Trump has once again backed semiannual reporting. What could this mean for stocks?

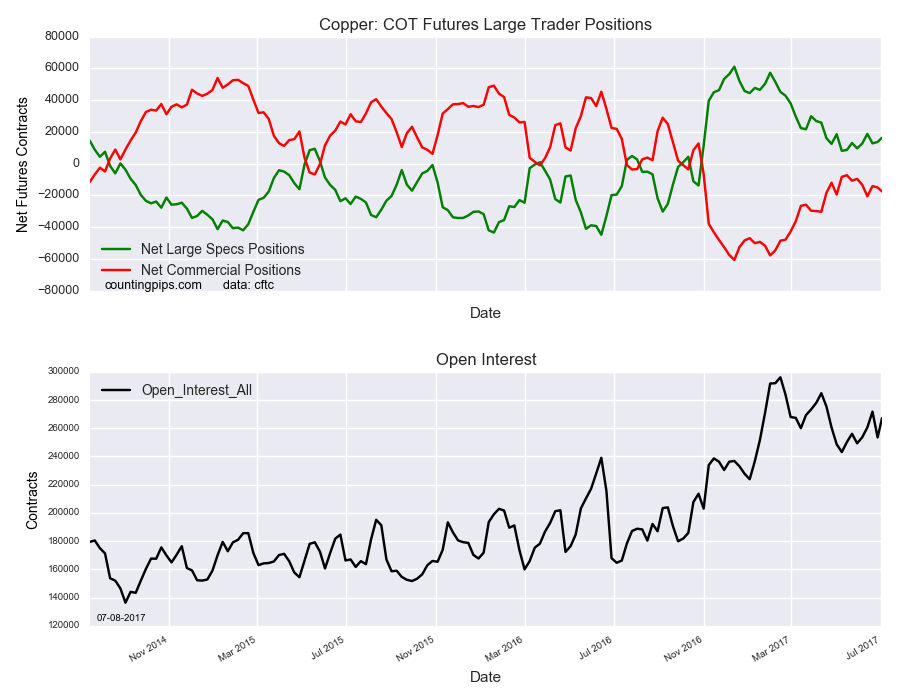

Copper Non-Commercial Speculator Positions:

Large speculators lifted their net positions in the copper futures markets this week for a second straight week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of copper futures, traded by large speculators and hedge funds, totaled a net position of 16,345 contracts in the data reported through Tuesday July 3rd. This was a weekly gain of 2,657 contracts from the previous week which had a total of 13,688 net contracts.

Copper speculative positions are now at the best level in three weeks and have remained above the +10,000 level for five straight weeks after falling below that level in May 30th.

Copper Commercial Positions:

The commercial traders position, categorized by the CFTC as hedgers or traders engaged in buying and selling for business purposes, totaled a net position of -17,521 contracts on the week. This was a weekly decrease of -2,511 contracts from the total net of -15,010 contracts reported the previous week.

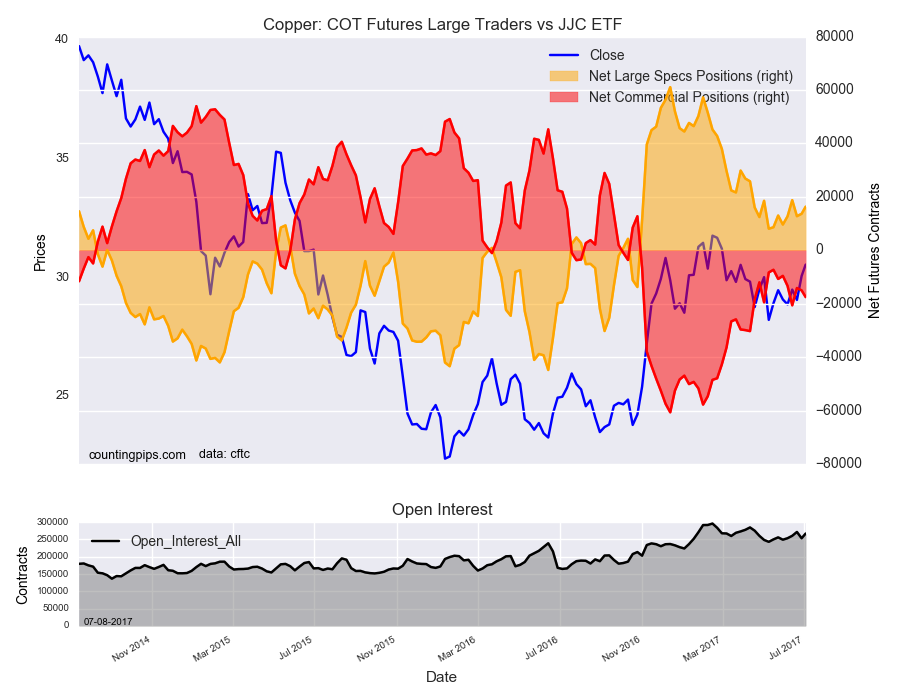

JJC (NYSE:JJC) ETF:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the JJC iPath Bloomber Copper ETN, which tracks the price of copper, closed at approximately $30.55 which was a boost of $0.48 from the previous close of $30.07, according to unofficial market data.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes dozens of winning stock portfolios chosen by our advanced AI.

Year to date, 3 out of 4 global portfolios are beating their benchmark indexes, with 98% in the green. Our flagship Tech Titans strategy doubled the S&P 500 within 18 months, including notable winners like Super Micro Computer (+185%) and AppLovin (+157%).

Which stock will be the next to soar?