WTI Crude Oil prices have come under concerted pressure following the release of figures from the American Petroleum Institute (API) showing a significant increase in inventory levels.

The API figures, which are typically released prior to the official EIA data, signalled a significant inventory build of 4.6 million barrels of crude. Subsequently, WTI prices dropped sharply, erasing over 1.13% to close the session around the $44.72 a barrel level.

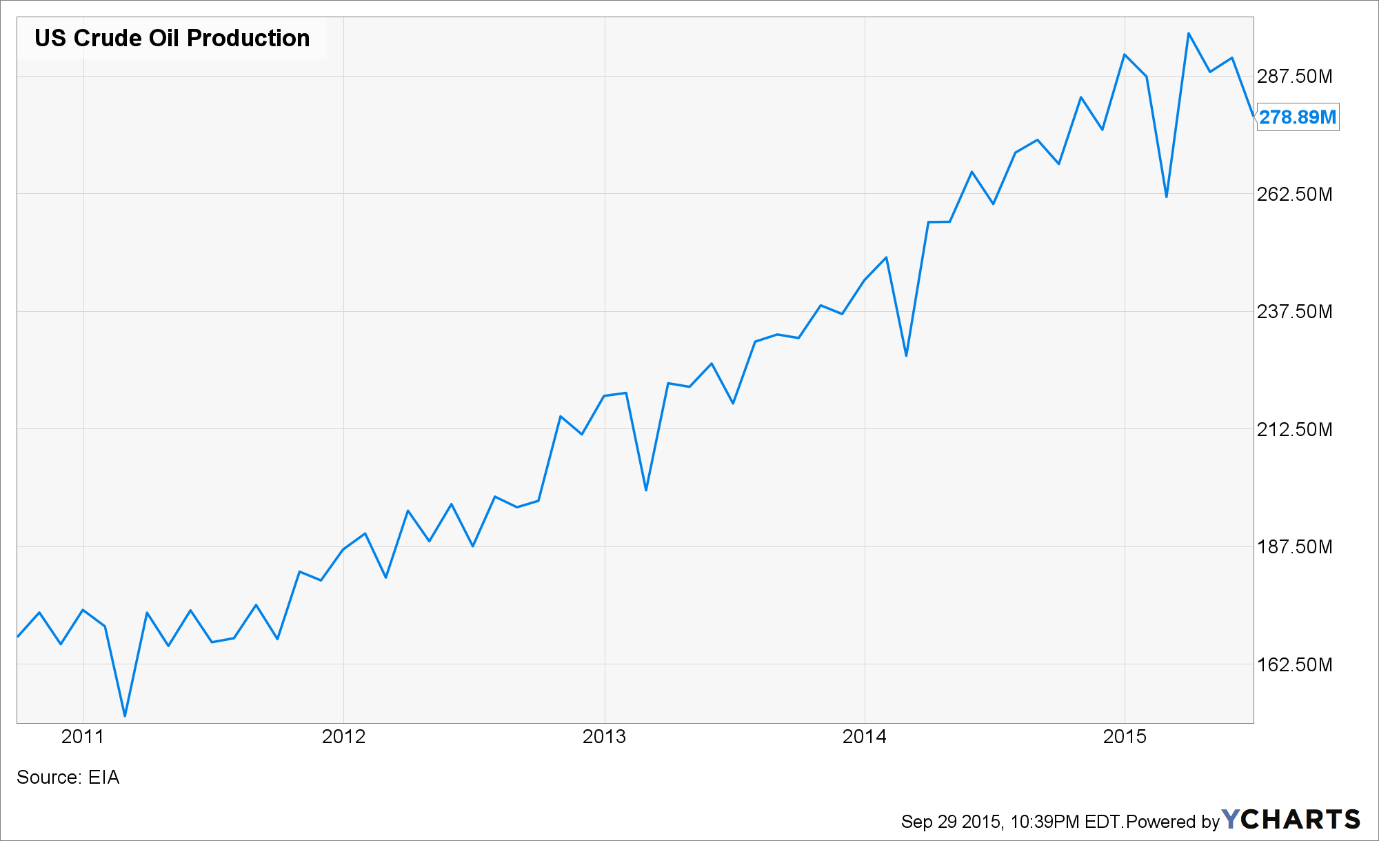

The reality is that US oil production is again on the increase as last week saw the weekly rig count increase for the first time in over 7 weeks. The increase in production activity has been primarily driven by Alaskan oil in contrast to the reductions occurring within the shale industry. It is clear, for the shale industry at least, that whilst prices remain below the key $50.00 level that any rallies will be self-defeating as rigs are returned to production.

The reality is that the systemic imbalances within the global crude oil markets have continued as a war rages between OPEC and US producers. Despite statements pointing at plans to reduce supply, OPEC has maintained their level of production in a strategy designed to damage the fledgling US shale industry.

However, OPEC’s game of chess may turn out to be a failed policy as the push is on for the US to ease the current export restrictions on crude. As long as the inventory stockpile at Cushing grows, so will the pressure to lift the export restrictions.

Given the ongoing battle for global energy market dominance, it would appear that there is plenty of fuel for a case of lower WTI prices. The incentive is in place for US shale producers to innovate to reduce their operating costs. Subsequently, in the medium term, we could see a slow increase in the rig count as new efficiencies are achieved.

Ultimately, the game changer is likely to be the lifting of export restrictions which could cause a significant increase in rig activity, in particular within the Bakken formation. Regardless of the short term outcomes, one thing is for sure, OPEC is facing a changing marketplace.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.