Thanks to Doug Wakefield, of Best Minds, Inc. who pointed out that the 200-day moving average is at 1264.52 today, yet another of a cluster of resistances that are giving the SPX trouble. Despite the SPX closing under all of the prior-mentioned technical resistances, there is still a majority of traders who are still bullish. My model pointed out a potential turn at 12:42 p.m. today. The SPX peaked at 12:53 p.m.

We still need a few more days to determine whether we just had an inverted Trading Cycle (high) today or whether the Trading Cycle puts in a low on Friday. There is still a potential for a Flash Crash, in which the Trading Cycle puts in a low below 1074.00 by Friday. No promises, just an observation for now.

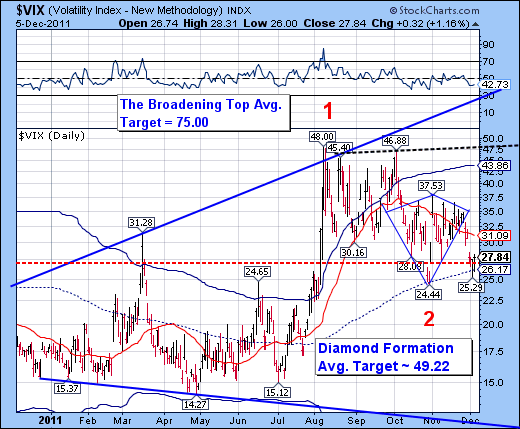

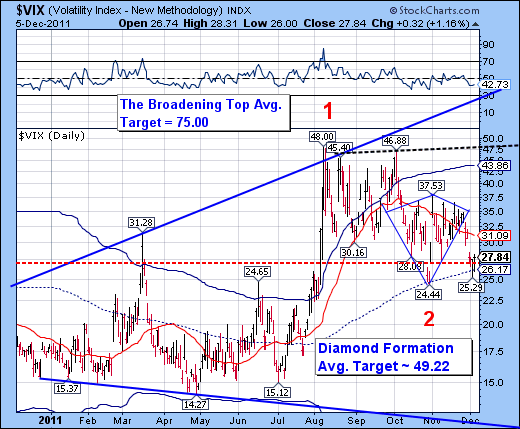

The VIX retested its daily mid-cycle support at 26.17 today and close yet again above the weekly mid-cycle support at 27.31. It appears to be building support at its one half Trading Cycle low and may be aiming for a trading cycle high during the week after Christmas. This information strongly suggests that we have just seen the Santa rally high for 2011 in equities.

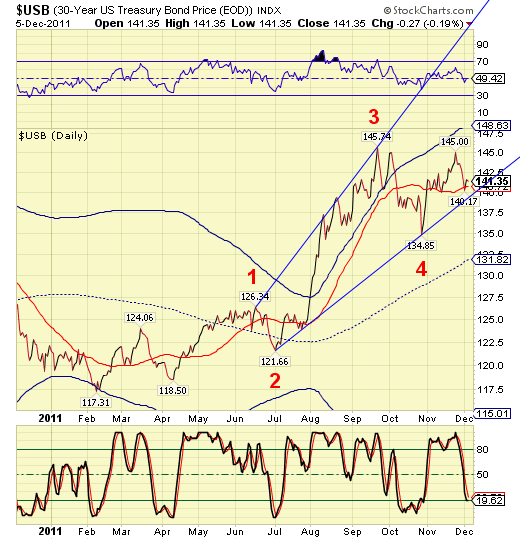

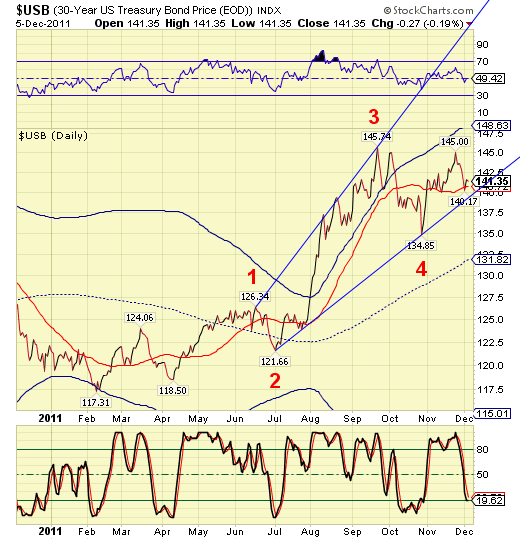

USB also made a one half Trading Cycle low last week and appears to care to make a new high before the year is out. Believe it or not, the potential target for USB may be as high as 198.00, or higher. I had thought earlier that bounce might give up the ghost in the rally since October 27. However, it refuses to break below intermediate-term trend support and its trendline, just below. Now that stocks appear to me making their turn, it also appears that investors are turning to bonds for safety. Unfortunately, this will not end well. In the meantime let's take with the market will give us.

Bank stocks rallied today, but could not achieve their cyclical target at 43.36, their index mid-cycle resistance. Today's high marks the top of a potential inverted trading cycle. However, a new low by the end of the week cannot the ruled out. In any event, bank stocks appear poised to be making new lows by year end, at the very least.

We still need a few more days to determine whether we just had an inverted Trading Cycle (high) today or whether the Trading Cycle puts in a low on Friday. There is still a potential for a Flash Crash, in which the Trading Cycle puts in a low below 1074.00 by Friday. No promises, just an observation for now.

The VIX retested its daily mid-cycle support at 26.17 today and close yet again above the weekly mid-cycle support at 27.31. It appears to be building support at its one half Trading Cycle low and may be aiming for a trading cycle high during the week after Christmas. This information strongly suggests that we have just seen the Santa rally high for 2011 in equities.

USB also made a one half Trading Cycle low last week and appears to care to make a new high before the year is out. Believe it or not, the potential target for USB may be as high as 198.00, or higher. I had thought earlier that bounce might give up the ghost in the rally since October 27. However, it refuses to break below intermediate-term trend support and its trendline, just below. Now that stocks appear to me making their turn, it also appears that investors are turning to bonds for safety. Unfortunately, this will not end well. In the meantime let's take with the market will give us.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

Bank stocks rallied today, but could not achieve their cyclical target at 43.36, their index mid-cycle resistance. Today's high marks the top of a potential inverted trading cycle. However, a new low by the end of the week cannot the ruled out. In any event, bank stocks appear poised to be making new lows by year end, at the very least.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.