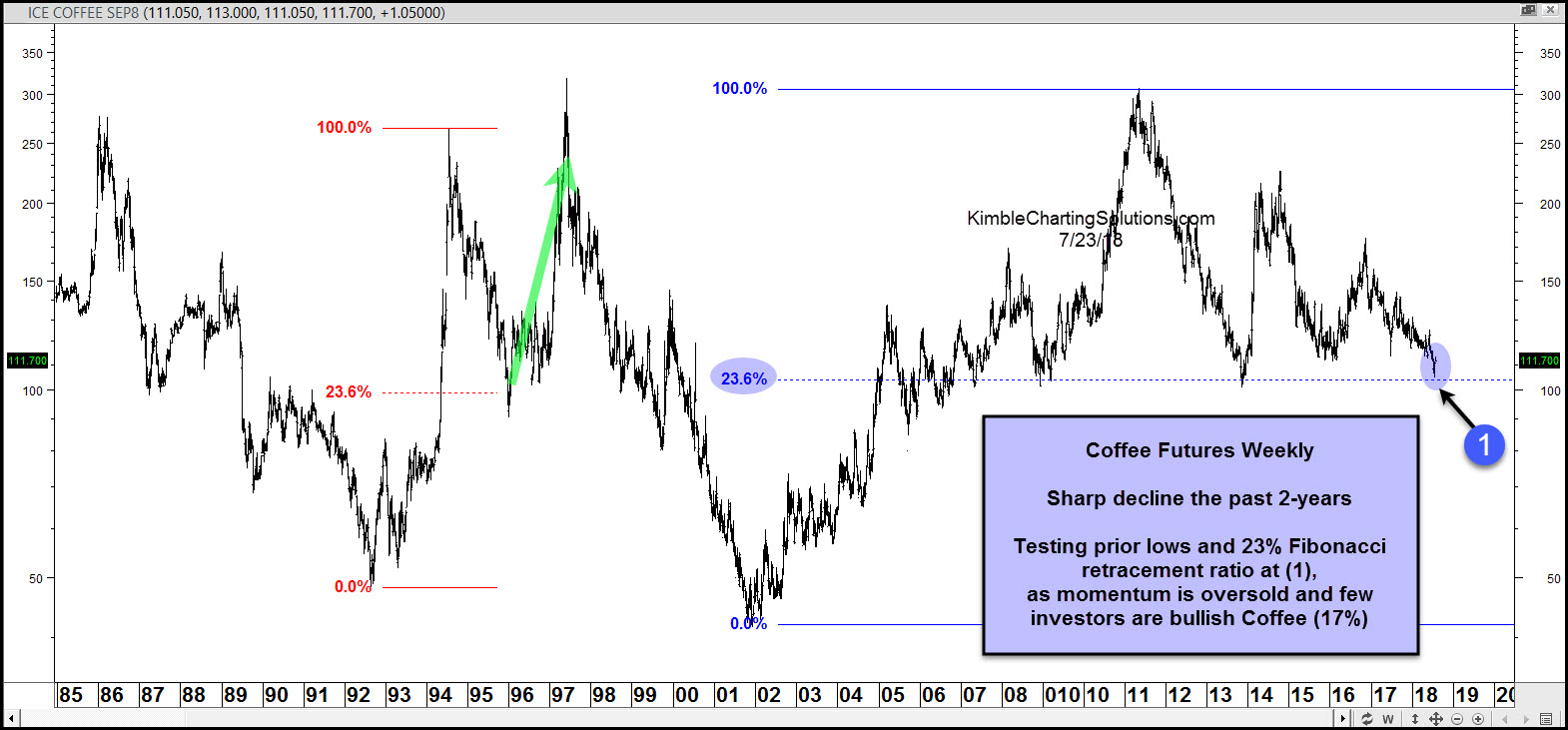

Coffee hasn’t been perking well over the past 2-years, as it has declined nearly 40%.

This sizeable decline has it testing the 2007, 2008 and 2013 lows, where rallies happened to get started. The current price is also testing the 23% Fibonacci retracement level at (1).

In the mid-1990’s when Coffee fell sharply and hit its 23% retracement level, a strong rally took place. Coffee is now testing the 1995 support/23% level currently as well at (1). Understandably the decline has bullish sentiment towards Coffee very low. (17% Bulls).

The trend remains down for Coffee. It finds itself at a price point where a short-term counter-trend rally could take place. If Coffee continues weak and breaks support at (1), aggressive traders would want to use the support break as a new price point to short it.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.