copper Non-Commercial Speculator Positions:

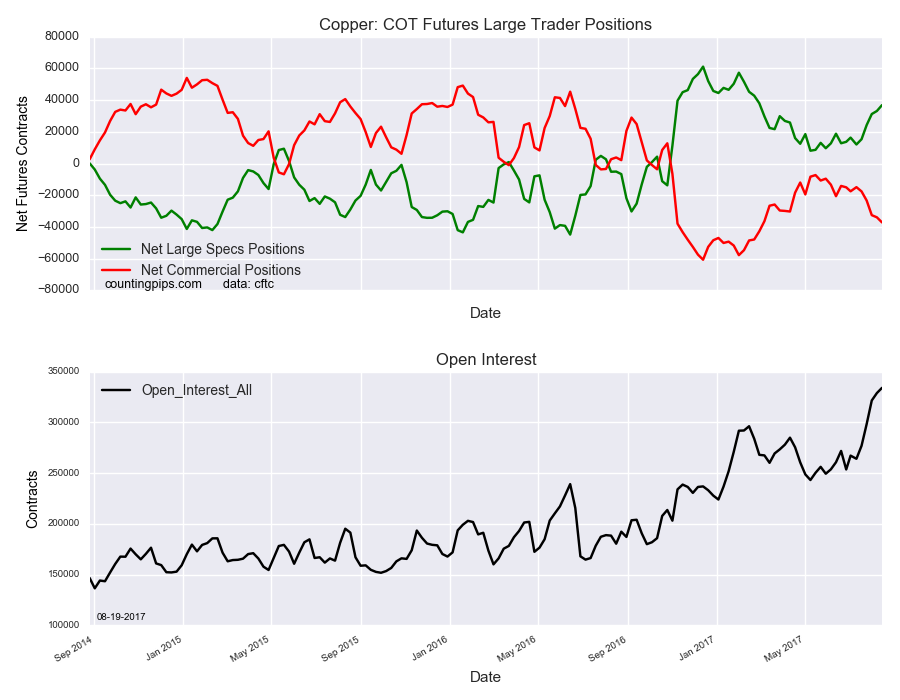

Large speculators continued to lift their net positions in favor of the copper futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of copper futures, traded by large speculators and hedge funds, totaled a net position of 36,829 contracts in the data reported through Tuesday August 15th. This was a weekly lift of 3,693 contracts from the previous week which had a total of 33,136 net contracts.

This week’s increase marked a fifth straight week of net bullish gains and put the current level of bullish net positions at the highest level since February 28th when bets totaled +37,998 contracts.

Copper Commercial Positions:

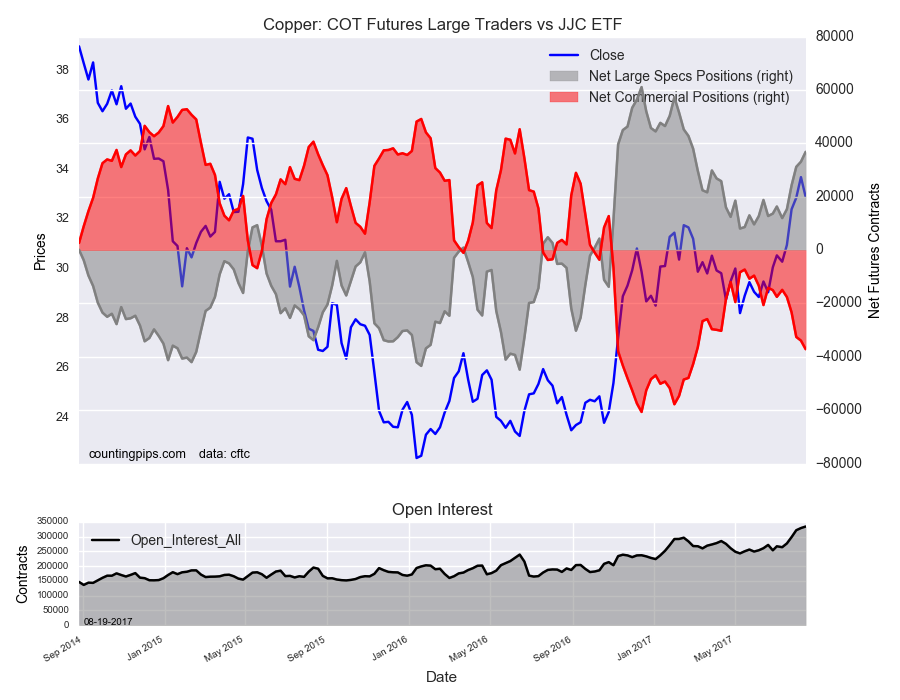

The commercial traders position, categorized by the CFTC as hedgers or traders engaged in buying and selling for business purposes, totaled a net position of -37,145 contracts on the week. This was a weekly drop of -3,218 contracts from the total net of -33,927 contracts reported the previous week.

JJC ETF:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the JJC iPath Bloomber copper ETN, which tracks the price of copper, closed at approximately $32.91 which was a loss of $-0.80 from the previous close of $33.71, according to unofficial market data.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.