The slow grind higher and towards the next monetary policy decisions from the world’s central banks continued with the deserved lack of fanfare yesterday. Volume on global share indices remained particularly low with volatility lower on FX markets for the most part.

Sterling had a little run yesterday morning following the latest jobs numbers. Unemployment fell to 8% while the jobless claims number came in 6,000 people lower. This is obviously a good headline which suggests that the UK economy is performing somewhat better than the GDP figures from the ONS suggest. Part of the fall is a result of people pricing themselves cheaper so as to obtain some form of unemployment, hence the still-depressed levels of wage growth especially in light of this week’s inflation numbers.

The minutes of the latest Bank of England survey suggested that the MPC has returned to its “wait-and-see” policy as expected following its injection of a further £50bn in July.

June retail sales are due this morning and we are looking for a bit of a shocker in all honesty. Although the figures include euro 2012, they also include some pretty shocking weather and news from retailers on the High St. suggest that the demand was simply not there in July. We are looking for a figure of -0.3% and a slight slip in sterling as a result.

Inflation from the US was interesting yesterday as it dipped to the lowest year-on-year figure since October 2010. It came through following more poor data from the US, this time a manufacturing survey, and the combination caused the USD to weaken following some initial strength in the morning session.

Data out of the US will be the main driver today with the binary switch between QE-on and QE-off being flipped from data point to data point. What this leads to is the market we have now; choppy within a range and likely to stay that way.

USD has strengthened further so far this morning following a few analysts changing their expectations of when, not if, further monetary policy easing will come from the Federal Reserve. The market is looking for a decision in September but outliers are now going for the turn of the year.

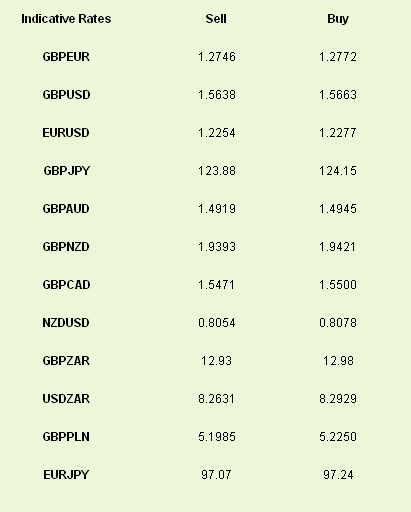

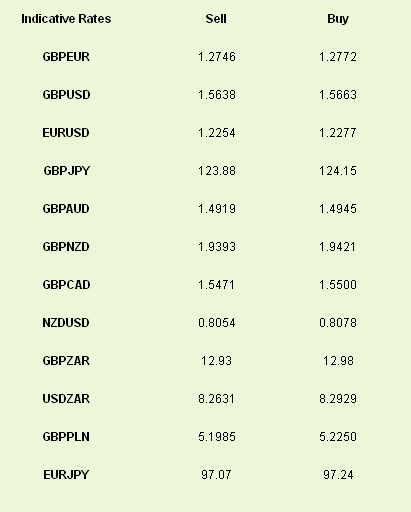

Latest exchange rates at time of writing:

Sterling had a little run yesterday morning following the latest jobs numbers. Unemployment fell to 8% while the jobless claims number came in 6,000 people lower. This is obviously a good headline which suggests that the UK economy is performing somewhat better than the GDP figures from the ONS suggest. Part of the fall is a result of people pricing themselves cheaper so as to obtain some form of unemployment, hence the still-depressed levels of wage growth especially in light of this week’s inflation numbers.

The minutes of the latest Bank of England survey suggested that the MPC has returned to its “wait-and-see” policy as expected following its injection of a further £50bn in July.

June retail sales are due this morning and we are looking for a bit of a shocker in all honesty. Although the figures include euro 2012, they also include some pretty shocking weather and news from retailers on the High St. suggest that the demand was simply not there in July. We are looking for a figure of -0.3% and a slight slip in sterling as a result.

Inflation from the US was interesting yesterday as it dipped to the lowest year-on-year figure since October 2010. It came through following more poor data from the US, this time a manufacturing survey, and the combination caused the USD to weaken following some initial strength in the morning session.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

USD/JPY slumped before Treasury yields popped higher.Data out of the US will be the main driver today with the binary switch between QE-on and QE-off being flipped from data point to data point. What this leads to is the market we have now; choppy within a range and likely to stay that way.

USD has strengthened further so far this morning following a few analysts changing their expectations of when, not if, further monetary policy easing will come from the Federal Reserve. The market is looking for a decision in September but outliers are now going for the turn of the year.

Latest exchange rates at time of writing:

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI