Sustained intervention by China’s central bank and policy changes are prompting traders to change their views and raise year-end targets for the yuan, after its surprise devaluation in August sparked fears the Beijing wanted a sharp fall.

The moves by the People’s Bank of China (PBOC) were prompted by market panic after the devaluation. The yuan dropped around 3 percent against the dollar in a few days.

That rattled global investors about Beijing’s commitment to currency market reform and made some exit yuan assets. Issuance in offshore yuan markets dried up as traders priced the currency at a sharp discount.

Just before the devaluation, the yuan was at 6.2097 to the dollar. Right afterwards, many traders saw it softening to 6.5 by year-end.

However, while the PBOC’s interventions in onshore and offshore markets eventually stabilised the currency, traders and economists said such action were ultimately unsustainable, as China would rapidly run down its foreign exchange reserves.

Fortunately for Beijing, traders now feel differently about the yuan, in part because of steps to cap capital outflows. And this month’s launch of the China International Payment System (CIPs), to facilitate trade settlement, is expected to boost offshore yuan usage.

“The yuan is now performing more in line with other emerging currencies,” said Li Liuyang, an analyst at Bank of Tokyo-Mitsubishi UFJ in Shanghai.

“If the (U.S.) Federal Reserve doesn’t raise interest rates by the end of this year, the yuan may rise to as much as 6.3 per dollar; otherwise it can weaken to as much as 6.45.”

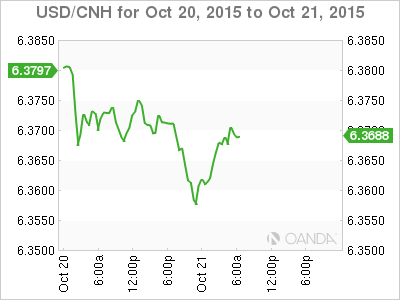

Li’s estimates were echoed by traders surveyed by Reuters. On Wednesday morning, the yuan was at about 6.343 to the dollar.

A KINDER U.S. TREASURY

Data also points to a gradually stabilising yuan.

The decline of the yuan’s real effective exchange rate (REER), or its value against the trade-weighted basket after adjustments based on inflation, eased to 0.32 percent in September, from 0.61 percent in August, according to the Bank for International Settlements (BIS).

Even the U.S. Treasury, which has consistently singled out the undervalued yuan and argued for its appreciation, was kinder in its new semi-annual report on trading partners’ currency policies. It said the yuan needs to appreciate more but was below its “appropriate medium-term valuation”.

Domestic traders naturally hope the International Monetary Fund will approve the yuan’s inclusion in its Special Drawing Rights basket in discussions expected next month.

Being in the SDR basket “can stimulate more demand for the yuan and thus boost its value,” said Liu Dongliang, a currency strategist at China Merchant Bank in Shenzhen.

HSBC said on Tuesday that China’s yuan “ticks all the right boxes” for inclusion in the SDR basket.

China this month told the IMF it had subscribed to its Special Data Dissemination Standard (SDDS). Data shows the PBOC already began publishing its data in line with the standard in July.

LONGER TRADING HOURS?

And China’s foreign exchange market will soon extend yuan trading hours to 2330 local time (1530 GMT) to cover Europe’s market day, sources say.

For all the steps taken, regulators remain on guard against bearish sentiment that might cause capital flight.

Beyond apparently instructing state banks to buy yuan and sell dollars, the PBOC also tightened rules on trading of currency derivatives, increasing corporate trading costs to cool speculation of yuan depreciation.

Furthermore, the central bank has asked banks to strengthen supervision of foreign-held non-resident accounts (NRA) purchases of foreign exchange in China.

And the weakening economy is a cause for concern.

“The authorities can and will continue intervening to prevent the yuan from dropping too much,” said a trader at an Asian bank in Hong Kong. “But they will not be able to sustain the currency’s strengthening in a weak economy.”

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.