Are DOGE layoffs set to resume?

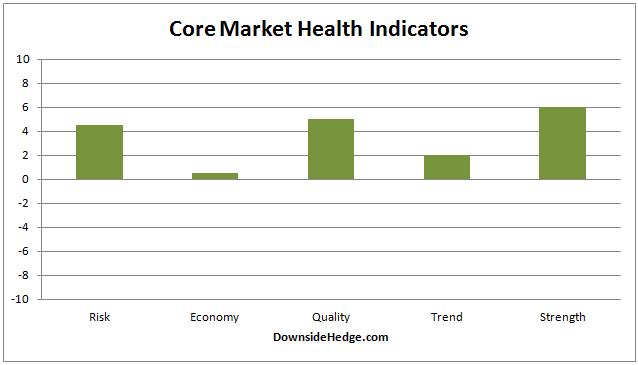

Over the past week the market has dipped a bit, but for the most part my core market health indicators have held steady. The one exception is my measures of risk. They have risen a bit and once again two of the four components of my market risk indicator are warning. The other two are a long way away so at the moment this appears to be just another short term dip in a long term uptrend. All of our portfolios are still 100% long.

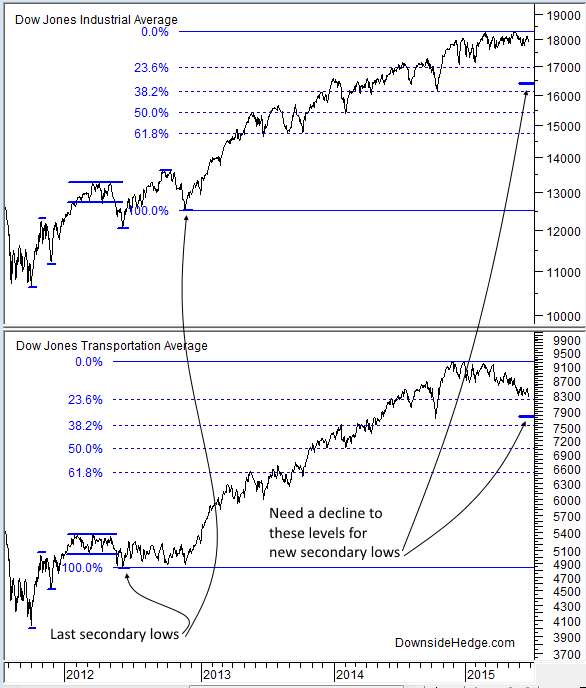

There’s been a lot of talk about the transports (DJT) this past week and the implications of their downtrend. If you look at the decline in a longer term context you can see that DJTA’s downtrend has only retraced about 20% of the rally out of its last secondary low. A “normal” decline in a bull market can decline more than 50% or even 67% of a move from a secondary low and still be healthy. With the industrials (DJIA) only a few percent away from all time highs Dow Theory is still confirming a long term bullish trend. I’ll need to see a decline in both indexes that are large enough to create new secondary lows before getting concerned about the long term trend.

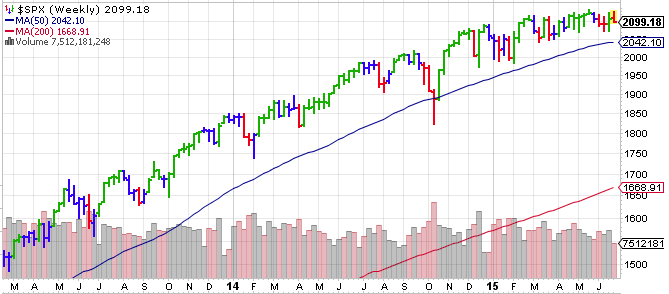

Elder Impulse for the S&P 500 Index weekly (SPX) is currently painting a red bar. That usually results in a few weeks of chop so don’t be surprised if we have more short term weakness.

The one thing I’m seeing that suggests we may be getting closer to a decent sized dip is the percent of stocks in SPX that are above their 200 day moving average. It’s back below the 60% level. When various measures of breadth get weak, the odds increase for a large decline.

Conclusion

The long term trend is still up, most market internals are healthy, but I’m seeing signs that short term weakness is ahead. If we get a signal from my market risk indicator the odds will increase that we’ll finally see a 10% decline.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.