Fed's James Bullard popped the market's latest "exuberance" by pointing out that the Fed minutes discussing QE3 were actually "stale."

CNBC: Current economic conditions are not dire enough to justify more Federal Reserve monetary easing, St. Louis Fed President James Bullard told CNBC in remarks that seemed to counter meeting minutes released Wednesday.

Bullard said economic data has changed since the Fed meeting on July 31 and August 1, when the central bank's Open Market Committee indicated more stimulus would "be warranted fairly soon" unless the economy improved.

He labeled those minutes as "stale" and said if growth continues around 2 percent for the remainder of the year, the Fed likely will remain on the sidelines.

He was referring to what seems to be a reversal of economic news out of the US. Since July the Citi Economic Surprise Index has reversed direction. And the Fed minutes were based on data which came out in June or July.

But beyond the changes in economic indicators, the FOMC members (hopefully) understand that increasing bank reserves further via QE3 is not going to change banks' behavior. The problem of a number of small businesses and potential homeowners not being able to access credit is not going to improve just because bank reserves rise due to Fed's asset purchases.

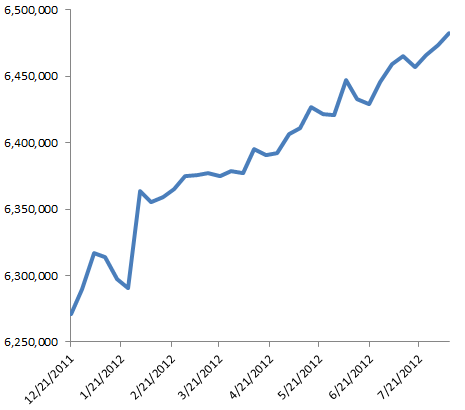

In fact, US banks are not liquidity constrained and are visibly increasing their lending activities (below). Also interest rates are already sufficiently low (near record lows) not to be a constraint when it comes to financing decisions. QE3 will do little to change the credit conditions in the US.

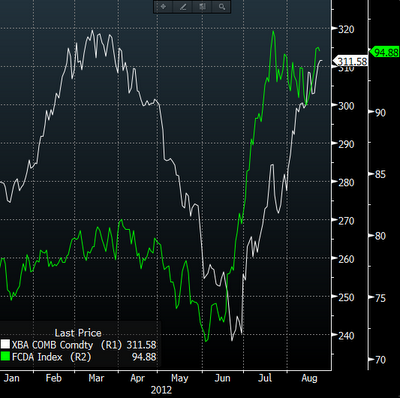

And there are significant downside risks. The latest FOMC minutes contain the following, somewhat disturbing quote: "... some participants noted that a new [QE] program might boost business and consumer confidence." That statement shows how out of touch some of these members are when it comes to the US consumer. Additional unsterilized asset purchases will undermine consumer confidence instead of improving it by raising commodity prices.

Gasoline prices have risen considerably already and food prices will rise as drought driven spike in agricultural commodities makes its way through the system. More QE will increase these prices further and aggravate an already difficult situation. Risks of such a program far outweigh the benefits. Cooler heads at the FOMC should prevail and the Fed will "remain on the sidelines."

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.