A couple of months ago some analysts from Credit Suisse took a trip across Asia to conduct a survey of China's steel industry. They later wrote in their report that the sector is in worse shape than it was in 2008. We got a number of e-mails suggesting that this report surely must be erroneous. It turns out that it wasn't.

FT: Chinese steelmakers saw their profits plunge by 96 per cent in the first half compared to a year ago, a Chinese official said on Tuesday, as the economic slowdown turned the industry into a “disaster zone.”

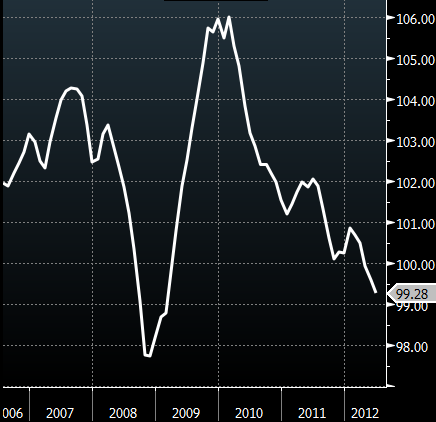

And it doesn't look like the situation is getting any better. In spite of the recent pop in the manufacturing PMI number, key indicators are pointing to a continuing slowdown. The Index of Leading Indicators hit a post-2009 low today,

... and so did the equity market. China's major cyclical sectors that depend so heavily on double digit growth are in trouble.

Bloomberg: China’s stocks fell to the lowest level in more than three years amid concern the slowing economy will hurt earnings growth. Foreign-currency denominated B shares dropped for their biggest two-day loss in almost a year.

Chinese steelmakers, including Baoshan Iron & Steel Co. and Angang Steel Co., slid after posting a 96 percent drop in first-half profit. Kama Co. led declines by B shares on concern stricter rules by the exchange may lead to companies being delisted.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI