Financial markets grew, despite reports of virus spreading, which remains alarming, and an increasing number of companies are experiencing supply disruptions due to interruptions in their usual supply chains. This situation seems to be a severe test of China integration into the world economy and how its problems can affect the growth dynamics of other regions of the world. So far, we can see that Oil is almost the most affected major instrument on financial markets due to the coronavirus outbreak.

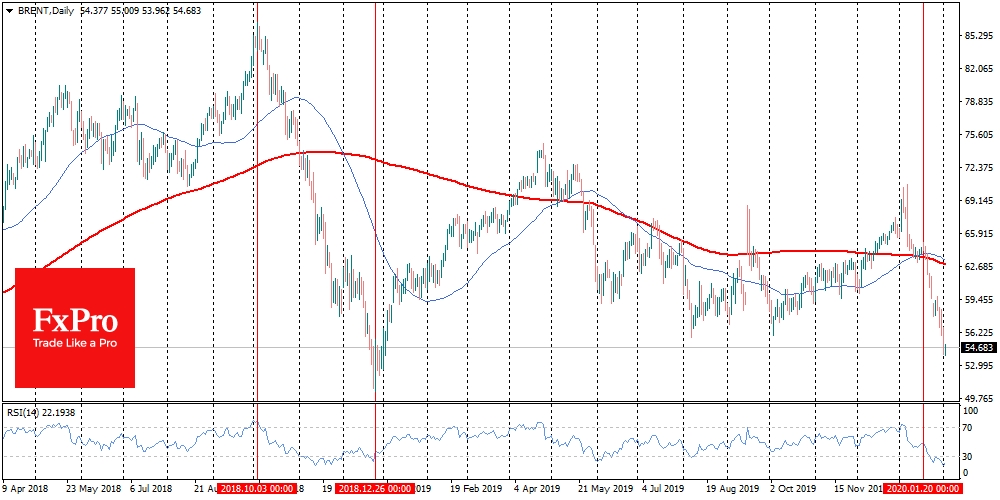

At the end of trading on Monday, Brent quotations declined below $54, in the region where Oil spent a couple of weeks at the end of 2018 at the peak of stock markets’ fears. At that time, market participants were afraid that further tightening of monetary policy would sharply slow down the growth rates of the largest world economies.

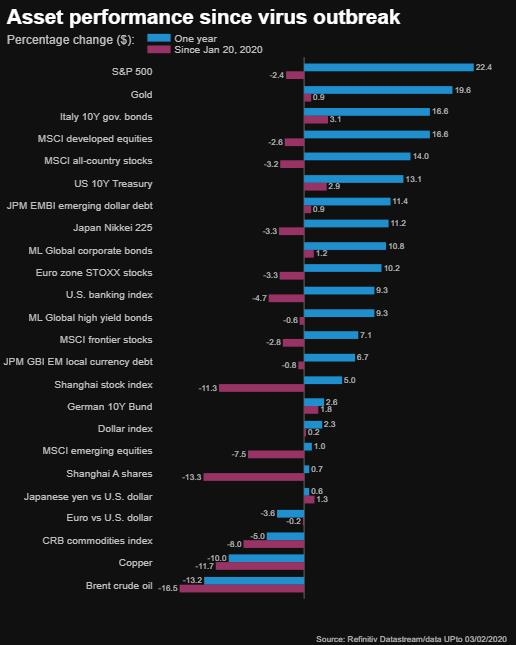

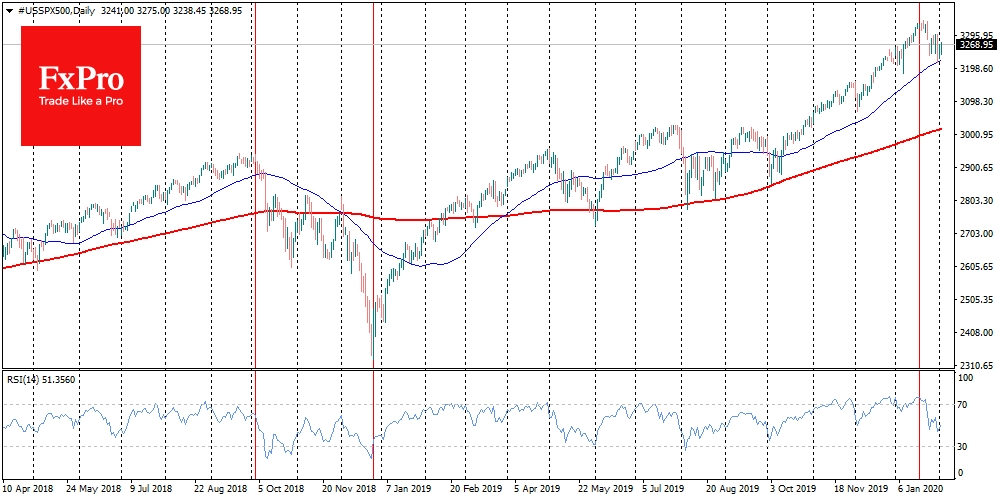

There is a striking contrast to how stock markets react this time. Fearing the coronavirus, Brent began its decline on January 20, losing 17% to a low on Tuesday morning. The difference between the S&P highs and lows over the same period is not more than 4%, and the net decline over this period is 1.7%, only one-tenth of Crude’s reaction. For comparison, between early October and late December, the S&P500 lost about 20%, while Oil lost twice as much.

This difference in the reaction of stock and commodity markets, as well as the inability to find the bottom of Oil, is clear evidence of the energy market weakness. It’s not so much about the coronavirus and fears of declining Oil consumption in China.

Increasingly, the underlying reason is the relative stagnation of demand, while US production increases. Worse yet, the markets are well aware that current OPEC+ quotas are forced short-term measures, as well as periodic supply disruptions from the Middle East. There is much Oil in the market. Potentially, there is much more Oil ready to be produced than is needed. Many countries prepare to do so as soon as they get the chance. And this makes prices vulnerable.

This is a wrong signal for Oil in the short term. The current situation can well be described as a market play against OPEC. Speculators bet that artificial restrictions are an unstable system, which will collapse sooner or later. The coronavirus outbreak now makes us think that it will happen sooner rather than later.

In the early 1990s, the market (not only the Soros Foundation) bet against the Bank of England that it would not be able to keep Pound course and volatility in times of economic decline. Them the market won. It is quite probable that it will win this time too, sending Oil into free flight for a while. Unfortunately for the prices, it will mean a sharp decline in the coming weeks and months, but in the long term, such a strategy may be beneficial for oil producers too.

The FxPro Analyst Team

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI