China’s biggest political meetings of the year, the so-called Two Sessions, kick off over the weekend, with the focus centred mainly on the government's work report, which will include GDP growth targets and the fiscal budget. Comments about the CNY/USD's path could also provide insight into a possible future draft trade agreement.

Work report to follow the Central Economic Work Conference

The Two Sessions, or back-to-back meetings of China's major political bodies, will take place on March 3 (Chinese People's Political Consultative Conference) and March 5 (National People's Congress).

It's a bit strange this year that official media has not put out a dedicated page for these meetings but we believe this could be because the Central Economic Work Conference has already drafted the direction of economic growth, fiscal stimulus and monetary easing for 2019.

Still, we're looking forward to reading the government work report on March 5 because it's expected to announce a set of economic targets for 2019.

What to expect in the government work report

1. GDP target

We expect that the GDP target will not be lower than 6%, to reinforce the Central Economic Work Conference's main priority of providing job stability.

It's possible that the work report will announce a target range for GDP growth, or just repeat last year's growth rate of around 6.5%. Our forecast for this year is 6.3%.

If the GDP target range were to be set between 6% and 6.5%, investors would almost certainly fixate on the lower end of the range at 6%, which could create hiccups in the market. But we expect this would be a temporary setback, as investors have been aware that growth could take a hit due to growing trade tensions and, in theory, should have been preparing for a lower target.

A more worrying sign would be if the government announced a future five-year average of around 6%. This could really create market concern of a deeper slowdown.

2. Fiscal budget

We expect the fiscal deficit will be 3.0% of GDP. But China's actual fiscal deficit is usually 0.5 percentage points higher than the planned deficit. We expect it will be even greater than that because this year is intended to support economic growth. We forecast the fiscal deficit at 4% of GDP.

We will be focusing on whether the government is prepared to invest in infrastructure to support the economy. From this, we will be able to gauge the severity of the headwind from the ongoing trade dispute.

Aside from infrastructure projects, the work report could also focus on tax cuts. We don't believe tax relief would be as effective at stimulating the economy during a downward cycle as infrastructure spending, but some changes in this area would be an important signal about how the government gauges the economic situation in 2019.

3 Monetary easing

Here, our focus will be the description of the yuan's path. Last year, the government committed to "keeping the yuan exchange rate stable at a reasonable equilibrium level". The US wants China to keep the yuan stable as part of any trade agreement, so the wording on this in the government's work report could form part of a final trade agreement.

We would not be surprised if the government drops its description of monetary policy as "prudent" so as to remain consistent with the recently-published monetary policy report. The emphasis will be to divert liquidity to small private firms, which suggests that the Targeted Medium Lending Facility could replace the Medium Lending Facility.

4. Economic reforms

We expect that economic reforms will focus more on improving public services such as providing affordable medicine to public hospitals, education and rural infrastructure to improve the quality of life.

Technology will also be in focus but we assume this will be a relatively low key item in the report to avoid attracting further negative comments from the rest of the world.

Our view is that reform efforts will no longer include deleveraging or cuts to overcapacity this year. Economic conditions don't allow for further deleveraging, which would put additional pressure on growth.

The main focus will be....

In sum, we believe that the work report will be in line with the government's existing policy direction. If there is any divergence from current policy, it will likely be to provide more support for the economy.

For us, the main focus will be on the wording of the yuan's trend, as this could affect how trade talks progress.

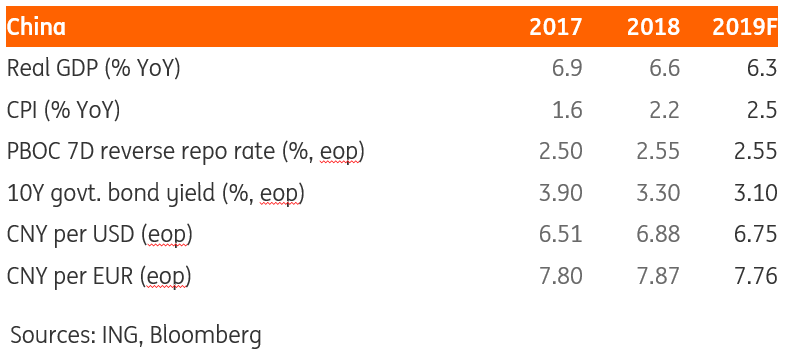

ING China economic forecast for 2019

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI