U.S.-EU trade deal, U.S.-China talks kick off pivotal week - what’s moving markets

More signs of China's weakening economic conditions are once again showing up in overbuilt coal inventories.

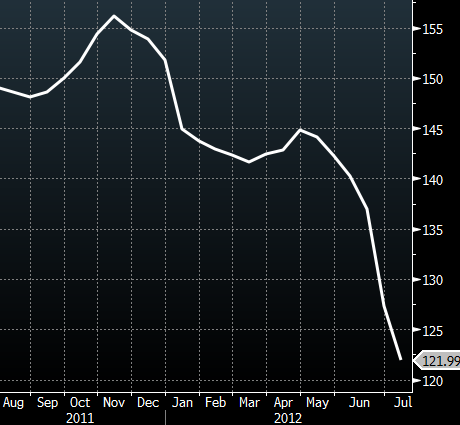

Xinhua: The China Coal Price Index shows that China's benchmark power-station coal price fell for the 11th week as stockpiles at the Qinhuangdao Port in Hebei province, which boasts one of the country's highest export volumes, rose the most in six months on slowing demand.

Rising inventories are now translating into sharp price declines, hurting domestic coal producers.

Xinhua: Guo Xutian, CEO of Xinshi Coal & Coking Co. Ltd., in north Shanxi province, China's second-largest coal production base, said the entrapped coal mine selling has resulted in lay-offs for two-thirds of workers.

"Sales were never a problem, but now, look at the coal piling up on the ground," Guo sighed, saying the company has been on limited production since April. X "The price dived by 80 yuan to 120 yuan a metric ton, even though we didn't put the brakes on production. We are barely making ends meet, gaining zero profit," said Ma Zhi, chairman of Jinhuagong coal mine's trade union with Datong Coal Mine Group And China's shipping industry is beginning to struggle as well.

Xinhua (different article from above): China's shipping industry is grappling with a recession caused by waning demand and higher costs, and many small businesses are facing bankruptcy, the Ministry of Transport said Thursday.

Qinhuangdao Port on China's northern coast, the nation's coal-shipping center which is also seen as a barometer of the economy, should have experienced a busy July, as daily transport capacity was at least 50 vessels per day in the past. However, only one-quarter of that capacity was achieved this July, and inventories hovering near the maximum storage capacity piled up.

In spite of Goldman's interpretation of the latest PMI number as "a very strong reading," things on the ground in China continue to look weak.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.