Is the economy already benefitting from an AI boom?

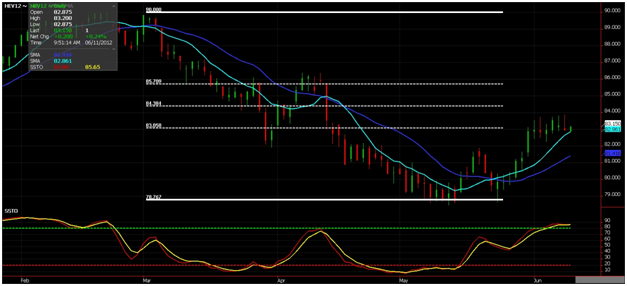

In less than one month lean hog prices have gone from oversold to overbought. Lena hogs are on a short list of commodities that have been able to trade higher in recent weeks. From my perspective, the fact that prices have been unable to make it to higher ground, perhaps due to outside market influence, leads me to suspect prices are due for a correction.

Lean hogs are a 40,000 lb. contract which means every penny move in futures results in a $400/move gain/loss per contract. Aggressive traders can get short or gain bearish exposure with an exit strategy if futures trade above 84.00. Look to capitalize on deprecation in the coming days to week.

I would expect more selling once prices close below the 9 day MA which has supported for the last 2 weeks. My target is a trade back to 80.00 in the October contract. What makes this compelling is the risk to reward dynamic.

Risk Disclaimer: The opinions contained herein are for general information only and are not intended to provide specific investment advice or recommendations and are not tailored to any specific’s investor’s needs or investment goals. You should fully understand the risks associated with trading futures, options and retail off-exchange foreign currency transactions (“Forex”) before making any trades. Trading futures, options, and Forex involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change without notice. Past performance is not necessarily indicative of future results.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.