Circle Property's (LON:CRC) recent interim results show asset management initiatives continuing to drive operational progress, delivering strong growth in rental income and cash earnings, and lifting portfolio valuations. Letting progress has continued in H218, including at recently refurbished assets, but significant reversionary potential remains and capital values remain low. We are raising our estimates again but continue to see potential for further upside from faster letting of refurbished assets than we have assumed. Even before that, the shares trade at a hefty 25% discount to FY18e NAV with a yield of more than 3%.

Letting progress driving income and capital gains

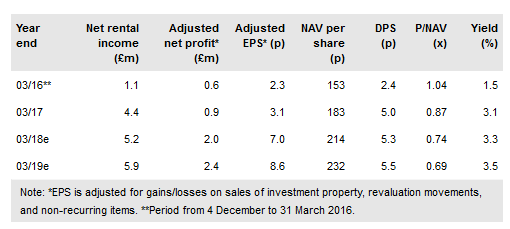

H118 net rental income increased 30% on H117 and 11% on H217. Letting progress in the period is yet to fully contribute to income and has continued into H218. The improving income profile of the portfolio had a significant impact on adjusted earnings and dividend-paying capacity, with the former more than tripling y-o-y and more than doubling versus H218. Meanwhile, the 11.3% gain in the portfolio value to £103.5m supported NAV per share growth to 212p. NAV total return was 17.1% during the six-month period. We have increased estimates again, with faster rental growth having a geared impact on adjusted EPS, which for FY18e goes from 5.4p to 7.0p. NAV per share forecasts also increase, though more moderately, and we have increased our FY18e DPS to 5.3p (5.2p).

To read the entire report Please click on the pdf File Below:

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI