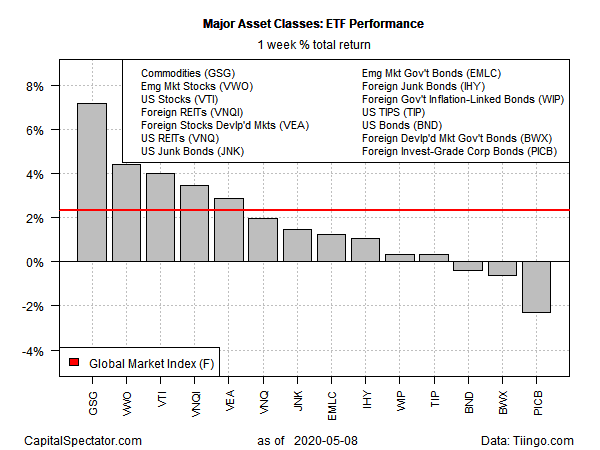

A broad measure of commodities continued to catch a bid last week. For the second week in a row, commodities rallied, posting the strongest gain for the major asset classes, based on a set of exchange-traded funds through Friday, May 8.

The iShares SPY GSCI Commodity-Indexed Trust (NYSE:GSG) rose 7.2% last week, marking the second straight weekly gain for the fund. That’s the first run of back-to-back increases for GSG since February.

The rebound in prices of raw materials, including crude oil, is partly a reflection of optimism that flows from news that some economies around the world are reopening, at least partially. Although commodities prices have been battered recently, the latest bounce suggests that the worst of the selling wave has ended. A sustained rally is probably assuming too much, but looking for price stability constitutes bullish thinking for commodities these days and the latest bounce offers a reason for hope on this front.

Meanwhile, prices across the major asset classes were broadly higher last week. Stocks in emerging markets were the second-best performer. Vanguard FTSE Emerging Markets (NYSE:VWO) rallied 4.4%, lifting the fund to a price that’s close to a two-month high.

Last week’s weakest performer: foreign corporate bonds. Invesco International Corporate Bond (NYSE:PICB) lost 2.3%, the fund’s first weekly decline since mid-March.

The upside bias in prices overall lifted an ETF-based version of the Global Markets Index (GMI.F). This unmanaged benchmark that holds all the major asset classes (except cash) in market-value weights via ETFs rose 2.3%–the index’s second straight weekly gain.

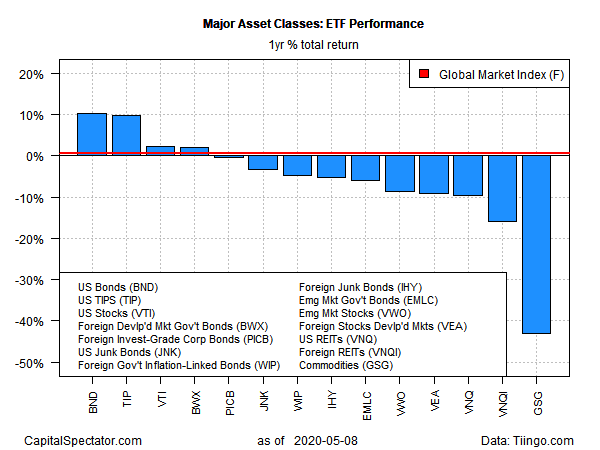

Looking at asset classes through a one-year lens continues to show a broad measure of US investment-grade bonds in the lead for the major asset classes. Vanguard Total US Bond Market (NASDAQ:BND) is up 10.3% on a total-return basis for the trailing one-year period after factoring in distributions.

Meanwhile, commodities are still the worst one-year performer by far. Despite the recent rally, GSG was down a hefty 43.9% at Friday’s close vs. the year-earlier price.

GMI.F is back in positive terrain for the one-year trend, albeit just barely. This multi-asset-class benchmark is up 0.7% over the past year.

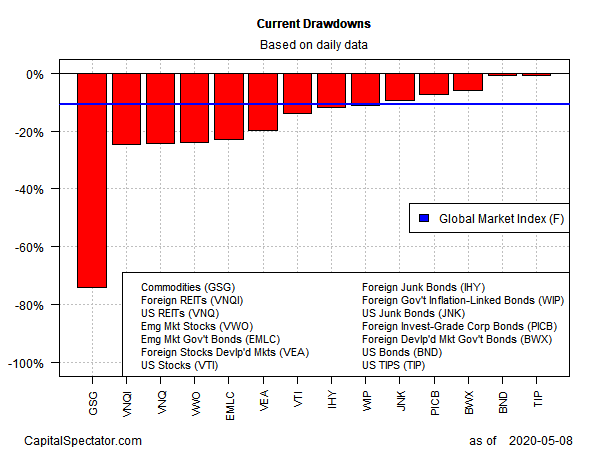

Ranking asset classes via current drawdown continues to show a wide range of results, ranging from the deep 74% peak-to-trough decline for commodities (GSG) to the fractional drawdown for inflation-indexed Treasuries (NYSE:TIP).

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.