Asia stocks slip as looming tariff deadline eclipses trade progress

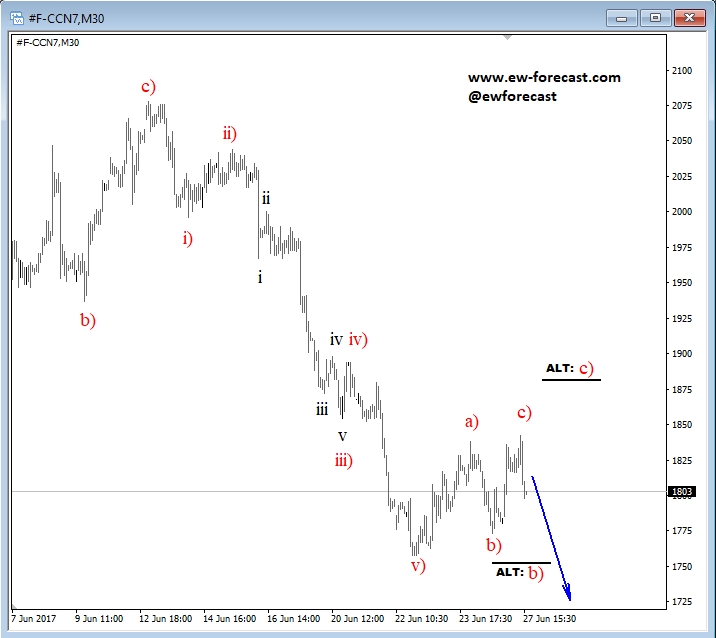

Let's look at cocoa and see what we have here.

Cocoa is trading clearly bearish since 13th of June, where we labeled end of a corrective retracement.

That said, we have already seen a five wave impulsive structure, which means current slow and three wave pull-back can only be a temporary correction. We see red waves a),b) and c) potentially completed, which means more weakness can follow in the near-term. But we also know that corrections can get complex, and this is why current drop can only be a fake one.

Cocoa, 30min

Disclosure: Please be informed that information we provide is NOT a trading recommendation or investment advice. All our work is for educational purposes only.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.