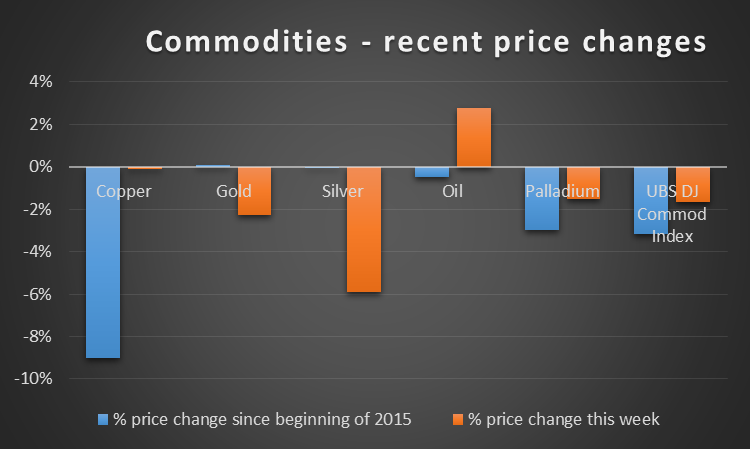

Copper has significantly underperformed other commodities since the beginning of the year as shown in the graph below.

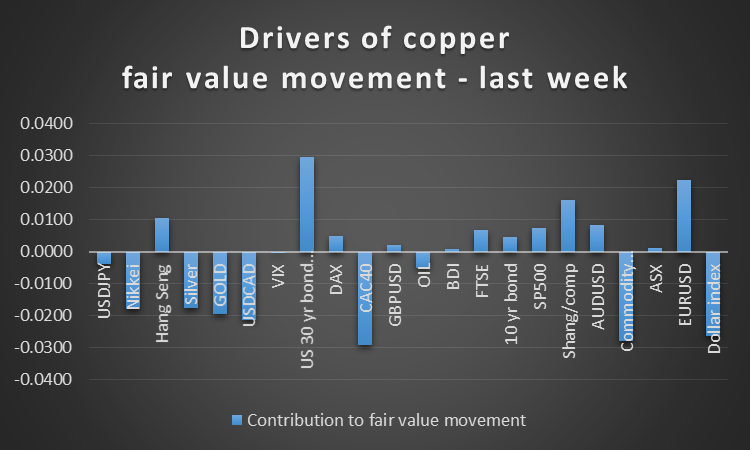

Despite the levelling in the copper price over the last week, when most other commodity prices weakened, it’s fair value declined by 2.8%. The graph below analyzes the drivers.

The decline in copper’s fair value exceeded the small drop in price and such a disparity would normally be a signal to sell copper short term. Taking positions based on disparities between fair value and price change of copper over the last 90 days would have yielded an annualized gain of 52% with volatility of 23%.

The sell signal is reinforced by our assessment that copper is overvalued on fundamentals - we have copper’s fair value at more than 20% below the current price. Taking positions based on this signal of under/over valuation would have generated an annualized return of 54% with volatility of 23% over the last 90 days.

We find further confirmation from our signal based on the lead given by the change in the Baltic Dry Index (BDI) of raw material shipping freight rates. This index is widely seen as a leading indicator of world economic growth, with increases viewed as bullish and conversely. The copper price is also seen as an indicator of economic health and we were not surprised to find a positive correlation between the copper price and the BDI over the last six years. Given the 29% drop in the BDI over the last month, this bodes for a short term price decline in copper.

Trading this signal would have yielded a 21% annualized gain with volatility of 24% over the last six years.

What to watch for

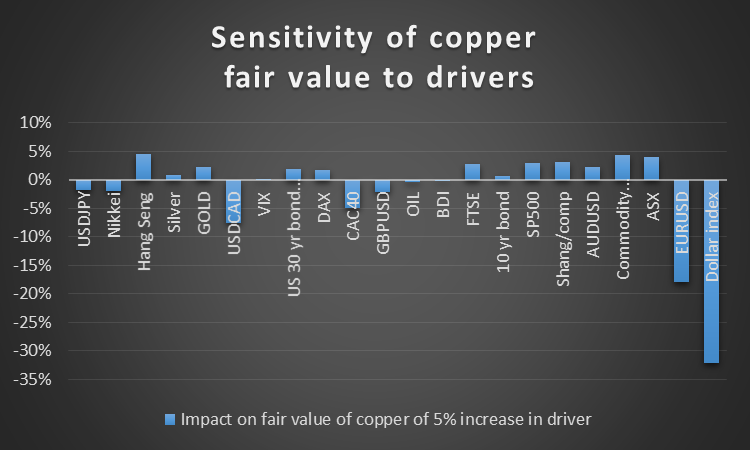

The graph below shows the sensitivity of copper’s fair value to various drivers.

The graph highlights copper’s sensitivity to USD currency pair exchange rates. These could undergo some volatility around Tuesday and Wednesday this week when Janet Yellen gives testimony to Congress on economic conditions and the Fed’s economic strategy. This could translate into volatility in the copper price. Mario Draghi’s press conference on Wednesday could further impact the copper price through movements in EUR/USD.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.