Trump announces 50% tariff on copper, effective August 1

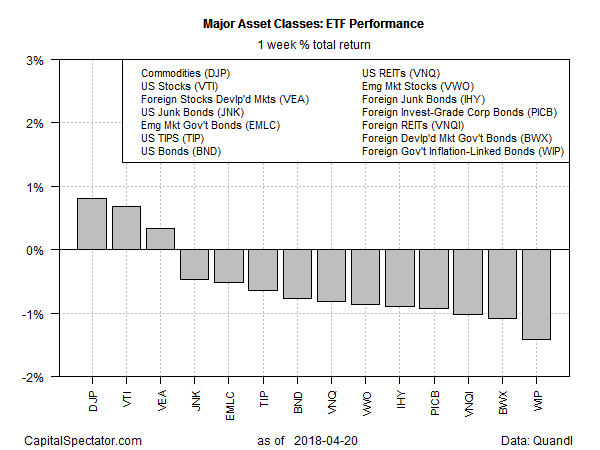

Broadly defined commodities posted the strongest advance last week for the major asset classes, based on a set of exchange-traded products. The gain marks the second week in a row that raw materials prices topped the performance list.

The iPath Bloomberg Commodity (DJP) edged up 0.8% for the five trading days through Friday, April 20. The gain lifted DJP to a weekly close that’s near a two-year high.

Mark Schultz, chief analyst at Northstar Commodity, told CNBC last week:

Prices [for commodities] had been relatively depressed over the last 3½ years.

It’s been a down type of market mainly because we have dealt with at or near-record production just about everywhere around the globe. That is now reversed, and you’re starting to see things build back up.

Last week’s biggest loser among the major asset classes: foreign inflation-indexed government bonds. SPDR Citi International Government Inflation-Protected Bond (WIP) slumped 1.4%, leaving the ETF at its lowest close in a month.

One of the headwinds for WIP, and foreign assets generally after conversion into US dollars: a rally in the greenback. The US Dollar Index edged higher last week, settling at its highest weekly close since early March.

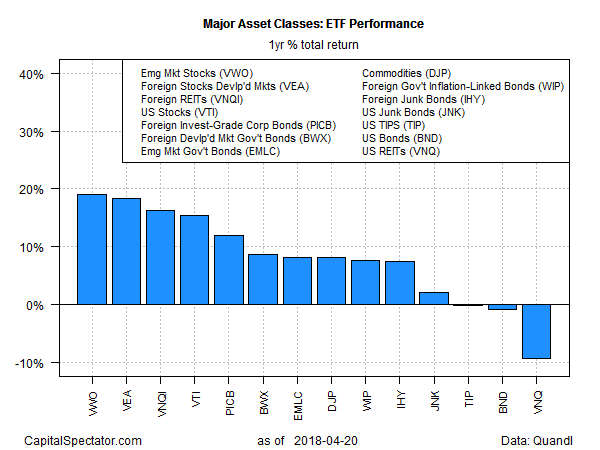

For the one-year trend, stocks in emerging markets continue to lead among the major asset classes. Vanguard FTSE Emerging Markets (VWO) posted a 19.0% total return for the trailing 12-month period at the close of trading on April. 20.

Meantime, US real estate investment trusts (REITs) remain in last place for year-over-year changes. Vanguard Real Estate (VNQ) continued to fall last week and is currently in the red by 9.9% in annual terms.

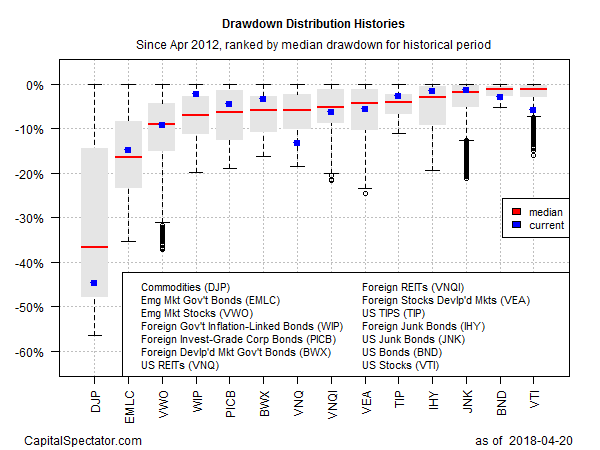

Comparing all the major asset classes through the risk lens of current drawdown shows that commodities, despite the recent rally, remain deep in the hole. DJP’s latest peak-to-trough slide exceeds 40%, far below the current drawdowns for the rest of the field.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.