The only way to change the meaning of a word like “transitory” is to put together a constant string of temporary factors that when taken individually keep with the traditional definition but in combination completely obliterate it. Something happens to knock inflation off track, and then just as soon as that one thing is about to abate and inflation is about to happen the next comes along to foil the trend.

Such a view, especially stretched out over so many years, might be better characterized differently. It might not be an unfortunate series of transitory disruptions rather than a constant negative pressure misinformed by mistaken interpretations. In other words, you might think there are “transitory” interruptions to the recovery/inflation scenario but what you are really doing is fitting that bias onto a baseline that doesn’t actually include either of them.

It’s how these BOND ROUTS!!!! get made:

“There is no mojo” for bond bears, said Ward McCarthy, chief financial economist at Jefferies LLC. “Seems we are looking at another Q1 slowdown.”

This quote taken from yet another Bloomberg article professing “The bears in the Treasuries market just can’t seem to catch a break.” Maybe there are none to be had. Bill Gross said February’s payroll report, the one with the headline above +300k, should wreck the 10s in price to finally and definitively deliver over 3% in yield. What, then, does March’s +103k do to them?

When you start to realize there is no difference between either of those two headline Establishment Survey estimates, they are both bad, then you can appreciate why when it seems everyone and their mother (and brother) is short UST’s the 10s still don’t seem able to break above that psychological barrier.

Inflation hysteria has died down simply because there was nothing really backing it. For a while, it seemed like there was some minor probability that things might be changing with better economic stats. These proved temporary, however, and more often related to nothing more than the predictable aftermath of last year’s big hurricanes. For hysteria to be other than emotion, the economy better start living up to the idea in concrete fashion.

That’s the problem with one “transitory” factor after another, or how bond bears can’t seem to catch more than a BOND ROUT!!!! here or there; any truly unremarkable selloff that requires all caps and exclamation points because the emphasis proponents give the idea is inversely related to how substantial it really is. You may even start to get the idea that it is these routs that are transitory.

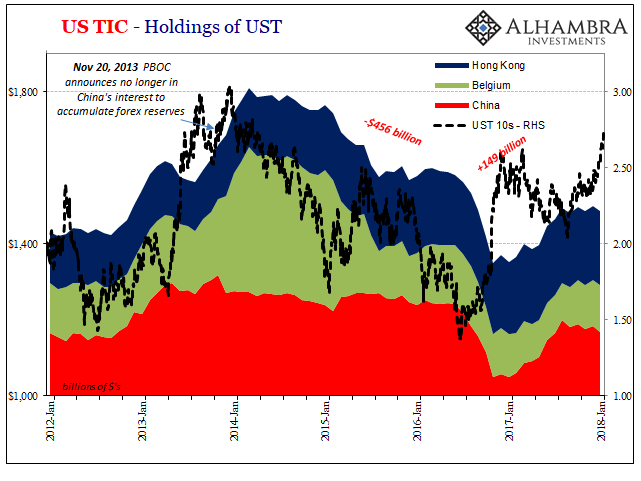

Earlier this week, Yale Economist (and former head, appropriately, of Morgan Stanley Asia) Stephen Roach warned that UST holders better look out now that China is making noises about retaliating in that market (thanks to M. Simmons) for President Trump’s initiation of a trade war.

If they just reduce their buying at a time when we are increasing our supply of new Treasurys into the market that could lead to a real rout in the bond market.

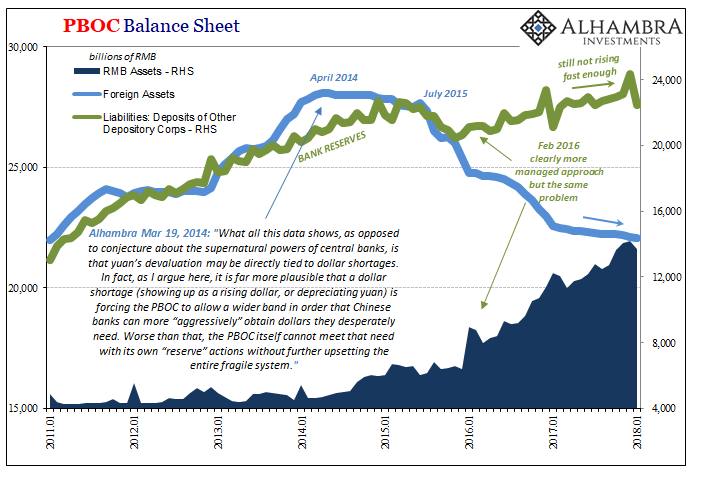

Pity those poor Ivy League statisticians who don’t seem to notice the obvious correlation that when China already did that, 2014 to 2016 to the tune of nearly half a trillion, 10-year yields went…down. What matters is not who is buying or selling, but why they might be doing any of one thing in response to a more important other thing (where that other is almost always misunderstood effects of the “dollar”).

