Nvidia to resume H20 chip sales in China, announces new processor

The economic recovery hit another record yesterday.

We’ve already had an incredible record-setting streak for food stamp usage. Now we can add high unemployment to the mix. The US economy just posted its 54th straight month at which unemployment was north of 7.5%.

This has never happened before. And the worst part is that unemployment is in fact much worse than this indicates. Indeed, the Feds implement multiple gimmicks to maneuver the unemployment number down. As I’ve told Private Wealth Advisory subscribers, the most nefarious is simply not counting those who haven’t looked for a job recently as unemployed.

BOOM! Suddenly a lot of the people who are in fact unemployed don’t count and the unemployment rate drops. After all, one cannot help but wonder how one in five US households is on food stamps, while unemployment is down near 7.5%.

A much better measure of unemployment which I’ve shared with Private Wealth Advisory subscribers, is U6 unemployment, which measures those unemployed plus those who are unemployed and have looked for work in the last 12 months and those who are working part-time for economic reasons.

When you use this measurement, the unemployment rate is closer to 14.3%.

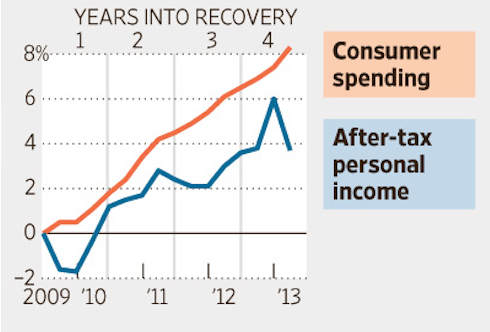

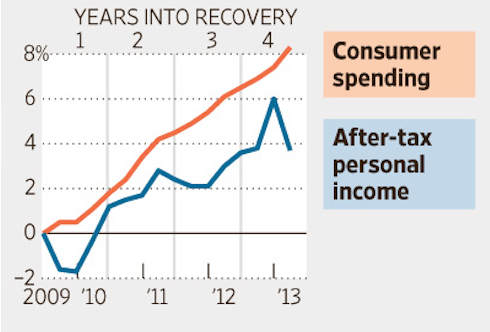

Against this backdrop of weak employment, analysts continue to believe that the US economy will pick up in the second half of 2013. This is absolutely impossible. Weak employment means lower incomes. Lower incomes means lower consumer spending. Lower consumer spending means lower economic growth.

We’ve already had an incredible record-setting streak for food stamp usage. Now we can add high unemployment to the mix. The US economy just posted its 54th straight month at which unemployment was north of 7.5%.

This has never happened before. And the worst part is that unemployment is in fact much worse than this indicates. Indeed, the Feds implement multiple gimmicks to maneuver the unemployment number down. As I’ve told Private Wealth Advisory subscribers, the most nefarious is simply not counting those who haven’t looked for a job recently as unemployed.

BOOM! Suddenly a lot of the people who are in fact unemployed don’t count and the unemployment rate drops. After all, one cannot help but wonder how one in five US households is on food stamps, while unemployment is down near 7.5%.

A much better measure of unemployment which I’ve shared with Private Wealth Advisory subscribers, is U6 unemployment, which measures those unemployed plus those who are unemployed and have looked for work in the last 12 months and those who are working part-time for economic reasons.

When you use this measurement, the unemployment rate is closer to 14.3%.

Against this backdrop of weak employment, analysts continue to believe that the US economy will pick up in the second half of 2013. This is absolutely impossible. Weak employment means lower incomes. Lower incomes means lower consumer spending. Lower consumer spending means lower economic growth.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI