Bitcoin price today: slips to $117k from record peak; US inflation awaited

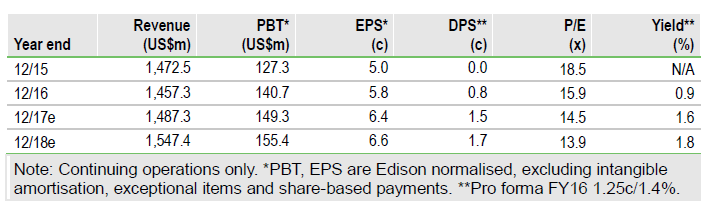

Following the latest quarterly review, Coats Group (LON:COA) is to enter the FTSE 250 Index with effect from 19 June. As well as signifying a strong share price performance over the last year, this concludes the company’s transition phase to a strong independent entity in our view. Valuation metrics are on a more conventional footing now and as the market’s understanding of the underlying business model increases we sense that it is starting to anticipate faster growth rates.

Moving into the next phase of development

FY16 can be seen as a watershed year for Coats, as it emerged from legacy pension structures, tidied up non-core exposures and further developed its portfolio of products and services while also delivering good profit growth. A new executive management team is also in place, bringing fresh impetus to an unchanged core strategy for the next phase of corporate development. Although we do not feel that group development was necessarily impinged by previous DB pension fund uncertainty, greater clarity following the pensions settlements is a positive and must, other things being equal, raise scope for more expansive investment should the opportunities arise. A resolution to the Staveley scheme position is still pending, though we do not expect this to change the current group picture materially.

To read the entire report Please click on the pdf File Below

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI