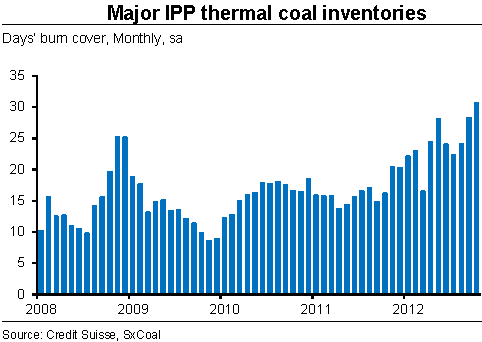

Thermal coal inventories at China's power plants continue to grow. This is an important leading indicator that analysts look to in order to understand inflection points in power demand and ultimately output growth.

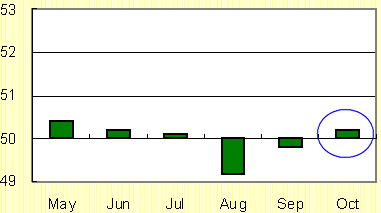

The question of course is how to reconcile this with somewhat stronger indicators coming out of China these days. For example the official manufacturing PMI from October shows a slight expansion.

But with the Markit/HSBC PMI indicating a slight contraction (see chart), the data is still mixed.

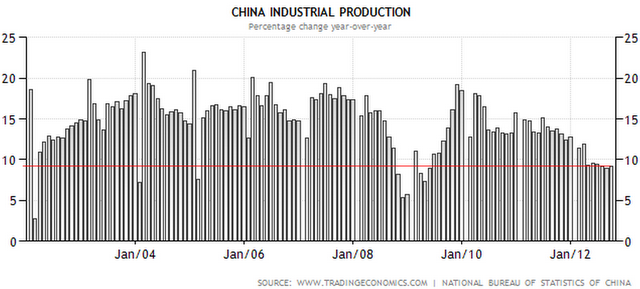

According to Credit Suisse, 75% of the increases in thermal coal inventory can be attributed to continuing relative weakness in China's Industrial production growth. China's official media seems to agree with this assessment, at least through September.

Xinhua: China's power consumption growth slowed further in September as factory activity and industrial output posted weaker increases amid the economic downturn.

The country's total electricity consumption grew only 2.9 percent from a year earlier to 405.1 billion kwh. The growth was 0.7 percentage point lower than that of August and 9.3 percentage points lower than that of September 2011, according to data from the National Energy Administration.

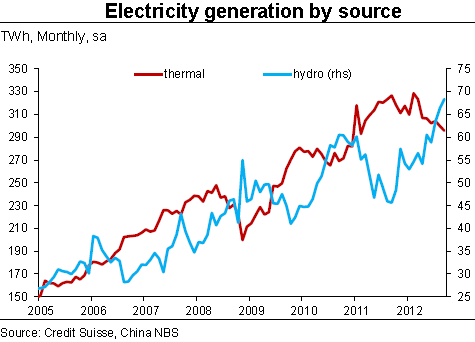

However there is another factor at play that is contributing to high coal inventories. It is China's partial shift in sources of power generation away from coal toward hydroelectric power generation.

CS: This soft thermal generation, as it has been all summer, was driven by a combination of weak IP [Industrial Production] – which accounts for ~75% of power demand – and the continued outperformance of hydro.

China's officials claim of course that the decline in electricity usage is temporary and, as Industrial Production picks up, so will power usage.

Xinhua: China's power consumption is expected to rise 4 percent to 6 percent year on year in the fourth quarter as the country's economy is stabilizing, the China Electricity Council (CEC) said on Tuesday.

That will bring electricity consumption in the entire year to 4.94 trillion kilowatt-hours (kwh), up 5 percent from a year earlier, the CEC said.

The country's total installed power generation capacity will hit 1.14 billion kilowatts at the end of this year, the CEC said.

Power demand and supply will be balanced because there are abundant coal stocks in most thermal power plants and hydropower plants, according to the CEC.

If that's the case, we should see thermal coal inventories begin to decline this quarter. Total coal inventory level remains a good indicator of China's industrial output growth, but one needs to take hydroelectric power usage into account in this analysis.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.