Apple edges up premarket as investors weigh estimated tariff costs, iPhone sales

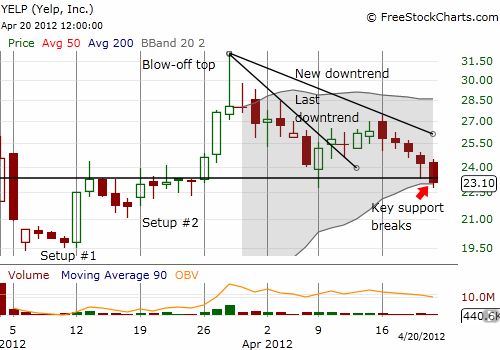

The recent batch of internet IPOs are collectively running into hard times these days despite the imminent introduction of Facebook (FB) to the public markets. On April 9, I noted a likely blow-off top in Yelp.com (YELP). Friday’s break of critical support all but confirms the top. I have updated the chart with the new downtrend.

While the break of support did not occur on large volume, it confirmed my expectation that support would not last much longer. The intervening rally took YELP up as much as 9%, but, the subsequent selling and new downtrend looks more ominous than the last sequence. The failed rally attempt establishes a lower high that confirms the existence of selling resistance far below the 52-week high. I believe a retest of all-time lows and the $15 IPO price have both became much more likely.

Be careful out there!

Full disclosure: no positions

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI