Chinese Circuit Breaker to Halt Panic, Halted to Halt Panic:

Yes, you read that headline correctly. Amazing scenes.

This beauty from FT correspondent Patrick McGee popped up in my social media stream this morning and it was too good not to publish:

As of today, the Chinese will suspend their relatively new stock market circuit breaker mechanism which is designed to halt panic selling and stop prices from falling too hard, too fast.

When the stock market experienced a 5% fall, a ‘pause’ in trading was implemented. In theory this was a good idea, but in the reality of the volatile Chinese stock market, all the pause did was give traders time to get their sell orders ready to go. By the the time trading had re-opened, it never took long to hit the -7% circuit breaker and suspend trading for the day.

In today’s world of algo trading, I think that circuit breakers are more relevant than ever. You have to give the humans time to re-consider panic selling, but 7% swings aren’t uncommon in the Chinese markets and the levels definitely need some tweaking.

Chart of the Day:

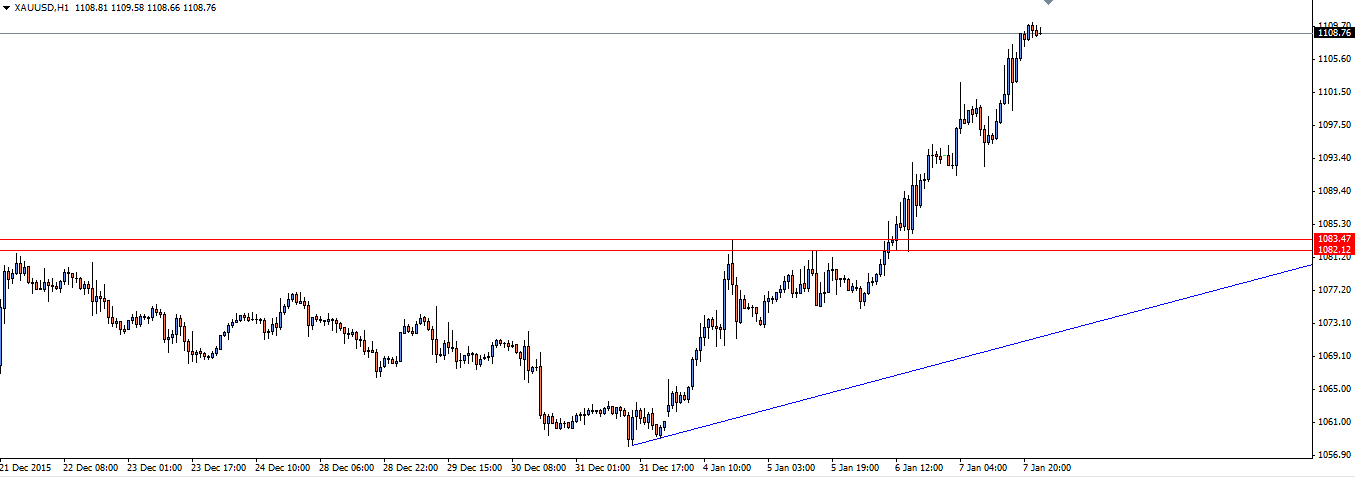

With all the uncertainty around stocks and currencies to begin the year, the quiet achiever has been gold.

Gold Hourly:

It’s an after the fact chart I know, but I had to share the perfect breakout and re-test of previous resistance as support. I know that some of you are on board the move, so leave a comment below letting us know where you got in and why?

On the Calendar Friday:

AUD Retail Sales m/m

CAD Employment Change

CAD Unemployment Rate

USD Average Hourly Earnings m/m

USD Non-Farm Employment Change

USD Unemployment Rate

Risk Disclosure: In addition to the website disclaimer below, the material on this page prepared by ECN broker Vantage FX Pty Ltd does not contain a record of our prices or solicitation to trade. All opinions, news, research, tools, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently any person acting on it does so entirely at their own risk. The experts writers express their personal opinions and will not assume any responsibility whatsoever for the Forex account of the reader. We always aim for maximum accuracy and timeliness, and Australian Forex broker Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.