Colgate-Palmolive Company (NYSE:CL) is a leading consumer products company, focused on healthcare, household and personal care. Founded over 210 years ago as a soap and candle factory by William Colgate, the company now employs 36 700 people worldwide. With $15.2 billion in revenue and a $2.44 billion profit last year, Colgate-Palmolive is a business investors feel safe to rely on for the long haul. This, however, does not mean an occasional setback cannot occur. For example, CL stock fell by 34% during the Financial crisis and then lost over 26% in five months in 2015. Turns out even a two centuries old company cannot escape the stock market’s vagaries.

Colgate-Palmolive stock closed at $73 a share yesterday, not too far from its all-time high of $77.27 registered in June. With Colgate’s exceptionally good performance, the question investors need to ask is if the price is right. After all, paying too much could turn even the best company into a bad investment. So, should we buy right away? The Elliott Wave Principle applied on the weekly chart of Colgate-Palmolive suggests otherwise.

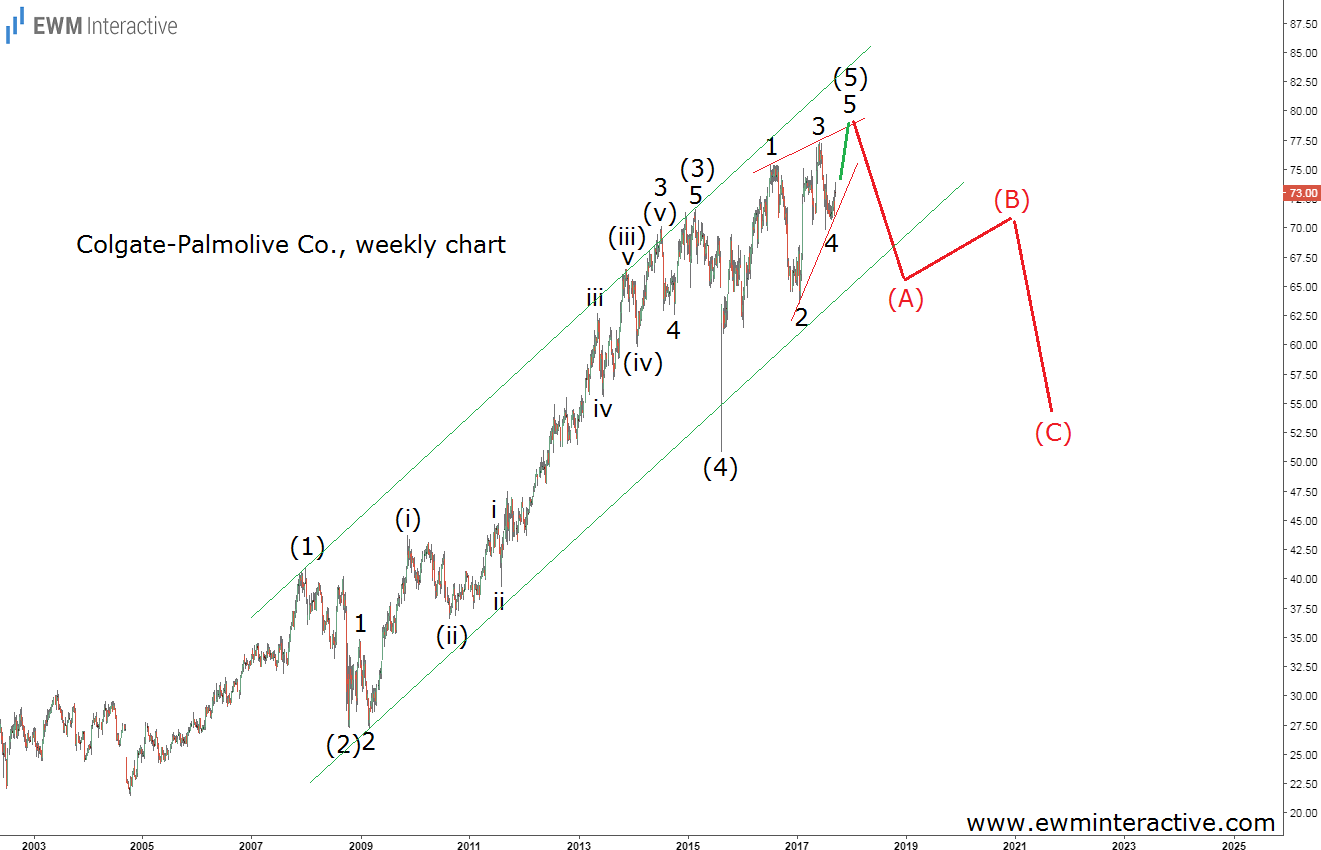

The chart above focuses on CL stock’s advance from $21.45 in October 2004. As you can see, it looks like a textbook five-wave impulse, whose fifth and last wave is currently developing. Also, counting the sub-waves of wave (3) is a good exercise for novice Elliott Wave analysts.

The good news is that this impulsive rally means Colgate-Palmolive is in a large degree uptrend. Well, that is actually quite obvious. The bad news is every impulse is followed by a three-wave correction in the opposite direction. In other words, if this count is correct, once the ending diagonal wave (5) is complete, CL stock could be expected to decline significantly. The support area of wave (4) near $55-$50 should be the bears’ natural target. If we assume the bulls would manage to lift the price to the $80 mark first in wave 5 of (5), this means that a 31%-38% retracement might follow. Certainly, Colgate-Palmolive would make a great long-term buy one day. Not today, though, and not at $73 a share.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI