It’s been another quiet start to trading in what is otherwise going to be a very busy week in financial markets, with a number of central banks scheduled to make interest rate announcements.

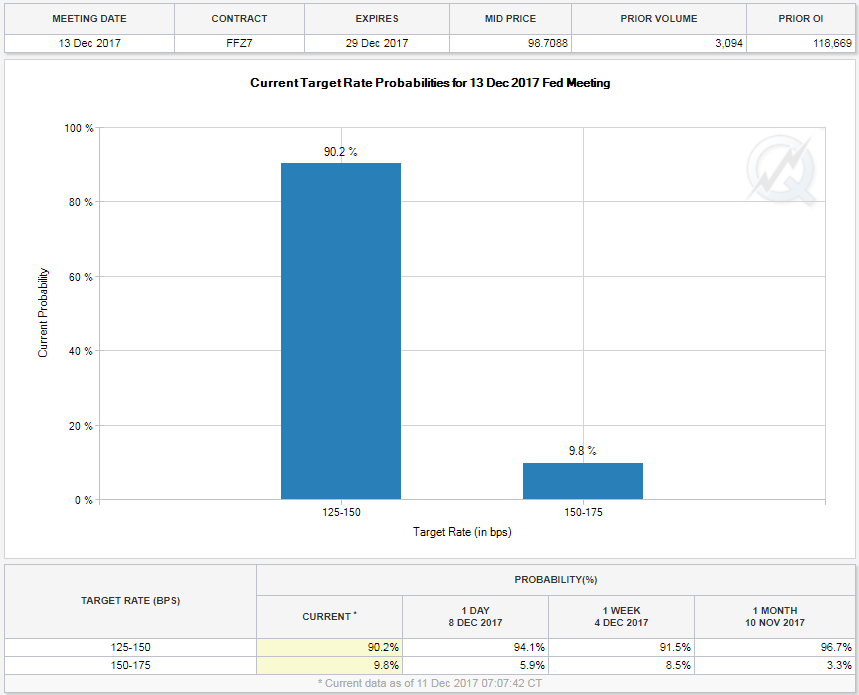

The Federal Reserve, ECB and Bank of England will be among those meeting this week, which should make Wednesday and Thursday particularly lively. Of these, only the Fed is expected to announce a change, with another 25 basis point rate hike all but priced in. That will take the number of hikes this year to three, as per its forecast towards the back end of last year, which markets were initially behind the curve on.

That currently remains the case for 2018, with the Fed projecting three more and markets only anticipating one or two. The most interesting thing on Wednesday is likely to be what the central bank says on this and whether the dot plot continues to forecast three hikes. With so many unknowns – vacant positions on FOMC and tax reform to name a couple – expectations are likely to change over the next six months, impacting how many rate hikes we actually get.

The BoE and ECB meetings are likely to be a more uninteresting affair, with both central banks having only recently tightened monetary policy and in no rush to do so again. That said, the ECB press conference can often be a volatile period for markets and traders will be keen to know what the next steps are beyond quantitative easing.

Brexit Phase Two Talks Hang on Friday’s European Council Vote

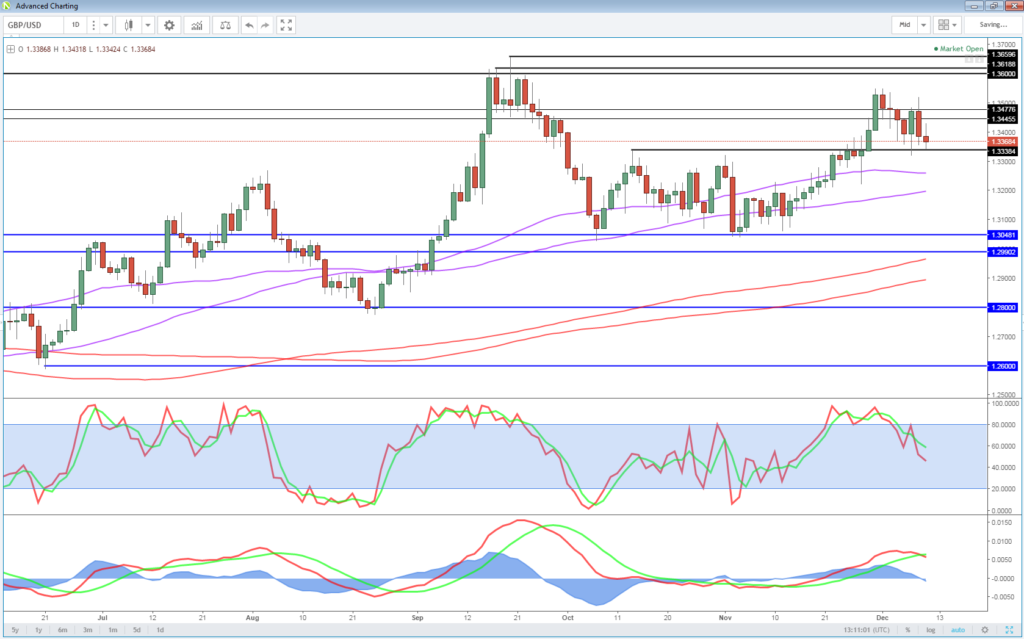

Friday’s agreement between Theresa May and Jean-Claude Juncker on phase one of Brexit negotiations was an important milestone but this is likely to remain heavily in the news this week, with the European Council due to vote on it on Friday. While this is expected to be a formality, should anything get in the way of the vote being passed, it would be a major setback for the negotiations and prevent them moving onto phase two, in which the future trade relationship will be discussed.

Bitcoin Near Highs After CBOE Launches Futures Contract

Bitcoin won’t be far from the headlines this week, despite attention potentially being diverted elsewhere at times, with volatility in the cryptocurrency remaining at extraordinary levels over the weekend as CBOE prepared to launch its first futures contract. Still, Bitcoin is back trading near record highs this morning, allaying fears for now that the ability to short would trigger a sell-off.

The January contract on CBOE has eased off its highs a little after rallying immediately after the launch to trade more than 20% higher at one stage. While nervousness about short sellers may remain, early trading suggests the adverse impact that some feared may not materialize just yet.