Stock market today: S&P 500 in weekly win as Fed shakeup stokes rate-cut hopes

The coronavirus has caused severe economic uncertainty, as economists are beginning to weigh its effect on economic growth.

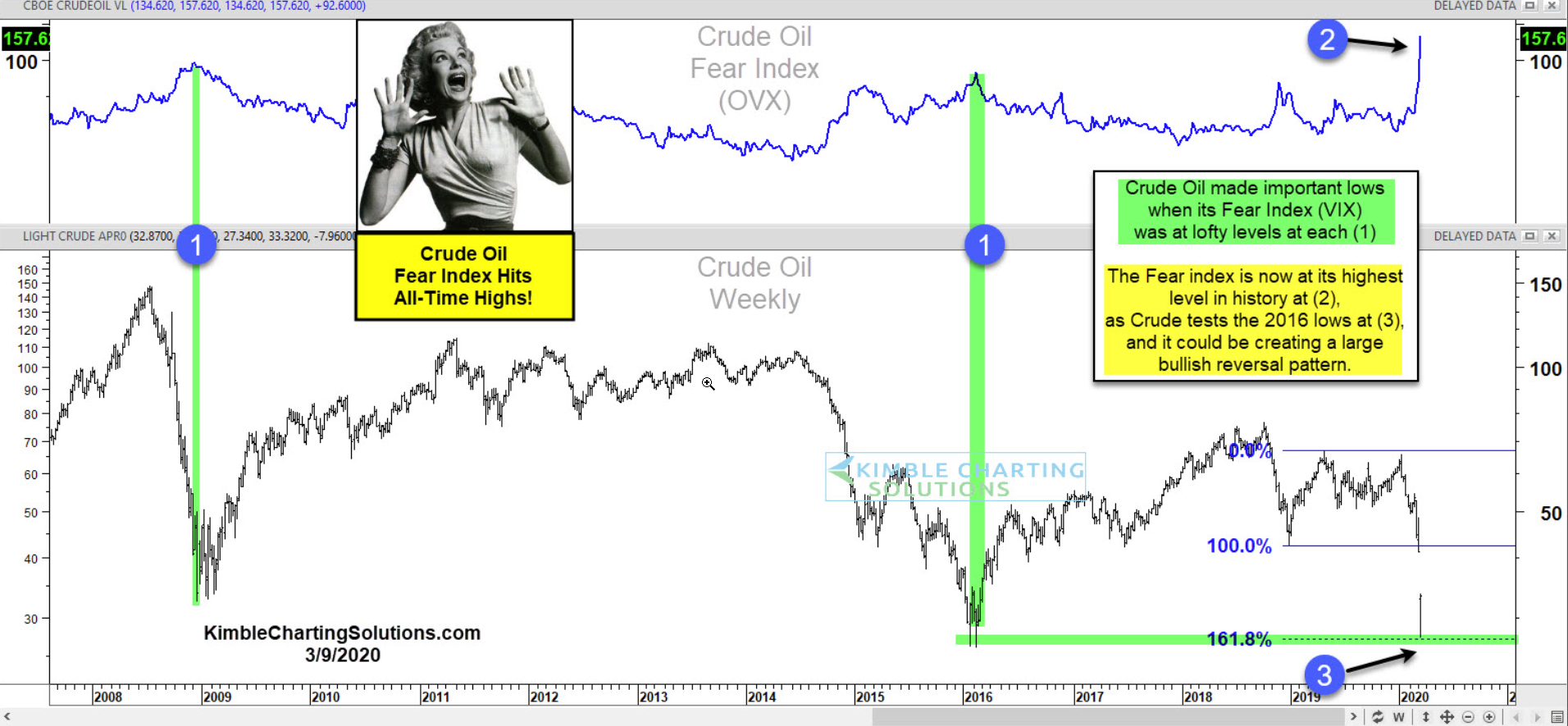

This has brought heightened levels of fear into the financial markets, sending both stocks and economically sensitive commodities like crude oil cascading lower.

On Tuesday crude futures crashed lower alongside the stock market. We warned about the potential for crude oil and stocks to top at the same time (back in January). And oil prices are now nearing levels not seen since 2016.

The crash in prices has sent crude’s fear index (OVX) spiking higher to all-time highs (2). The prior two spikes occurred near major crude oil price bottoms at (1).

And the latest spike comes as crude oil tests its prior price lows from 2016 at (3). Could this turn into a double bottom? Oil bulls (and stock bulls) sure hope so.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI