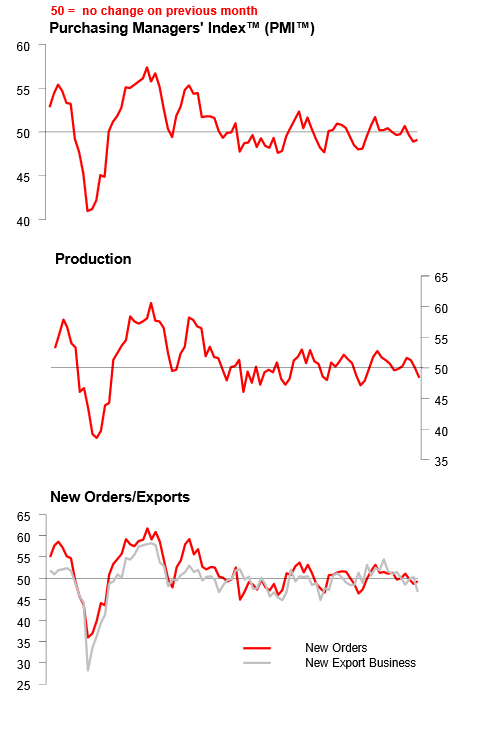

The slowdown in China continues as the HBSC Flash PMI shows Output contracts at strongest rate in just over a year.

Key Points

- Flash China Manufacturing PMI™ at 49.1 in May (48.9 in April). Two-month high.

- Flash China Manufacturing Output Index at 48.4 in May (50.0 in April). 13-month low.

Commenting on the Flash China Manufacturing PMI survey, Annabel Fiddes , Economist at Markit said:

“The Flash China Manufacturing PMI pointed to a further deterioration in operating conditions in May , with production declining for the first time in 2015 so far. “Moreover, softer client demand, both at home and abroad, along with further job cuts indicate that the sector may find it difficult to expand, at least in the near - term, as companies tempered production plans in line with weaker demand conditions. “On a positive note, deflationary pressures remained relatively strong, with both input and output prices continuing to decline, leaving plenty of scope for the authorities to implement further stimulus measures if required.”

The positive note is "deflationary pressures are strong so that leaves scope for stimulus." Isn't that a hoot?

And if there was strength, that would be a positive as well. I guess it's simply impossible for things not to be bullish.

Two Point Summary

- Economy weak - stimulus needed - stimulus is bullish

- Economy strong - no stimulus needed - also bullish

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.