Treasury yields declined as China sold them because those two things were actually the same idea being carried out in different ways. The Chinese had a desperate funding gap to make up while at the same time global liquidity risk was rising. The first caused the Chinese to “sell” the assets to “raise dollars” in supply, while the latter was the market response to the same exact thing.

In both cases, the net result was a global economic downturn, a very weak period of economic growth that took place at the very time the opposite was supposed to. Yields fell as predictions (late 2014/early 2015) of their rise reached a crescendo. The past, as always, is prologue.

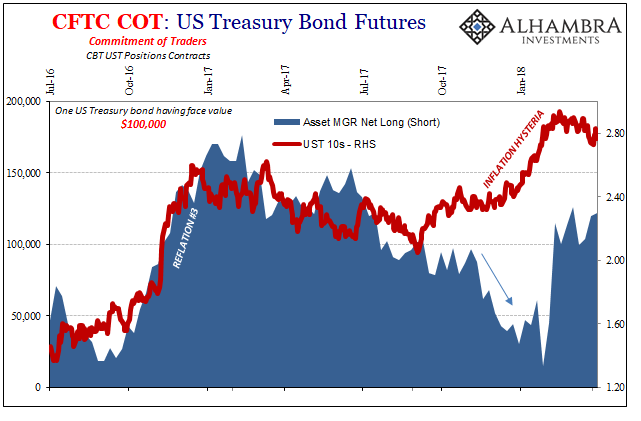

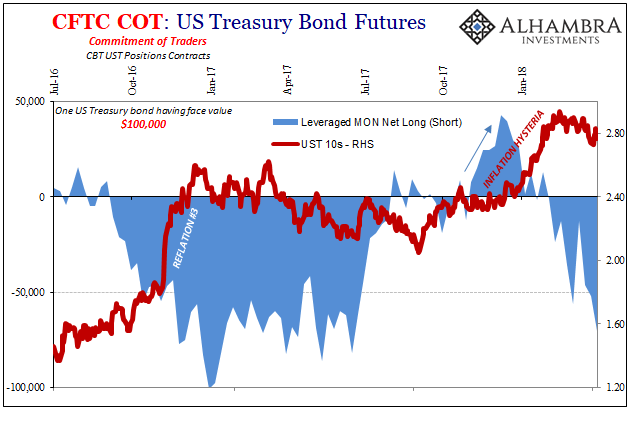

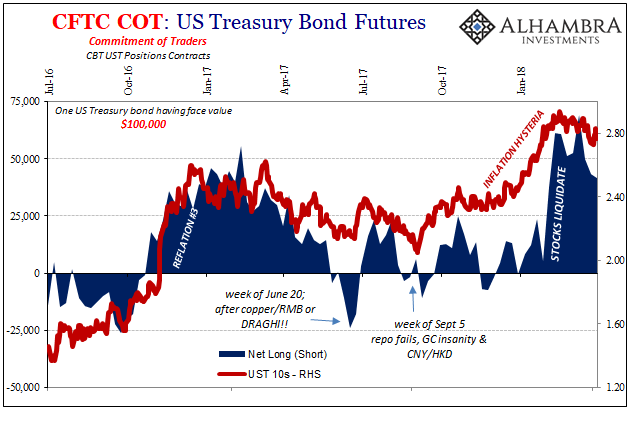

This isn’t to say there aren’t weird things going on even in the Treasury market; there are. For one, Asset Managers in the futures market were helping that massive short last fall but at the same time Leveraged Money players were moving quite long. These are not the usual kinds of displays, raising further questions about what really was going on as yields rose mostly in January 2018 right up until those stock market liquidations.

Why the change in UST futures positions, and was there any correlation with, say, HKD and what that might have suggested about China’s “dollar” activities and conditions?

It may have been, as indicated by the futures market pre-positioning, funding pressures hit the bond market first (negative global basis, repo collateral failures, etc.) causing a liquidation perhaps somewhat unrelated to inflation hysteria in the Treasury market but interpreted by an overeager mainstream to be that way – that then progressed to stocks and everything else (risk) in late January such that it triggered this countertrend in lower yields as per usual given global illiquidity and the renewed economic questions surrounding it.

Whatever it was, it certainly has been inconvenient (once again) for bond bears. The futures market shows that where everyone was once so certain about shorting them, they aren’t so sure betting against UST’s any longer. For all the supposed clarity about inflation hysteria and what that was going to do to yields, we are now six weeks (and counting) moving the wrong way again. Maybe that’s just a serious pause in the BOND ROUT!!!!, but economic indications over that intervening period aren’t close to being so hysterical.