I'll be watching this 5 min (market hours only) chart of the TF going forward. So far, today's (Wednesday's) "compression" tactics (price action within the blue boxes) have held price up, mostly within the upper one-half of this 3-day channel.

To put things into perspective, here's a shot showing last Friday's double-dip and rally, followed by Monday's gap up:

N.B. I'll post an updated chart with further comments after the close today.

Post Market Update: Here's a shot of how the TF closed today:

As you can see, any attempt for a rally to hold within the upper one-quarter of this channel has been met with selling, which has forced price down below the mid-channel level...signs of short-term day-only buying or short-covering. Today, as price nears the 800.00 level, the subsequent selling from this level has been shallower...possibly signs that this E-mini Futures Index is in accumulation mode, and poised to go higher.

Looking at a bigger picture, you can see on the 60 min (market hours only) chart below that price is, once again attempting to break free of a downtrend that began in mid-September. The 800.00 level is roughly in line with a 40% Fibonacci retracement from the September high to last Friday's low. Monday's gap remains unfilled, and, whether this is a breakaway gap and the beginning of a trend reversal remains to be seen. I'd like to see price reclaim and hold above the 800.00 level and begin to make higher highs and higher lows on this timeframe before I'd make such a call. Otherwise, a failure around this level would likely send price down to, potentially, fill the gap and on to a lower low.

