dip on the stock market was quickly bought back. In contrast, moves on the currency and commodities markets were one-sided.

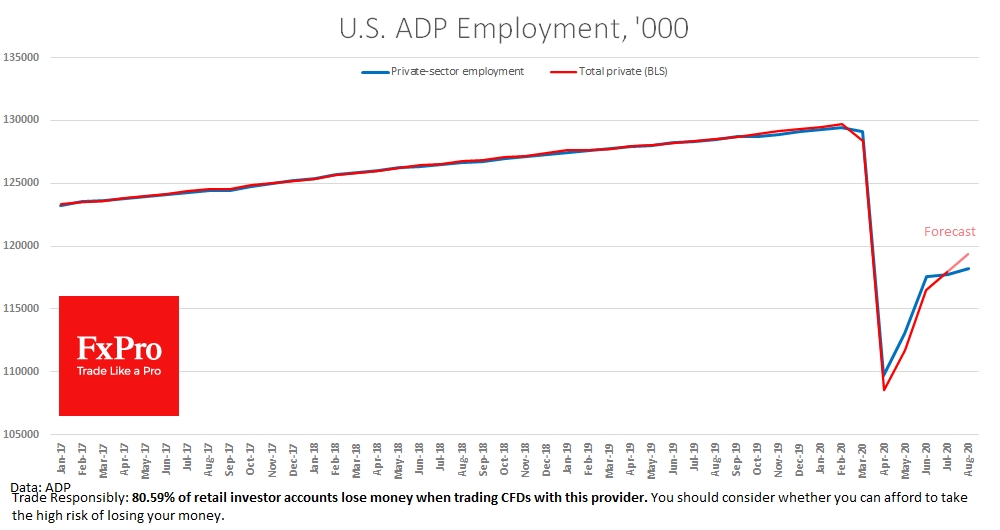

Brent and WTI prices lost over 3% on Wednesday. The decline in Oil coincided with the release of weak US labour market data from ADP, which showed an increase of 438,000 jobs in contrast to the expected 1.25 million increase.

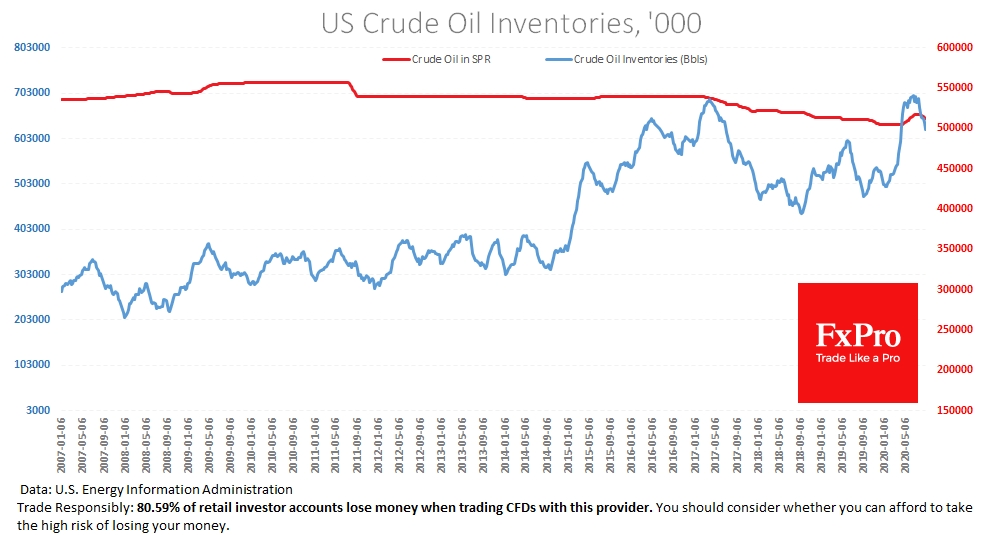

The Oil pressure increased with the release of weekly assessments of reserves and production in the USA. The failure of production from 10.8 million to 9.7 million barrels per day was due to a hurricane that paralysed output in Texas and the Gulf of Mexico last week. Reserves have declined by 9.3 million, but the decline seems small given the production collapse. Still, it was 17.8% higher than this week one year ago. This has alerted us to a recovery in demand for Oil.

An additional pressure factor in the commodity and currency markets was the strengthening dollar. As there are no risks of an increase in US rates on the horizon, the demand for USD can be explained by a lower risk demand and concerns about weak consumer and business activity.

The Chief Economist of the ECB drew attention to the exchange rate, which central banks and politicians are trying to avoid. The 12% appreciation of the euro against the dollar in the previous four months is a threat to Europe's recovery, where many economies have lost more than the US in Q2 but struggled to recover as euro growth promises to suppress exports.

The ECB's attention to the euro a week before the monetary policy decision should be seen as a signal of a softening tone or new easing, which is good for stock markets and negative for the single currency.

Presumably because of this, stock purchases have remained strong, which indicates investor optimism. This optimism may also return to previous trends in the form of a weakening dollar and a recovery in oil prices.

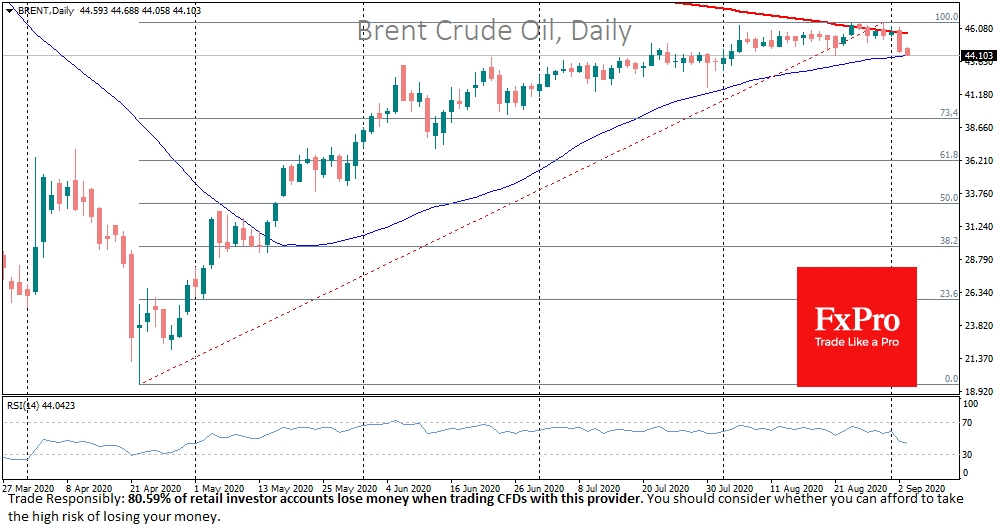

On the technical side, Brent is now testing a 50-day average from top to bottom and has not managed to exceed 200 days. The bear attack from an important technical level indicates medium-term pessimistic expectations.

Brent sustained drop below $44 could be a signal of a deeper and longer-term correction with potential targets at $36. The baseline scenario is still more optimistic with support close to current levels and a reversal to growth with targets around $50 by the end of the year.

The FxPro Analyst Team

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI