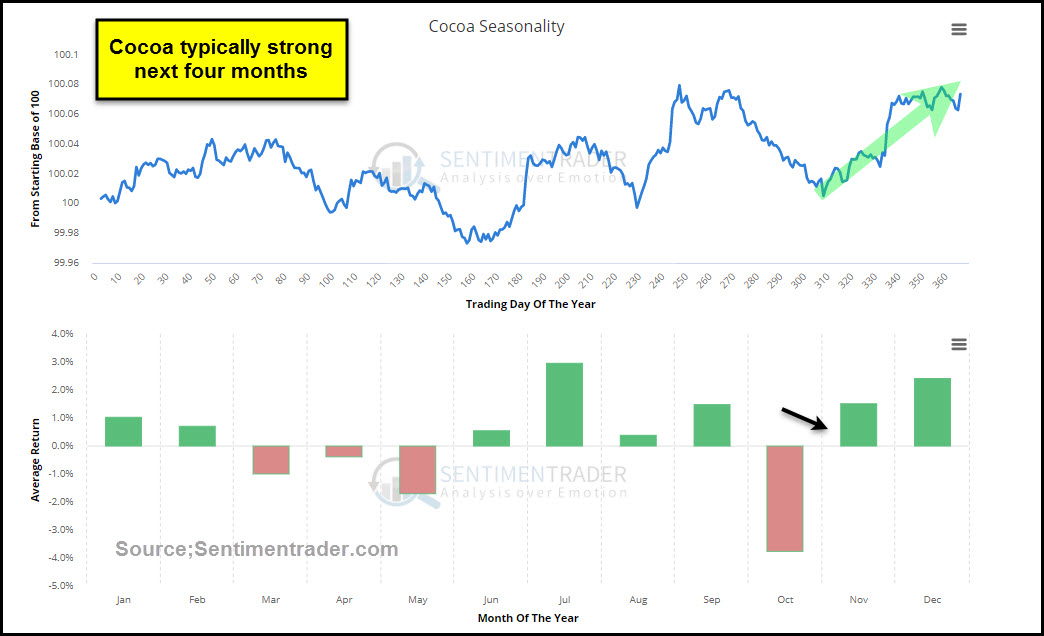

'Tis the season for Chocolate (cocoa) to do well, which begs the question – will it repeat its historical pattern again this year?

Below looks at cocoa's seasonal pattern from Sentimentrader.

Going into this period of seasonal strength, cocoa bulls have been hard to find, lately, as dumb-money traders have established one of the largest short positions in this commodity in years. The triple combo could make cocoa's price action very interesting going forward.

The commodity can be played in the futures markets or through two different ETFs: NIB and CHOC.

Cocoa ETF NIB could have built a base where seven different bullish wicks (reversals) took place just above 10-year support at (1). Recently NIB has been moving higher and looks to be breaking above highs hit earlier this week at (2).

A nice combo of pattern, as sentiment and trader positioning are in play in this asset, which is down nearly 50% in the past couple of years.

Some Perspective

Since the first of this month, NIB has gained over 7%, which is nearly half of what the S&P 500 has done year-to-date.

Full disclosure Premium and Sector members have been long NIB since the end of October. If you would like to become aware of these type of pattern and sentiment setups, we would be honored if you were a member.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.