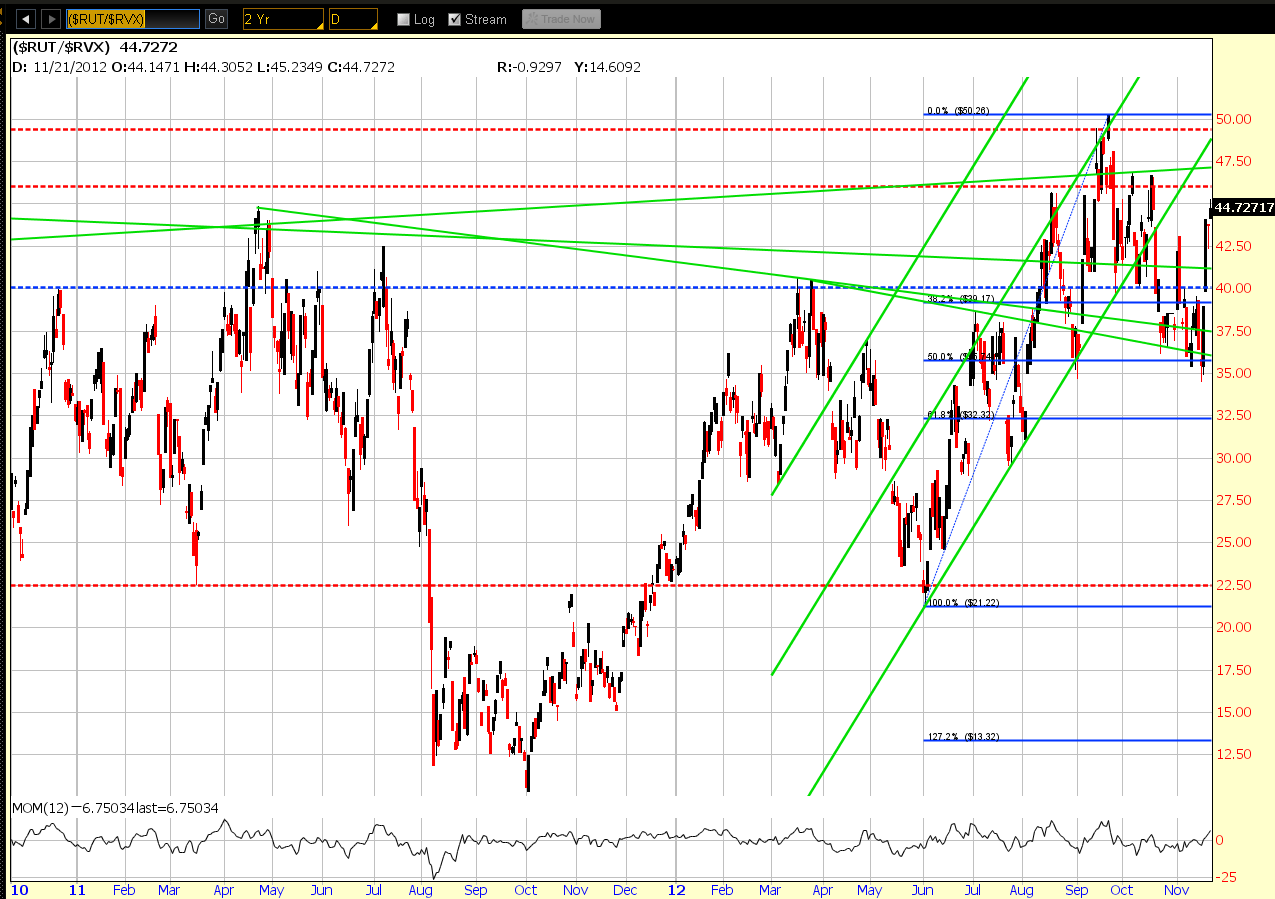

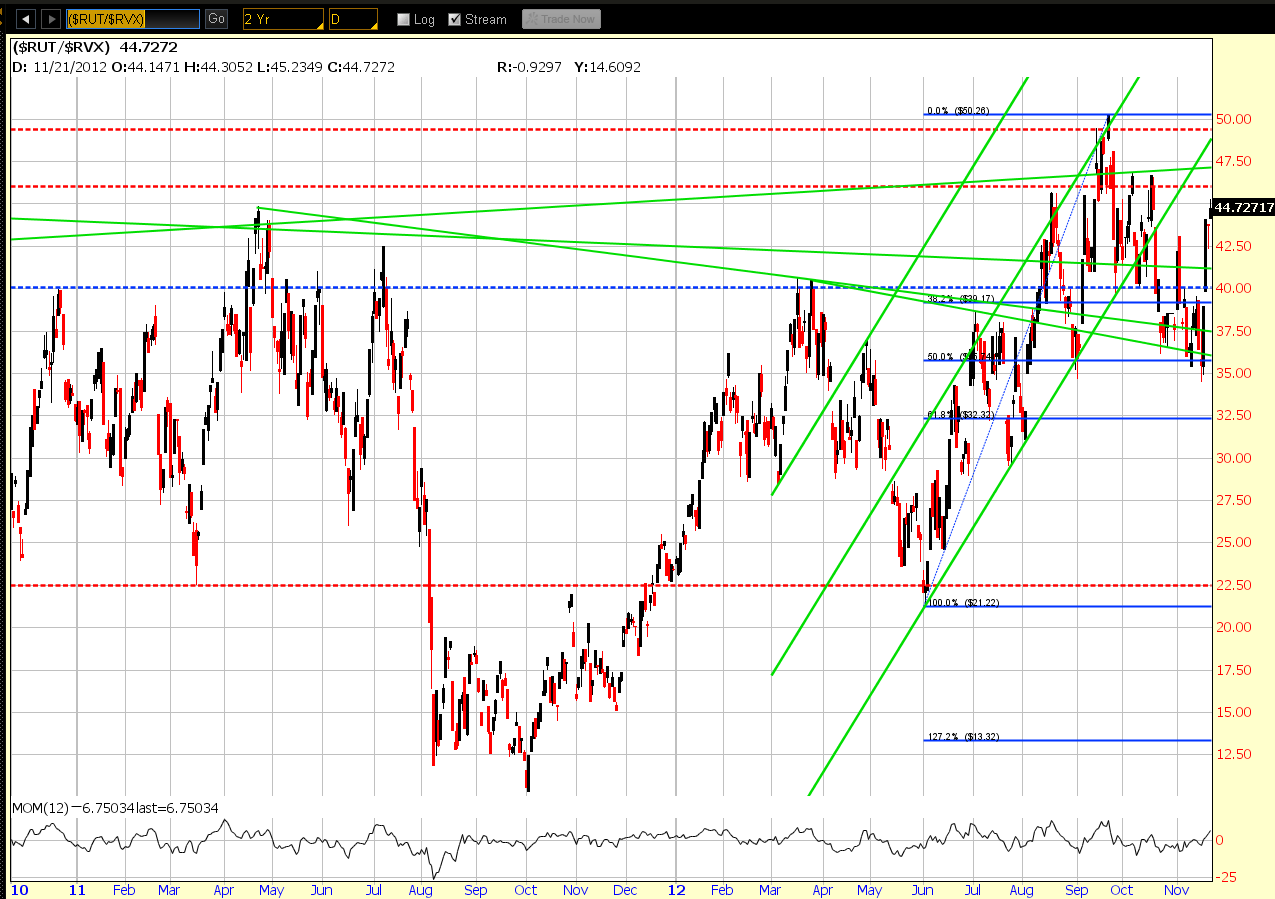

As a confirmation of any further (sustainable) rally, I'd also like to see price get (and stay) above 46.00, then 47.50, and, finally, 50.00 on this Daily ratio chart of the Russell 2000 Index compared with its Volatility Index. The Momentum indicator is flowing up and is still above zero. As long as it holds above that level, I'd look to see how price is behaving at/above 800.00 on the TF.

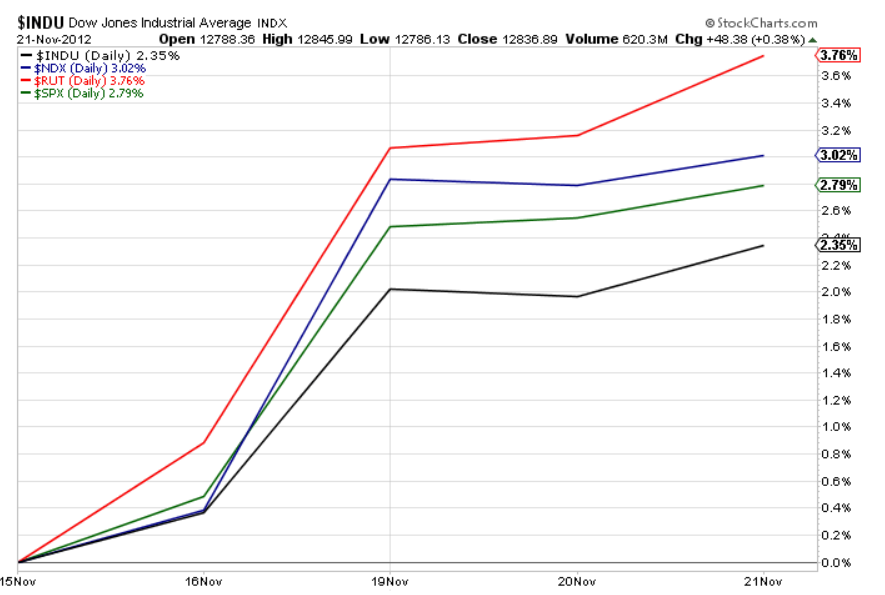

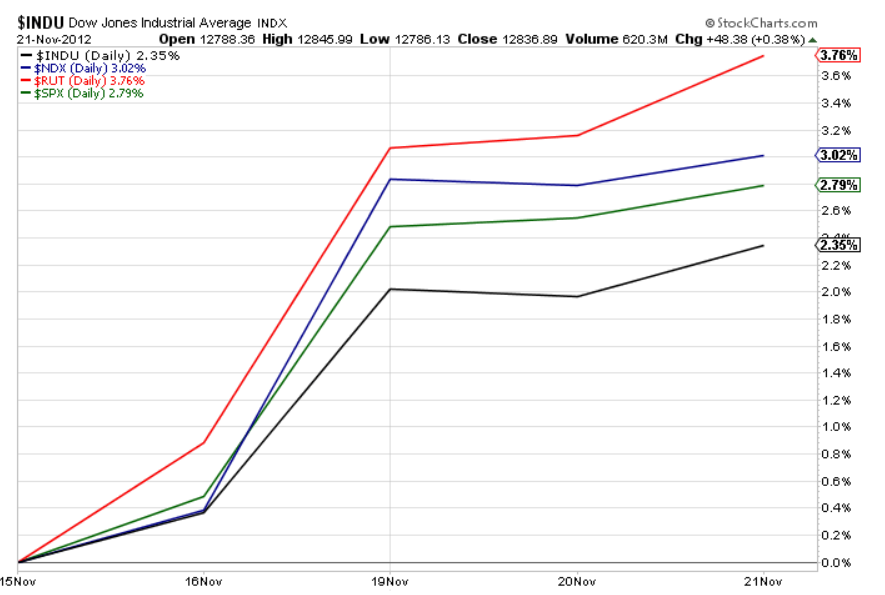

The Russell 2000 Index is still the leader ahead of the Nasdaq 100, S&P 500, and Dow 30 Indices after today's action in terms of percentage gained from last Friday, as shown on the 4-day comparison chart below. In fact, it pulled ahead at a greater pace today...one to watch to see if buying favours the riskier Small-Cap sector over Technology and Large-Cap/Blue-Chip stocks. Alternatively, I'd watch to see if this Index begins to weaken, particularly around the 800.00 level on the TF and on rising volatility, which could lead the other Indices down to fill their respective recent gaps, and lower.

***I'd like to take this opportunity to wish my American neighbours a Happy Thanksgiving...I hope no one goes hungry...please share with someone less fortunate. :-)

To put things into perspective, here's a shot showing last Friday's double-dip and rally, followed by Monday's gap up:

N.B. I'll post an updated chart with further comments after the close today.

Post Market Update: Here's a shot of how the TF closed today:

As you can see, any attempt for a rally to hold within the upper one-quarter of this channel has been met with selling, which has forced price down below the mid-channel level...signs of short-term day-only buying or short-covering. Today, as price nears the 800.00 level, the subsequent selling from this level has been shallower...possibly signs that this E-mini Futures Index is in accumulation mode, and poised to go higher.

Looking at a bigger picture, you can see on the 60 min (market hours only) chart below that price is, once again attempting to break free of a downtrend that began in mid-September. The 800.00 level is roughly in line with a 40% Fibonacci retracement from the September high to last Friday's low. Monday's gap remains unfilled, and, whether this is a breakaway gap and the beginning of a trend reversal remains to be seen. I'd like to see price reclaim and hold above the 800.00 level and begin to make higher highs and higher lows on this timeframe before I'd make such a call. Otherwise, a failure around this level would likely send price down to, potentially, fill the gap and on to a lower low.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

As a confirmation of any further (sustainable) rally, I'd also like to see price get (and stay) above 46.00, then 47.50, and, finally, 50.00 on this Daily ratio chart of the Russell 2000 Index compared with its Volatility Index. The Momentum indicator is flowing up and is still above zero. As long as it holds above that level, I'd look to see how price is behaving at/above 800.00 on the TF.

The Russell 2000 Index is still the leader ahead of the Nasdaq 100, S&P 500, and Dow 30 Indices after today's action in terms of percentage gained from last Friday, as shown on the 4-day comparison chart below. In fact, it pulled ahead at a greater pace today...one to watch to see if buying favours the riskier Small-Cap sector over Technology and Large-Cap/Blue-Chip stocks. Alternatively, I'd watch to see if this Index begins to weaken, particularly around the 800.00 level on the TF and on rising volatility, which could lead the other Indices down to fill their respective recent gaps, and lower.

***I'd like to take this opportunity to wish my American neighbours a Happy Thanksgiving...I hope no one goes hungry...please share with someone less fortunate. :-)

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.