For this week’s global market economic events, investors will be watching Germany’s April ZEW and Ifo surveys rather closely to get a better handle on business expectations from Europe’s largest economy. The markets will also be monitoring the flash PMI’s for China, Japan, the Eurozone, France, Germany and the U.S for signs of growth. Tomorrow’s Q1 CPI from Australia will be surveyed for clues to the next RBA monetary policy move at the next meet slated in early May. While finally, all investor eyes will end off focusing on Friday’s April 24 deadline where the Eurogroup’s will be meeting on Greece.

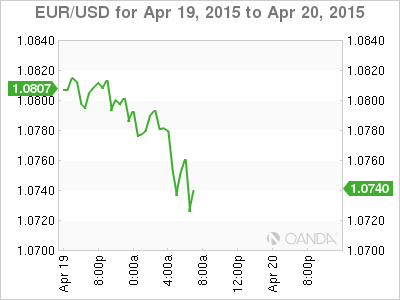

With the current impasse between Greece and its international creditors unlikely to be broken anytime soon, the EUR (€1.0740) is expected to remain under renewed downward pressure. It would be a surprise to the market if a deal for the release of the last tranche of bailout funds did happen before all Eurozone finance ministers sit down at the end of the week. However, if a deal were to happen the speculators bets are on May 11 as the more likely date.

China Reverts to Direct Stimulus

Despite it being a relatively quiet start to the week investors have had to digest some significant announcements from China over the weekend. Late on Friday, markets around the world sold off after reports quoted a China securities regulatory commission spokesperson “encouraging short selling” by institutional investors so as to crack down on high leveraged “umbrella trust” margin trading. The announcement did instigate the beginnings of a global equity selloff, and required the CSRC to clarify the statement on Saturday, indicating that it was not intended to punish equities or depress the market, but rather promote a “healthy” market function.

On top of all of that, the PBoC announced a -1% cut to the reserve ratio for all banks on its website on the weekend, the biggest cut in more than six-years (from +19.5% to 18.5% effective today). Policy makers also extended an extra -1% cut to rural financial institutions and a -2% cut to the rural policy bank. Collectively the cuts are estimated to release as much as CNY1-2 trillion of liquidity. The PBoC’s chief researcher explained the move as an intention by policy makers to keep liquidity stable, reaffirming “neutral stance” on monetary policy despite investor interpretations that China has now entered a more aggressive monetary easing cycle.

The surprise cut, and more specifically the depth of it, is considered significant from three different perspectives.

First, it highlights that Chinese monetary policy easing has yet to gain significant traction and the primary reason why policy makers have been required to be “bold” and aggressive. Nevertheless, the surprise move gives the PBoC the latitude to go deep again if required next time.

Second, the aggressive positioning by the PBoC would strongly suggest that China’s growth could very easily slip beyond the stated objective of “around” +7% while even acknowledging the growing risks of low inflation. Perhaps the world’s second largest economy is in more trouble than first thought?

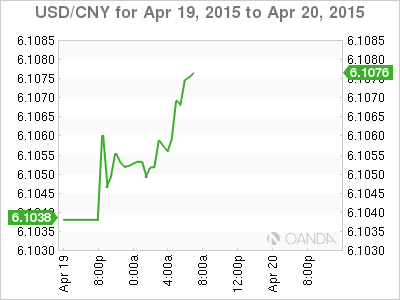

Finally, from a global perspective, it hardens the Chinese governments argument to keep CNY/CNH stable as opposed to seeing it depreciate further. The RRR cut in theory should be injecting more liquidity than an expected FX outflow (or declining FX reserves). This should also allow the PBoC flexibility to intervene in order to keep their currency stable.

The big winners in the reserve ratio cut will be banks. Analysts are estimating that this reserve ratio cut can support bank earning’s by as little as +2.7% and as much as +4.5%. The cuts will allow banks to free out the cash from deposit accounts and invest in higher yielding loans. The PBoC cut is also lowering the funding cost to banks. Banks can get capital more cheaply from deposits rather than getting short-term loans from the central bank.

The market seems to want to sit back and see how stateside investors wish to digest the weekend announcements out of China. The major currency pairs again have been well contained despite the RRR cut. The commodity and interest sensitive currencies like the AUD and CAD did find some initial support from the Chinese stimulus arrangements, however, the bid factor seems to have only be temporary as the currencies fall back inline ahead of the North American open. Obviously Greece will remain the big unknown factor for the week. Expect Grexit fears to continue to dominate rates, the EUR and equities, at least until the market gets clarity on Greece’s intentions.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI