The amount of mistaken hype over the years on this subject has simply been staggering.

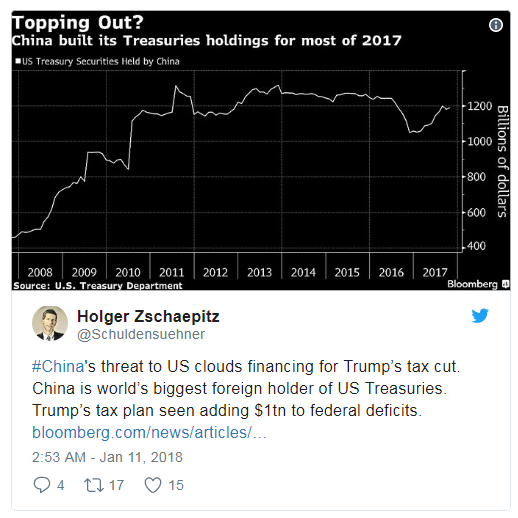

Here are some Tweets from today.

Historic Headline Not

Mathematical Certainty

The US runs a trade deficit. As a mathematical certainty nations who perpetually run surpluses with the US accumulate US assets. Foreign countries do not hold dollars they hold treasuries.

From time to time countries may use those dollars for things like halting capital flight to prop up the Renminbi.

Countries may also buy other US assets. China would probably love to buy Boeing (NYSE:BA) for example, but Congress would surely block such an attempt.

Meanwhile, as long as the US runs a deficit with China and Japan, China and Japan are going to keep buying US treasuries or other US assets. It's a mathematical certainty.

The Vise

Any alleged "vise" is a two-way street. The US gets cheap goods from China and China accumulates US treasuries. If, as some claim, "China is dumping below cost goods into the US", then as a matter of mathematical certainty the US consumer has benefited at the expense of China.

Some might argue that China will or should "dump treasuries". To whom? How? Let's see the math.

Someone must hold every treasury issued 100% of the time, and creditors mathematically must accumulate US assets of some sort as a result of trade surpluses.

For political purposes Chinese officials may make any statements they like. Bloomberg ought to point out the fallacies in them, but instead hypes them up and people retweet them as if they are accurate.